Key Takeaways

OPINION is infrastructure, not an app — it provides the backend for prediction and opinion markets using conditional tokens.

It enables shared liquidity and standardized settlement, allowing multiple platforms to build markets on the same system.

OPINION is in an early stage with tokenomics yet to be released, and users can participate via a Pre-TGE CandyDrop on Phemex.

Introduction

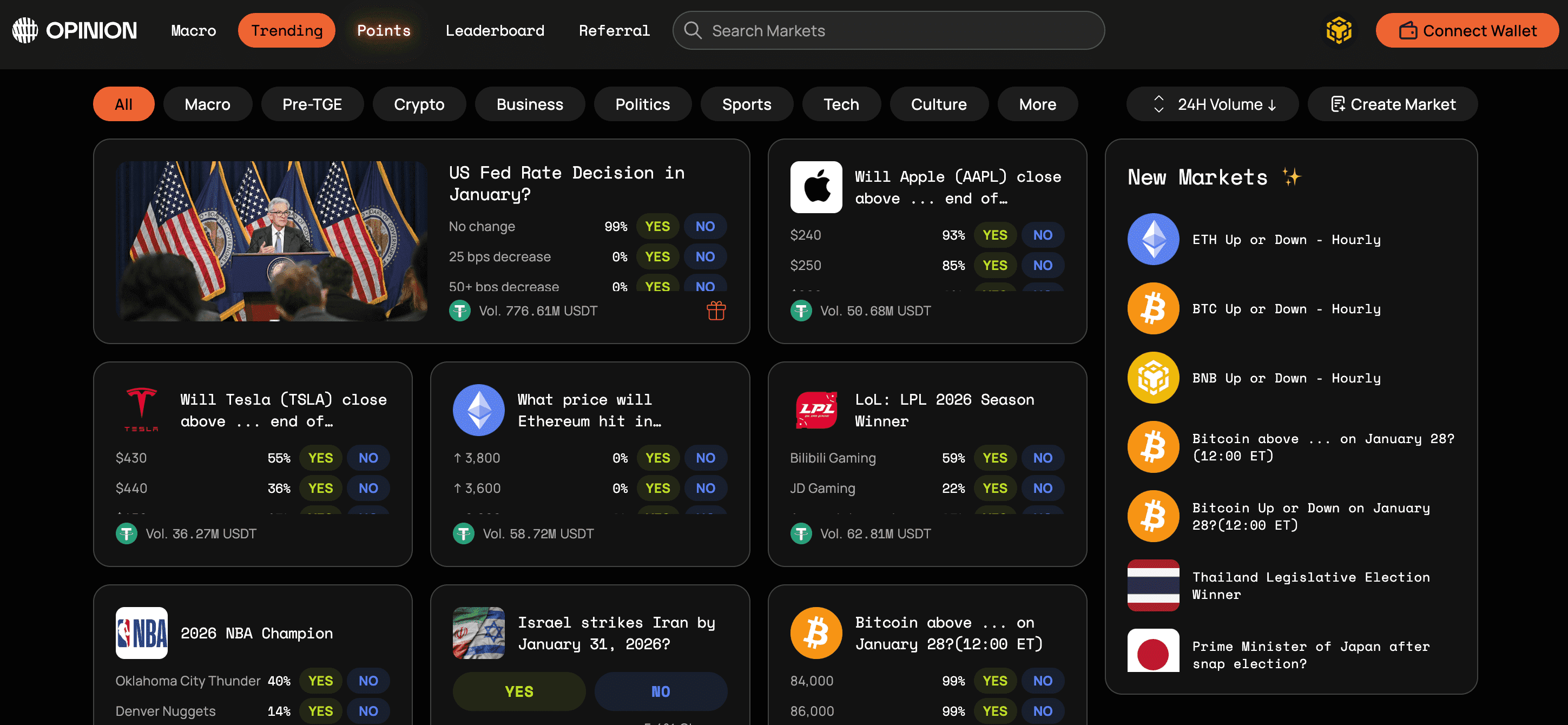

Decentralized prediction and opinion markets allow users to trade on future events or conditional outcomes without relying on centralized intermediaries. Instead of a single platform controlling market creation, liquidity, and settlement, modern designs move these functions on-chain using standardized token formats.

OPINION is designed specifically for this purpose. Rather than operating as a single prediction market platform, OPINION functions as infrastructure — a programmable clearing and settlement layer for outcome-based tokens that different prediction or opinion platforms can build on.

According to OPINION’s public documentation, the stack focuses on:

Scalable creation of conditional markets

Unified liquidity across venues

Trust-minimized settlement using smart contracts

This guide explains what OPINION is, how it works, why it matters, and what information is not yet publicly available.

Quick Facts About OPINION

| Metric | Detail |

|---|---|

| Name | OPINION |

| Token Symbol | OPINION |

| Blockchain Context | BNB Chain (conditional token operations) |

| Core Function | Infrastructure for conditional and outcome tokens |

| Primary Use Case | Prediction & opinion market settlement and liquidity |

| Public Tokenomics | Not published |

| Exchange Listings | Not publicly confirmed |

Opinion (OPN) Pre-TGE CandyDrop on Phemex

Ahead of the OPINION (OPN) Token Generation Event (TGE), Phemex is hosting a Pre-TGE CandyDrop campaign, giving users the opportunity to earn OPN rewards by completing trading tasks.

Event Highlights

Reward pool: Up to 30,000 OPN

Event period: Jan 28, 2026, 11:00 – Feb 1, 2026, 11:00 (UTC)

Distribution: Rewards distributed after the OPN TGE

How to Join the CandyDrop

Log in to your Phemex account

Complete trading tasks to collect candies

Receive your share of OPN rewards after the TGE

What Is OPINION?

OPINION is a blockchain-based infrastructure stack designed to support prediction and opinion markets using conditional tokens.

Public materials describe several core components:

Opinion Protocol – a universal token standard for outcome-based markets

Opinion Metapool – a unified liquidity mechanism

Opinion Token Operations – smart contract functions that manage conditional tokens on BNB Chain

Together, these components allow different platforms to:

Create markets based on the same event conditions

Use the same outcome tokens

Share liquidity and settlement infrastructure

OPINION is not a consumer-facing prediction market. Instead, it serves as middleware — infrastructure that applications and platforms can build on.

Key Features

Unified Liquidity via Opinion Metapool

The Opinion Metapool acts as a shared liquidity layer for conditional markets. Rather than isolating liquidity within individual platforms, markets built on the same framework can access aggregated liquidity, helping reduce fragmentation and improve pricing efficiency.

Opinion Protocol as a Universal Token Standard

The Opinion Protocol defines a standardized way to represent outcome and conditional tokens. This makes it easier for different platforms to interact with the same assets without custom integrations, distinguishing OPINION from siloed prediction market systems.

Conditional Token Lifecycle on BNB Chain

OPINION documentation describes token operations that control the full lifecycle of conditional tokens — including how collateral is split into outcomes, how tokens trade, and how winning outcomes are redeemed once events resolve.

Trust-Minimized Settlement

Settlement is enforced on-chain through smart contracts rather than manual intervention by a centralized operator. This reduces discretionary control and increases transparency once resolution conditions are met.

What Does OPINION Do?

OPINION focuses specifically on how outcome markets are created, traded, and settled — not on payments or store-of-value use cases.

Outcome Token Creation and Management

Collateral, such as stablecoins, can be converted into multiple outcome tokens tied to specific conditions. Each token represents a different possible result of an event.

Shared Infrastructure Across Platforms

Because OPINION uses a universal token standard, multiple platforms can list and settle the same outcome tokens, allowing market participants to interact with a single shared asset layer.

Liquidity Aggregation

The Opinion Metapool pools liquidity across compatible markets, supporting deeper liquidity and more efficient price discovery.

Technology Behind OPINION

OPINION’s conditional token operations are implemented on BNB Chain, governing how outcome tokens are created, traded, and redeemed. By standardizing both liquidity pooling and token representation, OPINION emphasizes reuse and interoperability across applications.

Is OPINION a Good Investment?

OPINION is positioned as infrastructure for prediction and opinion markets, focusing on conditional tokens, shared liquidity, and standardized settlement. If this type of infrastructure sees wider adoption, it could play a meaningful role in how decentralized event-based markets are built.

However, key details — including token supply, distribution, governance, and market liquidity — have not yet been publicly disclosed. At this stage, OPINION is best viewed as an early-stage infrastructure project, where potential opportunity exists alongside higher uncertainty.

Frequently Asked Questions (FAQ)

What is OPINION?

OPINION is infrastructure for prediction and opinion markets, built around conditional tokens, unified liquidity, and on-chain settlement.

Is OPINION a prediction market?

No. OPINION is not a standalone prediction market app. It provides the underlying protocol that platforms can build on.

Which blockchain does OPINION use?

Documented conditional token operations are implemented on BNB Chain.

Does OPINION have a token?

OPINION is associated with the OPN token. Detailed tokenomics have not yet been published.

How can users earn OPN before the TGE?

Users can participate in the Opinion (OPN) Pre-TGE CandyDrop on Phemex by completing trading tasks to earn candies.

Summary: Why OPINION Matters

OPINION aims to standardize the backend of prediction and opinion markets. By focusing on conditional tokens, shared liquidity, and interoperable settlement infrastructure, it addresses structural challenges that limit scalability in decentralized forecasting systems.

At the same time, important details — including token economics, governance, and adoption metrics — remain unpublished. OPINION today should therefore be understood as infrastructure in development, rather than a fully transparent financial asset.