Summary Box (Quick Facts)

-

Ticker Symbol: TRUST

-

Chain: Base (as a settlement layer for the L3)

-

Contract Address: 0x6cd905dF2Ed214b22e0d48FF17CD4200C1C6d8A3

-

Circulating Supply: 179,647,832 TRUST

-

Total Supply: 1,000,000,000 TRUST

-

Primary Use Case: Powering a token-curated knowledge graph to make information verifiable and ownable.

-

Current Market Cap: ~$39.7 million (based on a price of $0.221182 and circulating supply of 179.6M).

What Is TRUST?

TRUST is the native ERC-20 token of the Intuition project. The project's mission is to build a foundational "trust layer" for the internet, creating alignment between AI, blockchain, and online data. It operates on the concept of Information Finance (InfoFi), which treats information itself as a structured, verifiable, and tradable digital asset.

Intuition aims to solve the problem of information authenticity in a digital world by creating an open, token-curated knowledge graph. Through on-chain attestations and reputation staking, the protocol allows information to be exchanged peer-to-peer without centralized gatekeepers.

The Intuition system is comprised of three core components:

-

The Intuition Network: A Layer-3 blockchain built on Base using the Arbitrum Orbit stack. It serves as the coordination and settlement layer for the system's information markets.

-

The Intuition Protocol: A decentralized identity and verifiable data protocol that allows for the tokenization of information, enabling users to own, trade, and monetize their knowledge.

-

The Rust Subnet: An indexing layer that resolves data relationships at scale, making verified data and reputations accessible to builders and AI systems through open APIs.

How Many TRUST Are There?

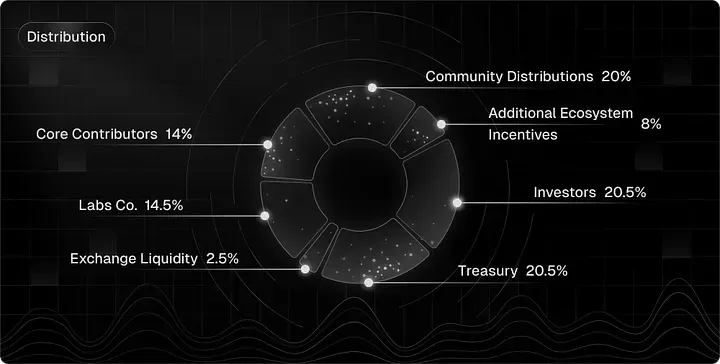

Intuition has a total supply of 1 billion TRUST tokens. The distribution is designed to foster a decentralized and sustainable ecosystem over the long term.

Token Distribution: The initial supply is allocated to key areas to ensure balanced growth:

- Community & Ecosystem: ~20%

- Investors: ~20.5%

- Foundation Treasury: ~20.5%

- Core Contributors: ~14%

- Labs & Strategic Reserves: ~14.5%

- Additional Ecosystem Incentives: ~8%

- Liquidity & Market Operations: ~2.5%

Crucially, allocations for investors and core contributors are subject to multi-year vesting schedules (e.g., a 1-year cliff followed by a 2-3 year linear vest), ensuring long-term alignment with the project's success and preventing premature market pressure.

What Does TRUST Do?

The TRUST token is the central economic mechanism of the Intuition ecosystem, with its utility planned to expand over time.

Current Utilities (At Launch):

-

Gas Token: All transactions on the Intuition Network, such as publishing or curating data, require fees to be paid in TRUST.

-

Data Creation Fee: A small, fixed TRUST fee is required to add new information to the knowledge graph, serving as a spam filter and an initial economic signal of value.

-

Data Curation: Users can stake TRUST in tokenized "vaults" associated with specific pieces of data. This action signals confidence in the information's validity and relevance.

-

Staking (veTRUST): Users can lock their TRUST for periods ranging from two weeks to two years to receive veTRUST (vote-escrowed TRUST). This grants them increased voting power in governance and a larger share of token emission rewards, aligning incentives with long-term commitment.

Future Utilities:

-

Delegation: Token holders will be able to delegate their TRUST to network node operators, allowing them to contribute to network security and earn rewards without running their own infrastructure.

-

Gauge Voting: veTRUST holders will be able to direct the flow of new token emissions to specific categories or domains within the knowledge graph, incentivizing growth in high-value areas.

-

Storage & Query Fees: Users will pay fees in TRUST for persistent data storage and for querying verified data through the Rust Subnet, creating a direct revenue loop for node operators and the protocol.

TRUST vs. KITE

While both TRUST and KITE operate at the intersection of blockchain and data, they address different challenges with distinct approaches. TRUST is focused on creating a foundational, human-curated knowledge graph, whereas KITE aims to build a decentralized network for AI agents and services.

Here is a breakdown of their key differences:

| Feature | TRUST (Intuition) | KITE |

| Core Objective | To create a universal, token-curated knowledge graph where information is verifiable, ownable, and economically weighted by humans. | To build a decentralized network for AI-powered applications and agents, providing a platform for AI services to be bought and sold. |

| Technology & Architecture | A custom Layer-3 network built on Base using the Arbitrum Orbit stack, optimized for high-throughput data attestations. | A Layer-1 blockchain built using the Cosmos SDK, designed specifically to support AI agent execution and interoperability. |

| Mechanism for Trust | Incentivized Intersubjective Consensus: Trust is established through "economic skin-in-the-game." Humans stake TRUST tokens to signal their belief in the truth or relevance of a claim. | Market-Based & Reputational: Trust in AI services is established through a marketplace where agents with a proven track record (performance, reliability) are more likely to be chosen. |

| Primary Use Case | Information Finance (InfoFi): Creating, curating, and querying a verifiable knowledge base for dApps, AI, and identity systems. The token is used for staking, fees, and governance. | AI Services Marketplace: The KITE token is used to pay for AI-driven services, computations, and data within its ecosystem. It powers the economy for autonomous AI agents. |

| Decentralization Focus | Decentralizing information and knowledge to combat misinformation and data monopolies. | Decentralizing AI infrastructure and services to prevent control by a few large tech companies. |

The Technology Behind TRUST

Intuition's technical foundation is a sophisticated blend of blockchain architecture, cryptoeconomics, and decentralized infrastructure.

-

Token-Curated Knowledge Graph: The core of the system. Every piece of data is linked to a stake of TRUST, creating a live, economically-weighted graph of information that is constantly being curated by its users.

-

Bonding Curves: Each data vault uses bonding curves, which are automated market-making mechanisms. They algorithmically determine the price to stake on a claim based on its existing support. This rewards early believers in true information (who get in at a lower price) and ensures continuous liquidity for staking and unstaking without needing a direct counterparty. The DAO can approve different curve shapes (e.g., linear, exponential) to create different incentive "games" for various types of data.

-

Decentralized Indexing Network: A network of independent node operators is responsible for indexing the on-chain and off-chain data that makes up the knowledge graph. They are rewarded with emissions and query fees for providing reliable and fast access to this data. Query routing is weighted based on operator performance, directing traffic to the most reliable nodes.

-

System & Personal Utilization: This unique mechanism links token emissions directly to network health. To unlock the full reward pool, the network as a whole (System Utilization) must see a certain level of new TRUST staked into the graph. Additionally, each individual bonder (Personal Utilization) must actively contribute and recycle a portion of their past rewards back into the system to claim their full share. This creates a powerful feedback loop where inflation fuels productive growth.

Team & Origins

Intuition was founded by a team with deep roots in the crypto industry, many of whom have been working on decentralized identity and related challenges since their time at ConsenSys nearly a decade ago. The project is supported by a strong coalition of over 100 investors, including Polygon Ventures, Shima Capital, and GSR, reflecting significant confidence from established players in the Web3 space.

Key News & Events

-

Exchange Listings: The TRUST token was introduced to the broader public market through listings on several crypto exchanges in late 2025.

-

Ecosystem Development: The protocol has focused on building out its core infrastructure, including the decentralized indexing network and the governance framework.

-

Partnerships and Integrations: Intuition is actively working with projects in the AI, DeFi, and decentralized identity spaces to integrate its trust layer, with notable collaborations including discussions with major tech players like Google.

Is TRUST a Good Investment?

Determining if TRUST is a good investment requires understanding its ambitious goals and the inherent risks. This section is purely informational and does not constitute financial advice.

-

Past Performance: As a recently launched token, TRUST has displayed the high volatility typical of new crypto assets, with its price being sensitive to market trends and project developments.

-

Tech and Market Positioning: Intuition is targeting the enormous market for trusted information, a foundational need for both Web3 and AI. Its sophisticated tokenomics, particularly the Utilization mechanisms that tie inflation directly to platform growth, are designed for long-term sustainability. This model actively discourages passive speculation and rewards productive participation, potentially creating a healthier token economy. The TRUST price is intrinsically linked to the demand for creating, curating, and querying data on its graph.

-

Community Growth and Adoption: The project's success hinges on attracting a critical mass of developers, creators, and curators to build and maintain the knowledge graph. Its strong backing and experienced team provide a solid foundation for this growth.

-

Risks: The primary risk is execution. Building a universal, decentralized knowledge graph is a monumental task. The system's complexity could also be a barrier to entry for mainstream users. As with all crypto assets, TRUST is subject to market volatility and evolving regulatory landscapes.

Conclusion: Intuition offers a compelling and technically robust solution to one of the internet's most significant problems. Its investment potential is tied to its ability to achieve network effects and become an indispensable layer of the future web.

Disclaimer: Crypto trading involves risks; only invest what you can afford to lose.

Community & Analyst Sentiment

Community and analyst perspectives on Intuition are largely focused on its high-level ambition and technical depth.

-

Positive Sentiment: Supporters are highly optimistic about the "Information Finance" (InfoFi) narrative, seeing it as a massive, untapped market. The project's deep connections to the Ethereum ecosystem via its ConsenSys-veteran team and strong VC backing are seen as major validators. The unique tokenomic designs, like bonding curves and utilization-based emissions, are often praised by sophisticated analysts as innovative solutions to long-standing problems in crypto incentive design.

-

Points of Caution: The complexity of the system is a recurring theme. Concepts like bonding curves and personal utilization, while powerful, can be difficult for the average user to grasp, potentially slowing adoption. Skeptics are in a "wait-and-see" mode, looking for tangible evidence of the knowledge graph's growth and utility before being fully convinced. The latest news about TRUST and its developer adoption metrics are key data points the community is watching.

How to Buy TRUST on Phemex

Ready to participate in the future of decentralized information? You can easily acquire TRUST on Phemex by following these steps:

-

Create a Phemex Account: Sign up on the Phemex website or mobile app if you haven't already.

-

Fund Your Account: Deposit funds via crypto transfer or purchase crypto directly using a credit card, debit card, or bank transfer.

-

Find the TRUST Market: Navigate to the Spot Trading section and search for the TRUST/USDT pair.

-

Place Your Order: Select your desired order type (e.g., Market, Limit), enter the amount of TRUST you wish to purchase, and confirm the trade.

For a more detailed guide, see our page on How to buy TRUST. After purchasing, you can Trade TRUST or hold it to participate in the Intuition ecosystem.

FAQs

1. What is the main goal of the Intuition (TRUST) project?

Its primary goal is to build a decentralized, token-curated knowledge graph. This makes information verifiable, ownable, and economically rational, creating a trustworthy data layer for the internet.

2. What problem does staking on claims solve?

Staking requires users to have "economic skin-in-the-game." By backing claims with real value in the form of TRUST tokens, it discourages spam and low-quality contributions. This system rewards those who correctly identify and support valuable information while making it costly to promote falsehoods.

3. How are token rewards tied to platform usage?

Through a mechanism called System and Personal Utilization. The protocol's token emissions are scaled based on the overall growth of staked data on the platform and each individual's active participation. If the platform isn't being used, token inflation automatically slows down, aligning incentives with sustainable growth.

Summary: Why It Matters

In an era where distinguishing fact from fiction is increasingly difficult, Intuition offers a novel solution. It matters because it moves beyond the limitations of centralized platforms by embedding trust directly into the data itself through transparent, economic incentives.

By creating a "Token-Weighted Web of Trust," Intuition provides the critical infrastructure needed for a more honest and reliable digital world. It gives creators ownership of their knowledge, rewards curators for finding the truth, and equips developers with a foundational layer to build the next generation of trusted applications.