The landscape of Layer-1 blockchains is characterized by continuous innovation, with new projects emerging to address persistent challenges in scalability, security, and developer experience. Among these is Mango Network (MGO), a public blockchain engineered for high-performance decentralized applications (dApps). It integrates the Move programming language with a modified Tendermint consensus mechanism to offer a platform designed for complex Web3 functionalities, including Decentralized Finance (DeFi), GameFi, and SocialFi.

This article provides a comprehensive, technical overview of the Mango Network. We will dissect its architecture, tokenomics, core technology, and market positioning based on its official documentation. The objective is to present a factual, neutral analysis of the project's design and stated goals, free from promotional language or unsubstantiated claims.

Summary Box (Quick Facts)

-

Ticker Symbol: MGO

-

Chain: Mango Network (Native Layer-1)

-

Contract Address: N/A (Native coin on its own mainnet)

-

Circulating Supply: To be determined upon mainnet launch and vesting schedule

-

Total Supply: 10 Billion MGO

-

Primary Use Case: Gas fees, network staking, and on-chain governance

-

Current Market Cap: Not available

-

Availability on Phemex: No (As of Writing)

What Is Mango Network (MGO)?

To begin, what is MGO? The MGO token is the native cryptocurrency of the Mango Network. The network itself is a sovereign Layer-1 blockchain, meaning it does not rely on another chain like Ethereum for security or transaction processing. Instead, it has its own independent infrastructure, consensus mechanism, and validator set.

The primary problem Mango Network is designed to address is the "blockchain trilemma"—the difficulty of simultaneously achieving high scalability (the ability to process many transactions), robust security, and true decentralization. Mango Network explained in technical terms is a platform that attempts to resolve this trilemma through a specific combination of technologies. It aims to provide the high-throughput and low-latency environment required for mass-market dApps, which often struggle to perform efficiently on more congested or expensive blockchains.

Its relevance in the industry stems from its architectural choices. By forgoing the widely adopted Ethereum Virtual Machine (EVM) in favor of the Move Virtual Machine (Move VM), Mango Network positions itself as a security-first platform. The Move language, originally developed for Meta's Diem project, was created specifically to handle digital assets with a resource-oriented model, which helps prevent entire classes of common smart contract vulnerabilities. This makes it a point of interest for developers building applications where asset security is paramount.

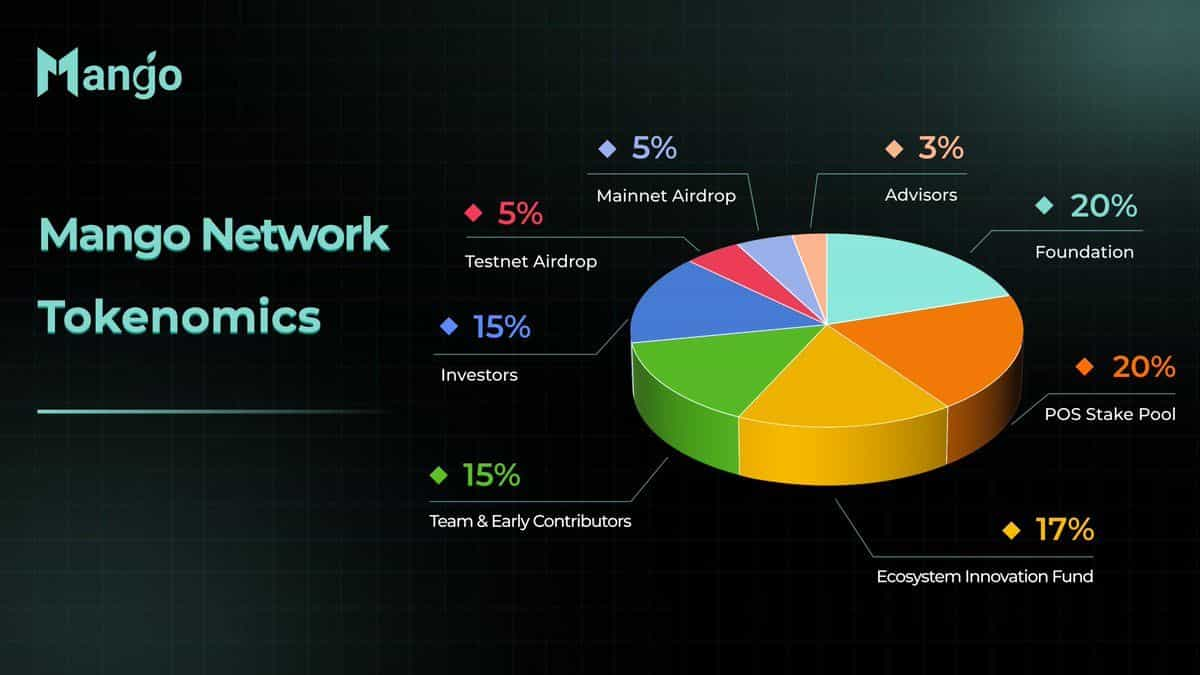

MGO Token Supply and Distribution

The economic model of the Mango Network protocol is defined by its tokenomics, which are based on a fixed total supply of 10 billion MGO tokens. This supply is allocated across several categories designed to support network security, ecosystem development, and community incentives over an extended timeframe.

The formal allocation of the total token supply is structured as follows:

-

POS Stake Pool: 20%

-

Foundation: 20%

-

Ecosystem Innovation Fund: 17%

-

Team & Early Contributors: 15%

-

Investors: 15%

-

Mainnet Airdrop: 5%

-

Testnet Airdrop: 5%

-

Advisors: 3%

The release of these tokens is governed by an unlocking framework intended to foster long-term stability. A total of 10% of the supply (split equally between Testnet and Mainnet airdrops) is designated for distribution to early supporters and participants who assist in the network's initial phases. The 20% allocated to the POS Stake Pool is the source of rewards for validators and stakers who secure the network. Concurrently, the 17% Ecosystem Innovation Fund is scheduled for progressive release to support developers and dApp growth.

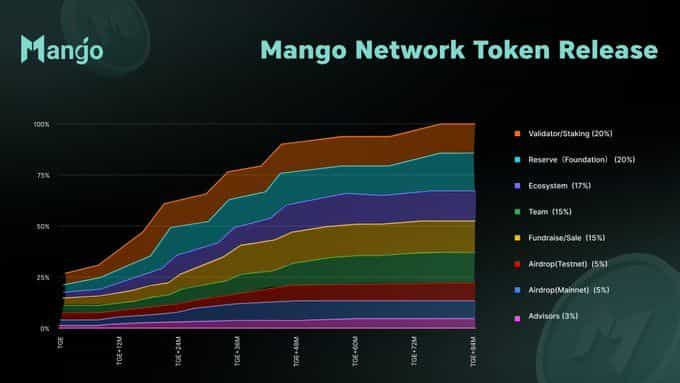

According to the project's documentation, the overall token release is designed to occur gradually over a seven-year period. This extended vesting and release schedule is a mechanism intended to align long-term incentives among all stakeholders and mitigate potential market pressure from large, sudden increases in the circulating supply.

The Utility of the MGO Token

The MGO token is integral to the functioning of the Mango Network, with its utility embedded in the protocol's core operations. The primary MGO use case encompasses three distinct functions:

-

Transaction Fees (Gas): All operations on the Mango Network, from simple token transfers to complex smart contract interactions, consume computational resources. Users pay for these resources using MGO tokens as "gas." This fee mechanism serves to compensate validators for their work and prevent network spam by assigning a cost to every transaction.

-

Network Security (Staking): Mango Network utilizes a Proof-of-Stake (PoS) consensus model. To become a validator and participate in proposing and confirming blocks, a node operator must "stake" a quantity of MGO tokens as collateral. This stake serves as an economic bond to ensure honest behavior, as malicious actions can result in the loss of staked tokens (a process known as "slashing"). In return for securing the network, validators and those who delegate MGO to them receive staking rewards.

-

Protocol Governance: MGO is intended to function as a governance token, granting holders the ability to participate in the decentralized decision-making process of the network. Through on-chain governance, token holders can propose and vote on protocol upgrades, adjustments to network parameters (such as fee structures), and the use of community treasury funds.

Beyond these fundamental roles, MGO will be the principal unit of account and medium of exchange within its ecosystem's dApps, such as decentralized exchanges and NFT marketplaces.

Technical Comparison: Mango Network vs. Ethereum

A comparison with Ethereum, the largest smart contract platform, highlights Mango Network's differing design philosophy.

| Feature | Mango Network (MGO) | Ethereum (ETH) |

| Core Technology | Move-on-Tendermint: Employs the Move VM for execution and a Tendermint BFT-based consensus for block production. | EVM on Proof-of-Stake: Utilizes the Ethereum Virtual Machine (EVM) and its own custom Proof-of-Stake consensus mechanism. |

| Programming Language | Move: A resource-oriented language designed for safe asset management, preventing certain bugs at the language level. | Solidity: A mature, Turing-complete language that is the industry standard but requires careful coding to avoid vulnerabilities. |

| Scalability Approach | High-Throughput L1: Designed for parallel transaction processing, with a theoretical target of over 100,000 TPS. | Layer-2 Centric: Relies on a rollup-centric roadmap, using Layer-2 solutions like optimistic and ZK-rollups to scale. |

| Transaction Finality | Near-Instant: Tendermint BFT provides fast finality, meaning transactions are quickly confirmed as irreversible. | Probabilistic Finality: Blocks are considered final after a certain number of confirmations, which takes several minutes. |

| Security Model | Proactive: Focuses on preventing exploits through Move's type system and resource model. | Reactive & Battle-Tested: Security is proven by its long history and value secured, with a robust community for finding and fixing bugs. |

| Ecosystem Status | Emerging: In the process of launching its mainnet and building its initial developer and user community. | Mature: Possesses the largest and most developed ecosystem of dApps, tools, developers, and users. |

The Mango Network vs. Ethereum comparison illustrates a classic trade-off: Mango Network prioritizes a novel, security-focused architecture with high theoretical performance, while Ethereum leverages its established network effect, vast ecosystem, and a scaling strategy based on Layer-2 solutions.

The Technology Behind Mango Network

The technical architecture of Mango Network is its defining characteristic, combining several well-regarded technologies into a novel framework.

-

Consensus Layer: Tendermint Core and Mango-Consensus

The foundation of Mango Network's consensus is Tendermint Core, known for its Byzantine Fault Tolerance (BFT). BFT enables a distributed network to reach agreement even if a fraction of its participants (up to one-third) are faulty or malicious. This provides high security and fast transaction finality.According to the project's website, this is augmented by Mango-Consensus, an algorithm that draws inspiration from the Narwhal & Tusk protocols. This design separates the process of transaction dissemination from formal consensus. A Directed Acyclic Graph (DAG) component (similar to Narwhal) is used to broadcast and order transactions in parallel, while a separate consensus component (similar to Tusk) validates these ordered batches. This decoupling allows for significantly higher throughput compared to monolithic consensus designs where ordering and agreement happen sequentially.

-

Execution Layer: The Move Virtual Machine (VM)

For smart contract execution, Mango Network uses the Move VM. Unlike the account-based model of the EVM, Move employs a resource-oriented model. Digital assets (like tokens or NFTs) are treated as "resources" with special properties. These resources must have clear ownership, cannot be duplicated ("copied"), and cannot be accidentally discarded ("dropped"). This strict type system is designed to eliminate common smart contract exploits like re-entrancy attacks and double-spending at the language level, thereby enhancing the baseline security for developers. -

Modular Architecture

The network is designed with a modular approach, separating the key functions of consensus, execution, and data storage. This separation allows individual components to be upgraded or replaced independently without affecting the entire system, providing greater flexibility for future development and optimization.

Team & Origins

The development team behind Mango Network has not publicly disclosed the identities of its individual members. Information from the project's official channels describes the team as a global group of engineers and professionals with backgrounds in blockchain technology and finance.

This approach, where a team remains anonymous or pseudonymous, is not uncommon in the cryptocurrency industry. It places the focus entirely on the open-source code, the technical documentation, and the project's ability to deliver on its stated roadmap. Observers and potential users must evaluate the project based on the quality of its technology and the transparency of its operations rather than the reputation of its founders.

The project's origin is rooted in the perceived limitations of existing blockchains in supporting the next generation of dApps, which require a combination of high performance, low cost, and strong security guarantees.

Roadmap & Milestones

The trajectory of a new blockchain is best understood through its development roadmap. The key milestones for Mango Network in 2024, as outlined in its official documents, include:

-

Q2 2024: The official launch of the Mango Network Mainnet and the native Mango Wallet. This represents the transition from a test network to a live, operational blockchain capable of processing real-world transactions.

-

Q3 2024: Planned development of a cross-chain bridge to enable interoperability with other major blockchain ecosystems, such as Ethereum. The launch of a Developer Grant Program is also scheduled to incentivize builders to join the ecosystem.

-

Q4 2024: The deployment of the on-chain governance module. This is a critical step towards decentralization, as it will transfer decision-making authority over protocol upgrades and treasury management to MGO token holders.

As the network is new, there is no history of legal events, major forks, or significant exchange listings or delistings to report. Any news about MGO going forward will likely pertain to the successful execution of these roadmap items.

Analysis of Potential and Risks

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. All investments in cryptocurrencies are highly speculative and involve substantial risk of loss. You should conduct your own thorough research before making any investment decisions.

An objective evaluation of the MGO investment potential requires examining its strengths and the challenges it faces. The future MGO price will be influenced by how effectively the project navigates these factors.

Potential Strengths:

-

Technical Design: The combination of the secure Move language and a high-throughput, DAG-inspired consensus mechanism is technically compelling. If it performs as specified, it could offer a superior developer and user experience for certain classes of dApps.

-

Security Focus: The inherent security features of the Move language could attract developers and users concerned with the frequent exploits seen on other platforms. This is a significant potential differentiator.

-

Low-Cost Environment: The high-scalability architecture is designed to maintain low transaction fees, making it suitable for applications with high transaction volumes, such as games or social media platforms.

Challenges and Considerations:

-

Intense Competition: The Layer-1 market is extremely competitive. Mango Network must compete not only with established giants like Ethereum and Solana but also with other Move-based chains like Aptos and Sui, which have a head start in ecosystem development and funding.

-

Ecosystem Building (The "Cold Start" Problem): A blockchain's value is derived from the applications and users it attracts. Mango Network faces the significant challenge of building a vibrant ecosystem from scratch, requiring substantial effort to attract developers and cultivate a user base.

-

Anonymous Team: While common in crypto, an anonymous team can be a barrier for some institutional investors and users who prioritize transparency and accountability. The project's credibility rests entirely on its technical execution and communication.

-

Market Adoption: Ultimately, the success of Mango Network will depend on market adoption. It must prove that its technical advantages translate into real-world benefits that are compelling enough for developers and users to migrate from or choose it over established alternatives.

Conclusion:

Mango Network is an ambitious project with a sophisticated technical foundation aimed at solving key industry challenges. Its success is contingent upon delivering on its high-performance claims, fostering a robust and unique dApp ecosystem, and gaining the trust of the wider Web3 community. For now, it remains a new entrant in a crowded field. Those looking to trade MGO or learn how to buy MGO should monitor project developments and potential listings on reputable exchanges like Phemex.