Summary Box (Quick Facts)

-

Ticker Symbol: CYS

-

Chain: Cosmos CDK (EVM-compatible Layer-1)

-

Primary Use Case: Decentralized compute marketplace (ComputeFi) for AI, ZK-proofs, and mining.

-

Circulating Supply: 16.08% of total at launch

-

Total Supply: 1 billion

-

Current Market Cap: Data not available

What Is Cysic (CYS)?

Cysic (CYS) is a decentralized compute infrastructure designed to solve one of the biggest challenges in modern technology: the high cost and centralization of computational power. In today’s digital world, technologies like Artificial Intelligence (AI) and the zero-knowledge (ZK) proofs that help scale blockchains are incredibly power-hungry. This demand has been largely met by a few big cloud providers, making compute expensive and inaccessible for many.

This is the problem Cysic aims to solve. What is Cysic? It’s the foundation for ComputeFi, a new vision that transforms computational resources—like GPUs, ASICs, and servers—into a globally accessible, liquid, and verifiable marketplace. Explained simply, Cysic allows anyone, from individuals with a gaming PC to large-scale data centers, to contribute their unused computing power to a network. In return, developers and projects can access this power on-demand for tasks like generating ZK-proofs or running AI models, creating a more open and efficient compute economy.

How Many CYS Are There?

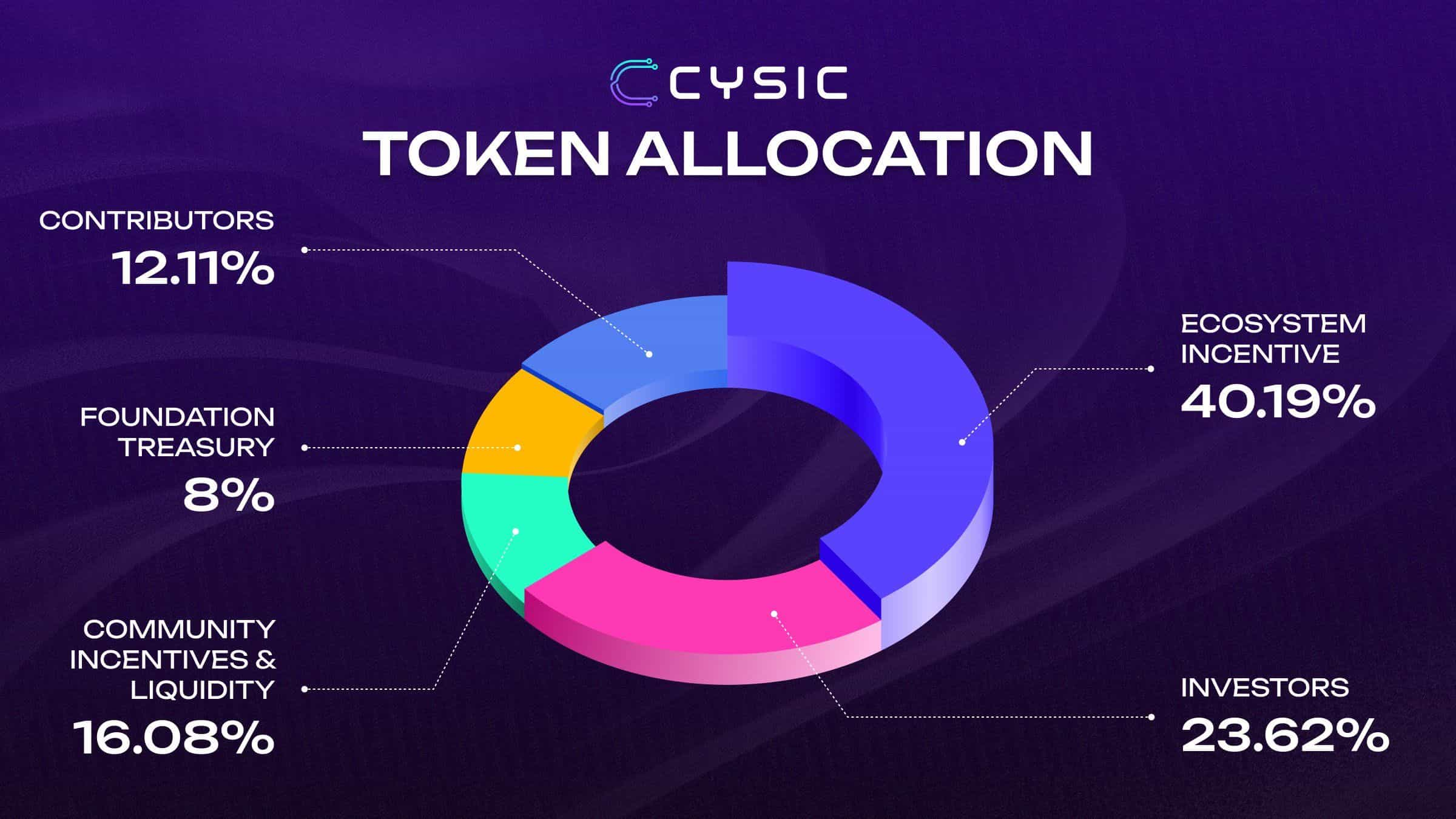

Cysic has a total supply of 1 billion CYS tokens, with a distribution strategy designed to foster long-term, sustainable growth. The allocation is as follows:

-

Ecosystem Incentives (40.19%): This is the largest allocation, designed to fuel the growth of the ComputeFi ecosystem over a 10-year emission schedule. These funds are used for mining and staking rewards, grants for developers, and other community-focused programs.

-

Investors (23.62%): This portion is allocated to the Seed and Pre-A round backers who provided the early capital for research, hardware development, and infrastructure scaling.

-

Community Incentives & Liquidity (16.08%): This allocation ensures market liquidity from the Token Generation Event (TGE) onwards and funds community rewards like airdrops.

-

Contributors (12.11%): Reserved to reward the core developers and early builders who were instrumental in creating the Cysic network.

-

Foundation Treasury (8%): Set aside to fund ongoing research and development, including future silicon design, and to cover operational expenses.

The network’s tokenomics are further strengthened by a dual-token model:

-

$CYS: The native utility token used to pay for compute tasks and reward network participants.

-

$CGT: A non-transferable governance token obtained by staking $CYS, granting voting rights and serving as collateral for compute providers.

What Does CYS Do?

Within its ecosystem, the primary Cysic use case is to facilitate a seamless market for computational tasks. The network coordinates several key participants to achieve this:

-

Task Requesters: Developers, rollup operators, or AI companies who need computational power. They submit jobs to the network, specifying their requirements and the reward they are offering in CYS.

-

Compute Providers: Individuals or organizations that contribute their hardware (GPUs, ASICs) to the network. They bid on available tasks and, if selected, execute the computation and submit the results.

-

Verifiers: Independent actors who check the correctness of the completed work. This verification ensures the integrity of the network, guaranteeing that requesters only pay for valid results.

For example, when a rollup needs a ZK-proof, it submits a task. Multiple providers bid, and a winner is chosen. After the proof is generated, it is checked by randomly selected verifiers. Once verified, the CYS reward is distributed to the provider and verifiers, creating a trustless and efficient workflow. This model supports AI inference, blockchain infrastructure, and even crypto mining.

Cysic vs. Pirate Chain

While both Cysic and Pirate Chain utilize zero-knowledge technology, they do so for fundamentally different purposes. Cysic is an infrastructure project that provides ZK computation as a service, whereas Pirate Chain is a cryptocurrency that uses ZK cryptography to deliver a specific product: private transactions.

The table below outlines their key differences:

| Feature | Cysic (CYS) | Pirate Chain (ARRR) |

| Primary Use Case | A decentralized marketplace for computational power (AI, ZK-proving, etc.). | A cryptocurrency focused on providing anonymous, private digital transactions. |

| Technology Focus | An infrastructure layer to supply verifiable computation to other networks. | An application layer that uses zk-SNARKs to shield 100% of its transactions. |

| Consensus Mechanism | Proof-of-Compute (PoC), a variation of Proof-of-Stake. | Proof-of-Work (PoW), secured by Komodo's delayed Proof-of-Work (dPoW). |

| Core Function | To orchestrate and sell computational resources in an open market. | To function as a secure and untraceable medium of exchange. |

In short, Cysic is building the factory that produces computational power for the entire Web3 ecosystem, while Pirate Chain is a specialized product built using similar underlying cryptographic principles.

The Technology Behind Cysic

Cysic's power stems from its unique full-stack architecture, which integrates everything from custom hardware to the blockchain protocol.

-

Layered Architecture: The network is built in four modular layers:

-

Hardware Layer: The physical foundation, including Cysic’s custom ZK-ASICs, optimized GPU clusters, portable miners, and third-party hardware.

-

Consensus Layer: Built on the Cosmos CDK, it uses a Proof-of-Compute mechanism. This consensus model considers not only staked tokens but also the amount of computation pledged to the network, rewarding real work.

-

Execution Layer: EVM-compatible smart contracts that handle job scheduling, workload routing, and matching providers with requesters.

-

Product Layer: The user-facing portal for specific services like the ZK-proof market, AI inference framework, and crypto mining framework.

-

-

Hardware-Software Co-Design: Unlike software-only projects, Cysic designs and builds its own silicon. Its specialized ASICs for ZK-proofs offer massive performance and efficiency gains over general-purpose GPUs, giving the network a powerful competitive advantage.

Team & Origins

Cysic was founded with the vision of making computation a publicly accessible, liquid, and trustless resource, much like how DeFi unlocked capital. The team began its research in 2022 to tackle the computational bottleneck hindering the growth of ZK and AI technologies, leading to the mainnet launch in 2025.

The project’s ambitious approach has attracted significant support from leading venture capital firms. Cysic raised $12 million in a pre-A funding round from prominent investors including Polychain Capital, HashKey, OKX Ventures, and ABCDE, validating the industry’s confidence in its mission to build a decentralized compute economy.

Key News & Events

-

Mainnet Launch (September 2025): The Cysic mainnet went live, quickly demonstrating its capacity by processing over 13 million transactions for more than 1.35 million users.

-

Strategic Partnerships: Cysic has become a critical infrastructure partner for top Web3 projects like Scroll, Aleo, and zkSync, providing essential ZK-proving services.

-

Token Airdrop: An airdrop was conducted to reward early adopters and community members, distributing a portion of the CYS supply to foster decentralized ownership.

-

Exchange Listings: CYS has been listed on Phemex for both spot and futures trading, making it available to a wider audience of traders and network participants. For the latest updates, follow the News about CYS.

Is Cysic (CYS) a Good Investment?

Disclaimer: This is not financial advice. Crypto trading involves risks; only invest what you can afford to lose.

Evaluating the Cysic investment potential requires weighing its significant strengths against the inherent risks of the crypto market.

Potential Strengths:

-

Market Positioning: Cysic targets the high-growth sectors of AI and ZK-proofs, where demand for computation is soaring. It aims to unify a fragmented market into a single liquid platform.

-

Technological Advantage: Its hardware-software co-design, particularly the development of custom ZK-ASICs, provides a distinct efficiency and performance edge over software-only competitors.

-

Proven Utility: Cysic is not a theoretical project; it is already providing essential services to major players in the blockchain space, demonstrating clear product-market fit.

Potential Risks:

-

Competition: The decentralized compute space is competitive, with other projects targeting niches like AI rendering or ZK-proving.

-

Execution Risk: Building and scaling a full-stack hardware and software solution is incredibly complex and capital-intensive.

-

Market Volatility: The CYS price will be subject to the same market volatility that affects all cryptocurrencies.

Conclusion: Cysic is tackling a fundamental problem with a unique and robust solution. Its success in becoming the foundational compute layer for Web3 could lead to significant growth, but investors should remain aware of the associated risks.

How to Buy CYS on Phemex

For those looking to get involved with the Cysic ecosystem, Phemex offers a simple and secure platform. You can follow our detailed guide on How to buy CYS to get started. To begin trading immediately, visit our markets to Trade CYS on either a spot or futures basis.

FAQs

What is "ComputeFi"?

ComputeFi is Cysic’s vision for the financialization of compute power. It aims to turn computational resources like GPUs and ASICs into a programmable, liquid, and verifiable asset class, creating a unified marketplace for all types of computational tasks.

What makes Cysic different from other decentralized compute projects?

Cysic’s key differentiator is its full-stack, hardware-software co-design. While most competitors are software-only, Cysic develops its own custom hardware, such as ZK-ASICs, to deliver superior performance and efficiency for specific workloads.

Is Cysic an AI coin?

Cysic is "workload-agnostic," meaning it's designed to support many types of computation, including ZK-proofs and crypto mining. However, AI is a primary use case, and the network provides essential infrastructure for verifiable and on-demand AI inference, making it a key player in the decentralized AI space.

Summary: Why It Matters

Compute has become the digital era's most critical resource, but its access remains centralized and costly. Cysic's vision for ComputeFi directly challenges this model. By creating a decentralized marketplace, it aims to establish compute as the missing pillar of Web3 infrastructure, alongside DeFi (finance), Filecoin (storage), and decentralized bandwidth.

Cysic is not just creating another blockchain; it is building the foundational rails for the next generation of AI and decentralized applications. By transforming raw compute into a liquid, verifiable asset, Cysic unlocks innovation and empowers developers to build a more open and efficient digital future.