Traditional cloud infrastructure often faces challenges with centralization, high costs, and inefficiencies, creating bottlenecks for Web3 applications, AI workloads, gaming, and real-time communication. Datagram Network (DGRAM) overcomes these limitations with a Layer 1 blockchain and decentralized Hyper-Fabric Network that delivers real-time connectivity and DePIN interoperability. By leveraging a global network of nodes across 150+ countries, Datagram ensures scalable, secure, and cost-effective infrastructure. The DGRAM token drives this ecosystem, incentivizing participation and enabling seamless transactions. This guide explains what Datagram Network is, how DGRAM works, why it matters in 2025, and how to buy DGRAM on Phemex.

Quick Facts About Datagram Network (DGRAM)

| Project Name | Datagram Network |

| Ticker | DGRAM |

| Blockchain | Layer 1, compatible with Avalanche C-Chain (ARC-20) and Binance Smart Chain (BSC) |

| Contract Address | 0x49c6c91ec839a581de2b882e868494215250ee59 |

| Total Supply | 10 billion DGRAM |

| Circulating Supply | ~2.09 billion DGRAM (November 2025) |

| Availability on Phemex | Spot (DGRAM/USDT) |

| Use Case | Payments, node rewards, governance for DePIN connectivity |

| Key Feature | AI-driven Hyper-Fabric Network for real-time Web3 connectivity |

What Is DGRAM? Datagram Network Explained

Datagram Network (DGRAM) is a Layer 1 blockchain and global Hyper-Fabric Network designed to deliver real-time connectivity and interoperability for Decentralized Physical Infrastructure Networks (DePIN). It tackles the inefficiencies of centralized cloud systems—high costs, latency, and bottlenecks—by utilizing a decentralized network of nodes across 150+ countries. Datagram optimizes idle hardware and bandwidth to support Web3 applications, AI workloads, gaming, and communication, offering a scalable, secure alternative.

The native token, DGRAM, drives the ecosystem, enabling payments, rewarding node operators, and supporting governance. Serving over 200 enterprises and 1 million+ users globally, Datagram bridges Web2 usability with Web3 decentralization.

Key Characteristics of Datagram Network

- Global Node Network: Hundreds of thousands of nodes in 150+ countries ensure low-latency connectivity.

- AI-Driven Optimization: Dynamically manages traffic to reduce congestion and enhance performance.

- DePIN Interoperability: Enables seamless collaboration across decentralized networks via the Datagram Core Substrate (DCS).

- Scalability: Supports high-throughput applications like video streaming and AI inference without bottlenecks.

- Community-Driven: Decentralized governance allows DGRAM holders to vote on network upgrades.

What Does DGRAM Do?

DGRAM serves multiple roles within the Datagram Network:

- Payments: Users burn DGRAM to generate DATA tokens (pegged at $0.01) for purchasing network services like bandwidth or compute resources.

- Rewards: Node operators (“Cores”) earn UDP tokens for contributing resources, convertible to DGRAM.

- Governance: DGRAM holders stake tokens to participate in Proof-of-Stake consensus and vote on proposals.

- Trading: DGRAM is tradeable on Phemex, enhancing liquidity for ecosystem participants.

The tri-token model (DGRAM, UDP, DATA) balances economic incentives, ensuring stability and scalability.

DGRAM Tokenomics

Datagram employs a Burn-and-Mint Equilibrium model to align value creation with network growth:

- Total Supply: 10 billion DGRAM (fully diluted).

- Circulating Supply: ~2.09 billion DGRAM (November 2025).

- Burn Mechanism: DGRAM is burned to generate DATA, reducing supply and creating deflationary pressure.

- Minting: New DGRAM is minted to reward node operators and active users based on participation.

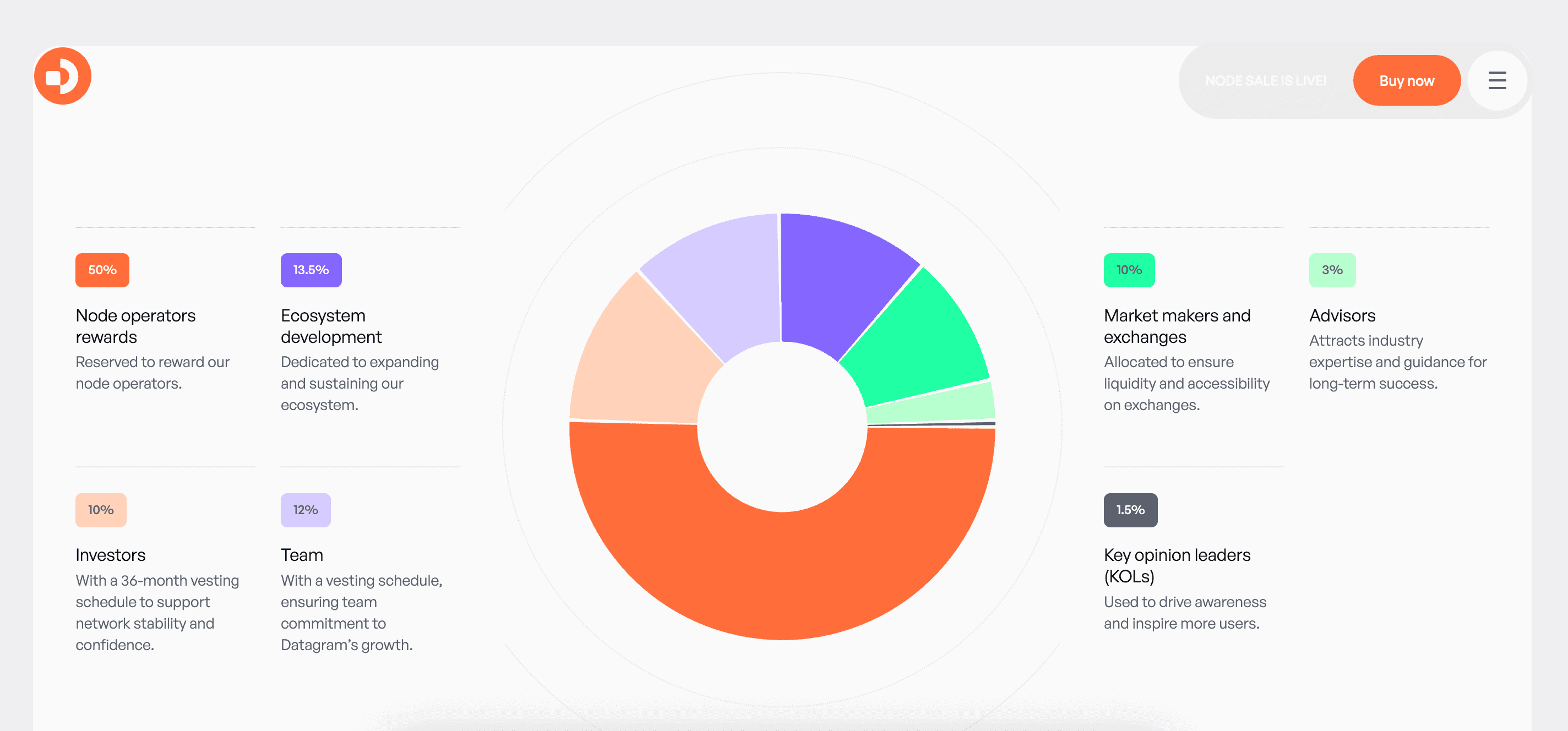

- Allocation: 50% for node rewards, 13.5% for ecosystem incentives, 1.5% for KOL and referral initiatives.

- No Taxes: Zero buy/sell fees to encourage trading.

- Airdrops: Includes community campaigns to distribute tokens.

Datagram Token Distribution Model

The Datagram token distribution model is designed to promote decentralization and long-term sustainability. The total supply of 10 billion DGRAM is allocated as follows:

| Percentage | Recipient | Purpose |

|---|---|---|

| 50% | Node Operators | Reserved for rewarding node operators who support the network’s traffic routing, data processing, and communication services. |

| 13.5% | Ecosystem Development | Dedicated to expanding and sustaining the ecosystem through development and community initiatives. |

| 12% | Team | Allocated with a vesting schedule to ensure team commitment to Datagram’s growth. |

| 10% | Investors | Subject to a 36-month vesting schedule to support network stability and confidence. |

| 10% | Market Makers | Allocated to ensure liquidity and accessibility on exchanges. |

| 3% | Advisors | Attracts industry expertise for long-term success. |

| 1.5% | Key Opinion Leaders (KOLs) | Drives awareness and inspires user adoption. |

Source: Datagram Network

This distribution prioritizes node operators and ecosystem growth, with vesting schedules for team and investors to align incentives with network success.

DGRAM vs. LINK

DGRAM and LINK both enhance Web3 infrastructure, with DGRAM specializing in physical connectivity and LINK in data provision, offering complementary roles in decentralized ecosystems.

| Aspect | Datagram Network (DGRAM) | Chainlink (LINK) |

|---|---|---|

| Purpose | Focuses on DePIN connectivity and real-time applications | Provides decentralized oracle services for smart contracts |

| Primary Use Case | Infrastructure for Web3 apps, AI, gaming, telecom | Real-time data feeds for DeFi, insurance, gaming |

| Technology | AI-driven Hyper-Fabric Network, Layer 1 blockchain | Decentralized oracle network, integrates with multiple blockchains |

| Scalability | Global node network optimizes low-latency connectivity | Scales via node operators, supports high-data throughput |

| Tokenomics | Burn-and-Mint model with 10B total supply | Inflationary model with 1B total supply, staking rewards |

| Market Position | Emerging DePIN token, ~$21.54M market cap | Established token, ~$7.8B market cap (as of 2025 estimates) |

| Interoperability | DePIN-to-DePIN via Datagram Core Substrate | Cross-chain data interoperability via CCIP |

Technology Behind DGRAM

Datagram Network leverages a Layer 1 blockchain with an AI-driven Hyper-Fabric architecture. Key technologies include:

- Datagram Core Substrate (DCS): A framework for DePIN-to-DePIN interoperability.

- AI Optimization: Machine learning allocates resources to minimize latency and congestion.

- Tri-Token System: DGRAM, UDP, and DATA tokens create a balanced economy.

- Node Network: Nodes across 150+ countries use UDP and TCP protocols for connectivity.

- Proof-of-Stake Consensus: DGRAM staking ensures decentralized governance and security.

DGRAM Team and Origins

Datagram Network was founded in April 2025 with a whitepaper addressing centralized cloud inefficiencies. The team includes:

- Jason Brink (CEO): Former President of Blockchain at Gala Games, awarded by the Bill & Melinda Gates Foundation for blockchain-based aid distribution.

- William Nguyen, Ph.D.: Three successful startup exits, former Gifto member, and Harvard Sloan postdoctoral researcher. The project evolved from a DePIN baselayer to a global Hyper-Fabric Network, with decentralized governance empowering DGRAM holders.

DGRAM News and Milestones

- April 2025: Whitepaper released, outlining the Hyper-Fabric Network vision.

- June 2025: Alpha testnet launched, enabling node operation and airdrop campaigns.

- November 2025: DGRAM listed on Phemex (November 18), with community airdrops.

- Ongoing: Serving 200+ enterprises and 1 million+ users, with plans for node expansion.

What Will Affect DGRAM’s Price 2025–2030?

Factors influencing DGRAM’s price include:

- Adoption Growth: Increased enterprise and user adoption could drive demand.

- DePIN Trends: Rising interest in DePIN projects may boost visibility.

- Token Burns: The Burn-and-Mint model reduces supply, potentially increasing value.

- Market Volatility: Recent 10% drop post-airdrop signals price sensitivity.

- Regulatory Changes: Evolving regulations could impact operations.

A 5% annual growth forecast suggests $0.0007146 by 2030, but volatility makes predictions uncertain.

Is DGRAM a Good Investment?

Assessing DGRAM’s investment potential in 2025 involves evaluating its current advantages, growth opportunities, and risks to help investors make informed decisions.

- Growth Opportunities: DGRAM benefits from strong fundamentals, including a global network of over 150,000 nodes and adoption by 200+ enterprises and 1 million+ users, reflecting robust usage metrics. Its AI-driven Hyper-Fabric Network and DePIN interoperability via the Datagram Core Substrate offer a technological edge, enhancing scalability for real-time applications like gaming and AI workloads. The governance model, powered by Proof-of-Stake, encourages community participation, while the Burn-and-Mint tokenomics could drive value growth by reducing supply.

- Risks and Considerations: Immediate challenges include market volatility, evidenced by a recent 10% price drop post-airdrop, and the pressure from only 19 wallets controlling most circulating supply, risking whale manipulation. Security concerns arise as a new Layer 1 blockchain, with potential vulnerabilities needing monitoring. Regulatory risks loom due to evolving DePIN and crypto laws, and emission uncertainty from the minting process could affect long-term stability.

- Community and Analyst Sentiment: Online discussions on platforms like Twitter and crypto media reflect mixed sentiment. Some analysts note the airdrop sell-off as a typical early-stage challenge, with potential for recovery if adoption grows, while others caution about whale dominance and volatility. Community sentiment leans cautiously optimistic, with hopes pinned on upcoming node expansions and enterprise partnerships, though concerns about short-term price dips persist. Datagram’s response includes ongoing airdrops and roadmap updates to boost engagement and address scalability concerns.

Investors should weigh these factors, conduct thorough research, and assess their risk tolerance before investing in DGRAM.

How to Buy DGRAM on Phemex

Phemex listed DGRAM/USDT for spot trading on November 18, 2025, at 10:00 UTC. To trade:

- Sign Up: Create a Phemex account and complete KYC verification.

- Deposit Funds: Add USDT to your wallet.

- Trade: Navigate to Spot > DGRAM/USDT, enter the amount, and confirm.

Summary

Datagram Network (DGRAM) is a pioneering Layer 1 blockchain and Hyper-Fabric Network delivering scalable, AI-driven connectivity for Web3 and DePIN projects. With nodes across 150+ countries, it serves 200+ enterprises and 1 million+ users. The DGRAM token powers payments, rewards, and governance, supported by a deflationary Burn-and-Mint model and a strategic distribution plan. Listed on Phemex, DGRAM offers investment potential but carries risks due to volatility. Start trading DGRAM/USDT on Phemex to explore decentralized infrastructure.

FAQ

- What is Datagram Network? A Layer 1 blockchain and AI-driven Hyper-Fabric Network for DePIN interoperability.

- What is DGRAM used for? DGRAM facilitates payments, rewards node operators, and enables governance.

- Where can I buy DGRAM? DGRAM is available on Phemex. Learn how to buy DGRAM.

- Is DGRAM a safe investment? DGRAM is volatile; research thoroughly before investing.

- How does Datagram differ from other DePIN projects? Its AI-driven, multi-functional infrastructure supports diverse applications.