Introduction

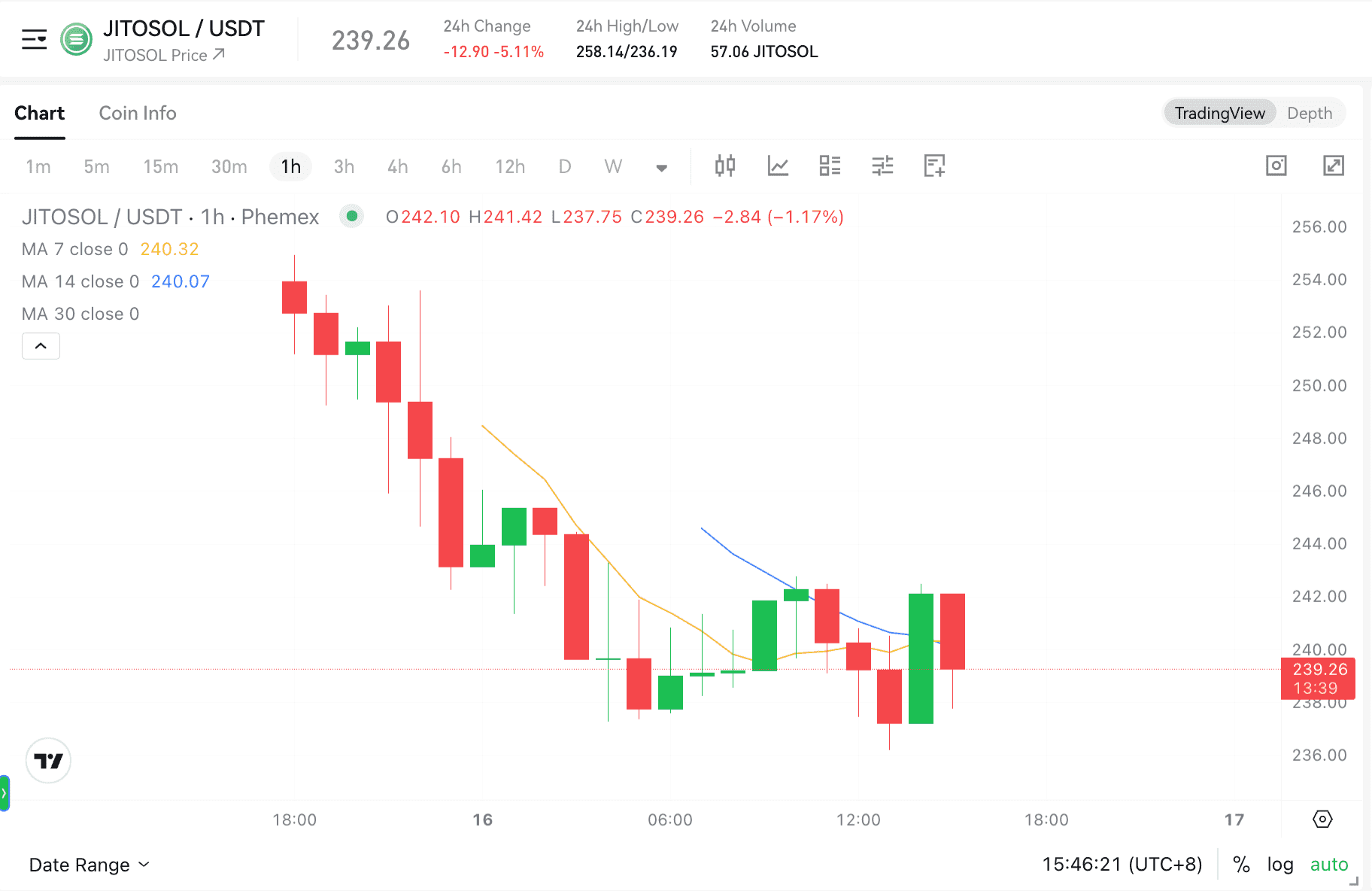

Staking SOL on Solana helps secure the network but often locks your funds. Jito Network’s JITOSOL, a liquid staking token, changes this—it’s like a flexible savings bond that earns interest you can use instantly. What is JITOSOL crypto? It’s a token you get by staking SOL, earning staking rewards plus bonuses from organizing Solana transactions efficiently (MEV). Jito’s system reduces network jams, sharing profits with JITOSOL holders. With Solana’s liquid staking market at $7 billion in 2025, JITOSOL stands out. Its secure pool uses trusted validators. Explore JITOSOL on Phemex to join Solana’s growth.

Quick Facts About JITOSOL

|

Metric |

Detail |

|---|---|

|

Ticker |

JITOSOL |

|

Chain |

Solana |

|

Contract Address |

J1toso1uCk3RLmjorhTtrVwY9HJ7X8V9yYac6Y7kGCPn |

|

Circulating Supply |

11.69M |

|

Total Supply |

11.69M |

|

Market Cap |

$2.78B |

|

Use Case |

Liquid staking with MEV rewards for yield enhancement and DeFi liquidity |

|

Phemex Availability |

Spot (JITOSOL/USDT) |

What Is JITOSOL? Jito Network Explained

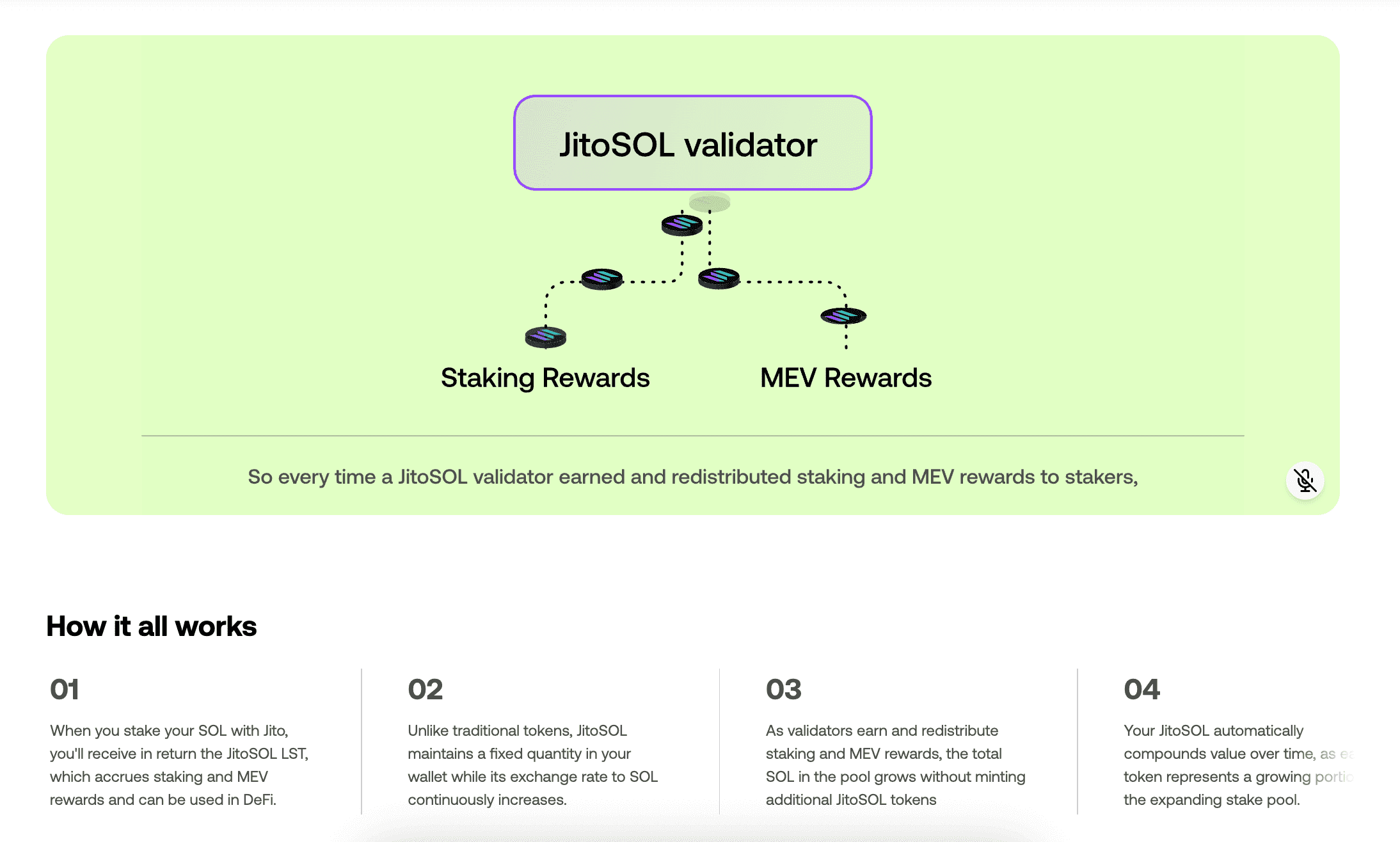

JITOSOL is Jito Network’s liquid staking token on Solana. You stake SOL to get JITOSOL, which you can use in DeFi apps like lending or trading pools, unlike regular staking that locks funds. Jito’s tools sort Solana transactions to avoid slowdowns, like organizing mail faster. This creates extra earnings (MEV) shared with JITOSOL holders, adding 1-3% to 6-8% staking rewards. Jito supports 40% of Solana’s network, making it more secure. JITOSOL grows automatically, stays close to SOL’s value, and can secure other apps for more rewards.

Key Characteristics of JITOSOL

-

Liquidity: Use JITOSOL in DeFi instantly.

-

Dual Rewards: Get staking rewards plus 1-3% MEV.

-

Security: Secure system with trusted validators.

-

Governance: Vote on fees with JTO tokens.

-

Stability: Stays close to SOL’s price.

JITOSOL Tokenomics

JITOSOL’s supply grows when you stake Solana (SOL) and shrinks when you cash out, always matching your SOL with no fixed limit—like a savings account tied to your deposits. Jito takes 6% of extra transaction earnings (MEV): 5.7% goes to its community fund, and 0.15% boosts JITOSOL’s value. Your rewards come from staking (6-8% yearly) and MEV, automatically added to the token’s price, with no extra tokens created. A 2025 plan (JIP-24) could use earnings to buy back JITOSOL, possibly increasing its value. A public ledger tracks validators to keep things transparent. This model scales with Solana’s transactions, prioritizing user returns.

Key Tokenomics Highlights

-

Dynamic Supply: ~11.7M circulating, tied to SOL.

-

Rewards: Auto-compounds staking and MEV (6% to DAO/stakers).

-

Fees: Low pool fees (<1%) maximize yields.

-

Vesting: Instant redemptions, no lockups.

-

Treasury: DAO manages JTO for development.

|

Category |

Percentage |

Vesting Schedule |

|---|---|---|

|

Staking Pool |

100% |

Dynamic (on deposit) |

|

MEV Share |

6% of tips |

Added to token value |

|

Community Fund |

5.7% |

Quarterly distributions |

|

Staker Share |

0.15% |

Added to token value |

What Does JITOSOL Do?

JITOSOL lets you earn staking rewards on Solana while keeping funds flexible for DeFi. Stake SOL to get JITOSOL, then lend it on Marginfi or add to Orca’s trading pools, like JITOSOL/SOL with $29.9M locked as of October 2025. JTO Boost in Kamino pools (e.g., $3.1M for JITOSOL/JTO) increases earnings. Jito shares ~94% of MEV bonuses, adding 1-3% yearly, like $3.6M daily tips in 2025. Restaking lets JITOSOL secure other apps for extra rewards. With 160+ validators, it strengthens Solana while growing your funds.

JITOSOL vs. Marinade Finance (mSOL)

JITOSOL and mSOL are Solana liquid staking tokens. JITOSOL adds 1-2% MEV rewards, reaching 7-9% yearly, while mSOL offers 6-7% from staking. Jito uses 160+ fast validators; mSOL spreads across 200+ for variety. JITOSOL’s value was steadier in 2025’s ups and downs. mSOL works in more DeFi apps, but JITOSOL’s JTO Boost pools give higher returns.

|

Feature |

JITOSOL (Jito) |

mSOL (Marinade) |

|---|---|---|

|

Rewards |

Staking + MEV |

Staking only |

|

Validators |

160+ (fast) |

200+ (varied) |

|

Yield (2025 Avg.) |

7-9% |

6-7% |

|

Value Stability |

Very stable |

Less stable |

|

DeFi Options |

High (JTO Boost) |

Broader |

Technology Behind Jito Network

Jito’s tools sort Solana transactions like an efficient postal service, avoiding network jams. Its Block Engine picks the best order, sharing MEV earnings with users. Fast data delivery supports quick apps. A 2025 update ensures fair ordering. A public ledger tracks validator work, and open tools let JITOSOL secure other apps, boosting rewards. Built for Solana’s speed, Jito handles huge MEV bonuses, keeping the network strong.

Jito Network Team and Origins

Started in 2022 by Lucas Bruder and Zano Sherwani, Jito Labs improves Solana with smart transaction tools. The small team includes Solana experts. Supported by Solana Ventures and Anatoly Yakovenko, Jito’s community-led group uses JTO tokens to make decisions. Its growth to a top liquid staking token shows its strong role in Solana.

JITOSOL News and Milestones

-

March 18, 2025: JITOSOL deemed non-security by report, per SEC clarity.

-

May 19, 2025: Validator tips hit $3.6M daily via Believe ecosystem.

-

July 21, 2025: Launched BAM, enabling programmable block building.

-

August 5, 2025: JIP-24 proposed routing 100% Block Engine fees to DAO.

-

October 15, 2025: Integrated LovePIPE for restaking expansion.

What Will Affect JITOSOL Price 2025–2030?

JITOSOL’s price can go up or down based on Solana’s success and crypto market trends. It follows SOL’s value but grows with staking and MEV rewards. Here’s what could change its price, explained simply.

Factors That May Increase JITOSOL Price

-

Solana’s Transaction Boom: More activity on Solana, like trading or NFT minting, means more MEV auctions, increasing JITOSOL’s rewards. A 2025 network upgrade could double transactions, making JITOSOL more valuable for its higher yields.

-

Clearer Regulations: In 2025, the SEC said LSTs like JITOSOL aren’t securities, encouraging big investors like funds to buy in, which could drive up demand and price.

-

DAO Fee Strategy: JIP-24’s plan to send all Block Engine fees to the Jito DAO could fund buybacks, reducing available JITOSOL and potentially raising its price.

-

Restaking Growth: Partnerships like LovePIPE let JITOSOL secure other networks, earning extra rewards. As more protocols adopt restaking, demand for JITOSOL could rise.

-

ETF Hype: If Solana-based ETFs launch, like Ethereum’s in 2024, they could bring billions into LSTs, boosting JITOSOL’s price as investors seek exposure.

-

BAM Revenue: The Block Assembly Marketplace’s plugins, generating $3.6M daily tips in 2025, add MEV revenue, increasing JITOSOL’s yield and attractiveness.

Factors That May Decrease JITOSOL Price

-

Rival LSTs: Tokens like mSOL or Ethereum L2 staking options could offer better yields or integrations, drawing users away and lowering JITOSOL’s demand.

-

Regulatory Uncertainty: Despite 2025 clarity, new global rules targeting crypto staking could scare investors, reducing JITOSOL buying interest.

-

Solana Outages: Network slowdowns, like early 2025’s, cut transaction volume, lowering MEV rewards and making JITOSOL less appealing.

-

Market Crashes: Crypto bear markets trigger sell-offs; JITOSOL’s peg held in 2025 but could slip in major downturns, hurting price.

-

DAO Errors: Poorly managed DAO initiatives, like failed buybacks, could erode trust, leading to sell-offs and price drops.

-

Low DeFi Adoption: If Solana’s DeFi growth stalls, fewer users will stake or use JITOSOL, limiting its price potential.

How to Buy JITOSOL on Phemex

-

Sign Up: Create a Phemex account by entering your email and completing the secure verification process.

-

Choose a Payment Method: Fund your account using flexible options like credit card, bank transfer, or crypto deposits to buy JITOSOL securely.

-

Buy JITOSOL: Enter your investment amount in your local currency, preview the JITOSOL amount, and confirm to receive it instantly in your Phemex wallet.

JITOSOL FAQ

-

What is JITOSOL? A liquid staking token on Solana, combining staking and MEV rewards.

-

How does Jito Network work? Optimizes Solana via MEV auctions and staking pools.

-

What does JITOSOL do? Earns yields while enabling DeFi use like lending or liquidity.

-

How to stake JITOSOL? Deposit SOL to mint JITOSOL; restake for extra rewards.

-

What is JITOSOL’s supply? ~11.7M circulating, tied to staking.

-

How to join Jito’s governance? Vote with JTO tokens or join the Jito Forum.

Conclusion

JITOSOL, Jito Network’s liquid staking token, offers Solana staking rewards plus MEV bonuses, with flexibility for DeFi apps like Kamino’s $29.9M JITOSOL/SOL pool. Its 2025 updates, like smarter transaction tools and community plans, strengthen Solana. From restaking to voting, JITOSOL connects you to Solana’s growth. Check JITOSOL on Phemex to explore its potential in 2025.