It is the question that dominates search engines whenever the crypto market heats up: "What does it mean to stake crypto?"

If you are looking for the gambling platform, this guide isn't for you. However, if you are looking to understand the financial mechanism that powers the modern blockchain economy—and how it can generate passive income for your portfolio—you are in the right place.

As we head into 2026, the days of simply "HODLing" (holding on for dear life) and hoping for price appreciation are over. Sophisticated investors now demand yield. Whether you hold Bitcoin, Ethereum, or stablecoins, your assets should be working for you, not gathering digital dust in a dormant wallet.

But here lies the confusion: Not all "Earning" is "Staking."

In this comprehensive guide, we will decode the difference between true On-Chain Staking and Crypto Savings, address the risks, and show you how to optimize your portfolio using tools like Phemex’s new On-Chain Earn and BTC Vault.

The Definition (The "What")

Demystifying Proof-of-Stake (PoS)

To understand staking, you must first understand how blockchains agree on the truth.

In the early days (Bitcoin), we used Proof of Work (PoW). This required massive amounts of electricity and hardware (miners) to secure the network. You couldn't "stake" Bitcoin in the traditional sense; you had to mine it.

Enter Proof of Stake (PoS). Blockchains like Ethereum, Solana, and Cardano replaced energy-hungry miners with "Validators."

-

The Mechanism: Instead of buying hardware, validators lock up (stake) their cryptocurrency tokens into the network's protocol.

-

The Job: These staked tokens act as a security deposit. They grant the right to check transactions and create new blocks.

-

The Reward: In exchange for doing this honest work, the protocol pays the staker new coins (block rewards) and a portion of transaction fees.

-

The Risk: If a validator acts maliciously or goes offline, the network can confiscate a portion of their staked tokens. This penalty is known as "Slashing."

So, strictly speaking:

"Staking" means locking your assets directly into a Proof-of-Stake blockchain protocol to help secure the network in exchange for protocol rewards.

However, in 2025 and 2026, the term "Staking" is often used loosely to describe any activity where you lock up crypto to earn interest. This leads us to the most important distinction for your wallet.

The Great Distinction: On-Chain Staking vs. Savings

Why "Earn" is a Spectrum

When you see an APY (Annual Percentage Yield) on a crypto platform, it is crucial to ask: Where is this yield coming from?

There are two main engines driving yields on Phemex and in the wider crypto market.

1. True On-Chain Staking (The "Native" Yield)

This is the purest form of yield.

-

Source of Yield: The Blockchain Protocol itself (e.g., the Ethereum network).

-

Transparency: High. You can verify on-chain that the assets are staked.

-

Pros: You are contributing to the decentralization of the network. Furthermore, engaging in on-chain staking often qualifies you for Airdrops—free token distributions from new projects building on top of that staking layer (like Liquid Staking Derivatives or Restaking protocols).

-

Cons: Usually requires a "lock-up" period (e.g., un-staking SOL takes a few days; un-staking ETH used to take weeks).

2. Crypto Savings / Lending (The "Bank" Model)

This applies to assets that cannot be staked (like Bitcoin or USDT).

-

Source of Yield: Lending demand. The platform lends your assets to institutional borrowers, market makers, or other users who pay interest.

-

Transparency: Depends on the platform. (Phemex prioritizes verified Merkle-Tree Proof of Reserves).

-

Pros: Often higher liquidity (Flexible Savings) and support for non-PoS assets like Bitcoin.

-

Cons: You generally don't get network airdrops, as you aren't validating the network.

The 2026 Portfolio Strategy

Why "Transparency" is the Keyword of the Year

In previous cycles, investors chased the highest APY without asking questions. Post-2022, the market matured. The trend for 2026 is Sustainable, Transparent Yield.

This is why Phemex has restructured its Earn ecosystem to clearly distinguish between these products, giving you full control over your risk and reward profile.

Strategy A: The "ETH & SOL" Believer

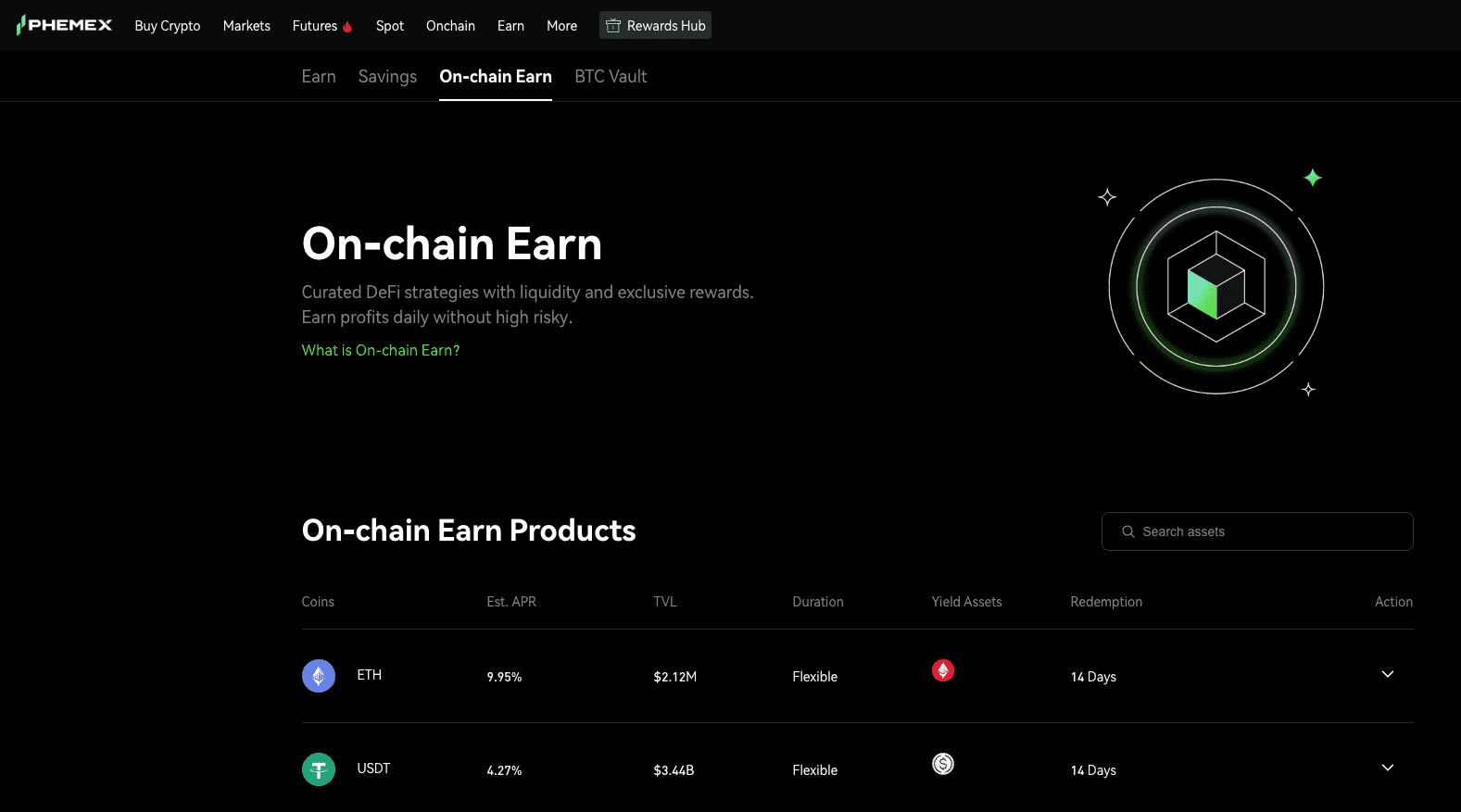

Tool: Phemex On-Chain Earn

If you hold Ethereum, you might know that running your own validator node requires 32 ETH (over $100k USD at times) and complex coding skills.

Phemex On-Chain Earn democratizes this.

-

How it works: You deposit as little as 0.1 ETH. Phemex pools user funds to spin up enterprise-grade validators.

-

The "New" Edge: Unlike old "Earn" products that were black boxes, Phemex's new On-Chain module connects you directly to the protocol yield.

-

The Alpha: Phemex explicitly notes the potential for "+ Airdrops". Because your assets are participating in real on-chain validation, you remain eligible for future ecosystem rewards that typically exclude centralized exchange users.

| Asset | Underlying Protocol | Est. APR | Key Feature | Redemption Period |

| ETH | xHASH Protocol | 9.98% | + Airdrop Eligible | 14 Days |

| SOL | Jito Protocol | 6.60% | MEV Enhanced Yield | 7 Days |

| USDT | Ethena Protocol | 4.27% | High TVL Stability | 14 Days |

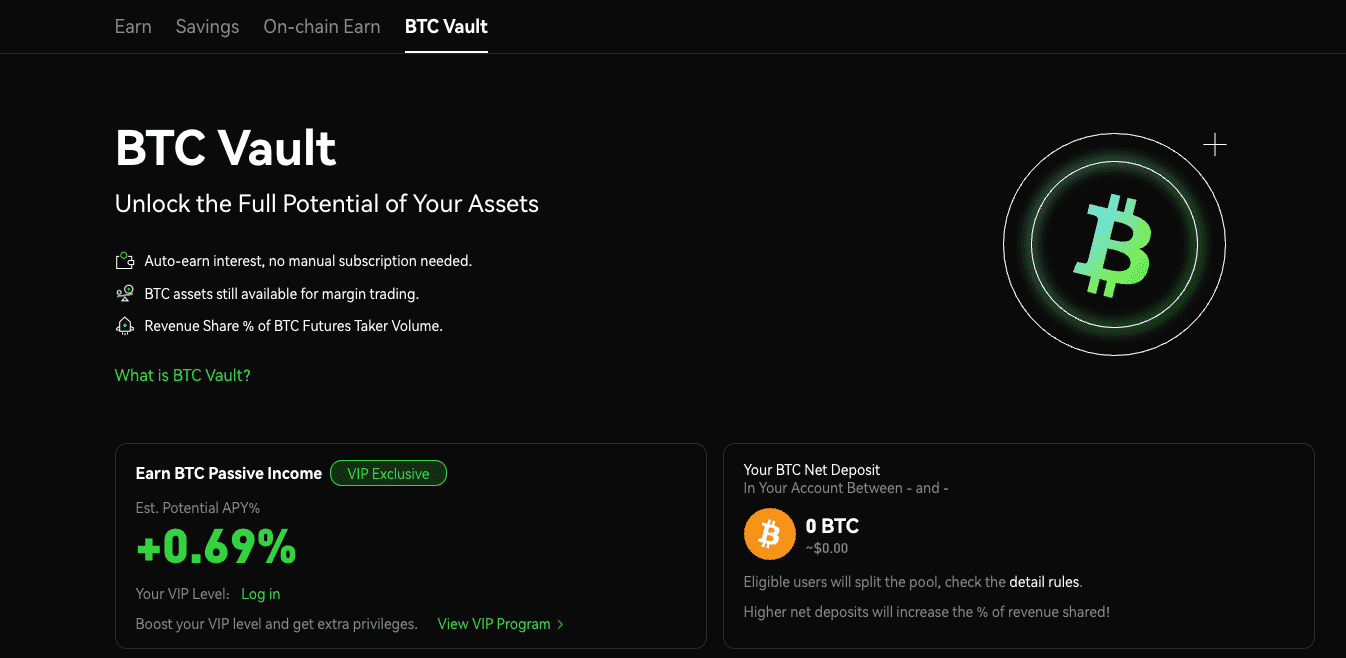

Strategy B: The Bitcoin Maximalist

Tool: Phemex BTC Vault

"Can I stake Bitcoin?" Technically, no. Bitcoin is Proof-of-Work.

However, leaving BTC idle is inefficient. The BTC Vault is a structured product designed specifically for the King of Crypto.

-

The Concept: It allows you to earn yield denominated in BTC.

-

Why it matters: If Bitcoin goes to $150k in 2026, earning 5% APY in BTC is significantly more valuable than earning 5% in USDT. The BTC Vault is designed to grow your stack, not just your dollar value.

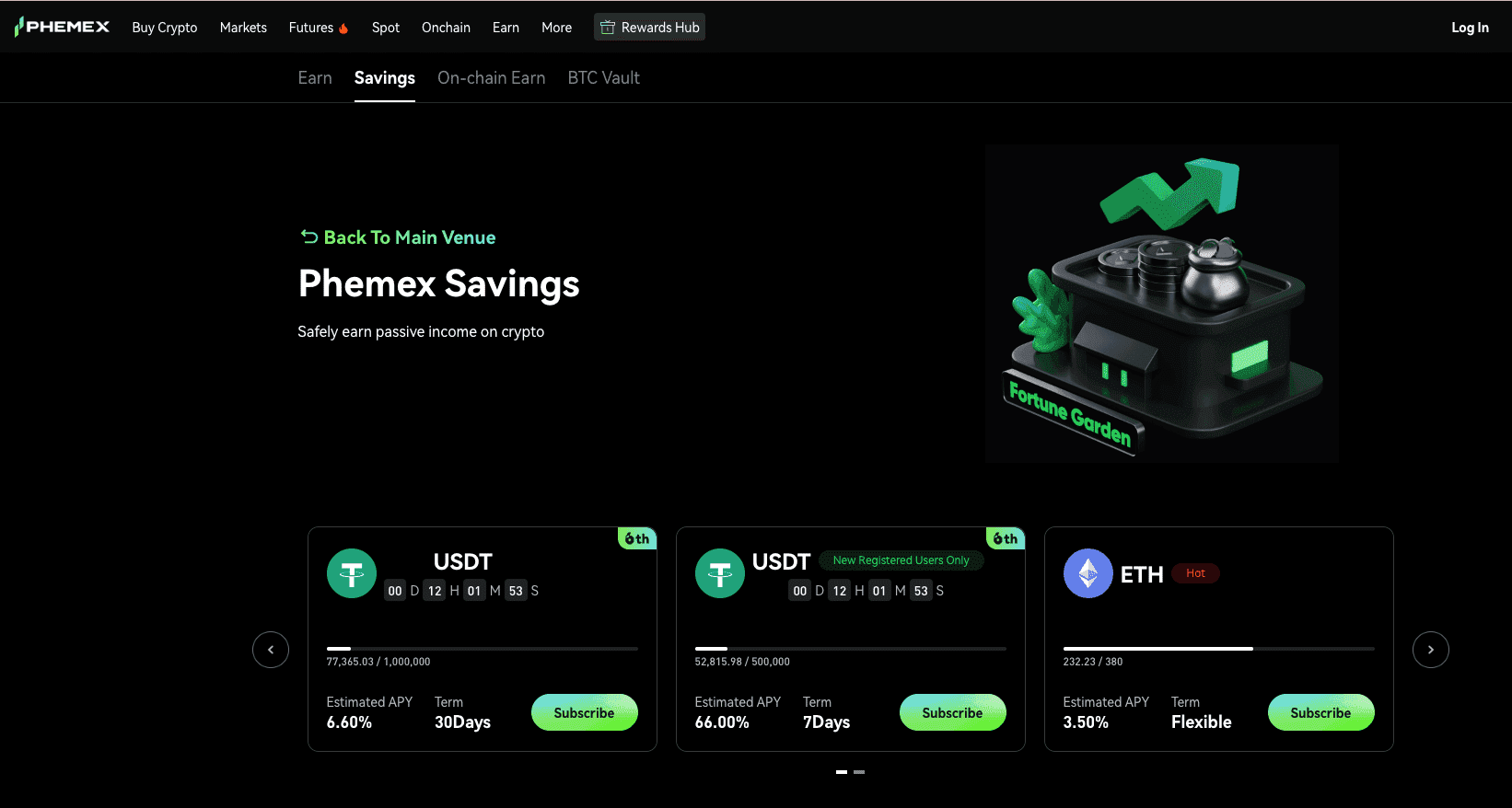

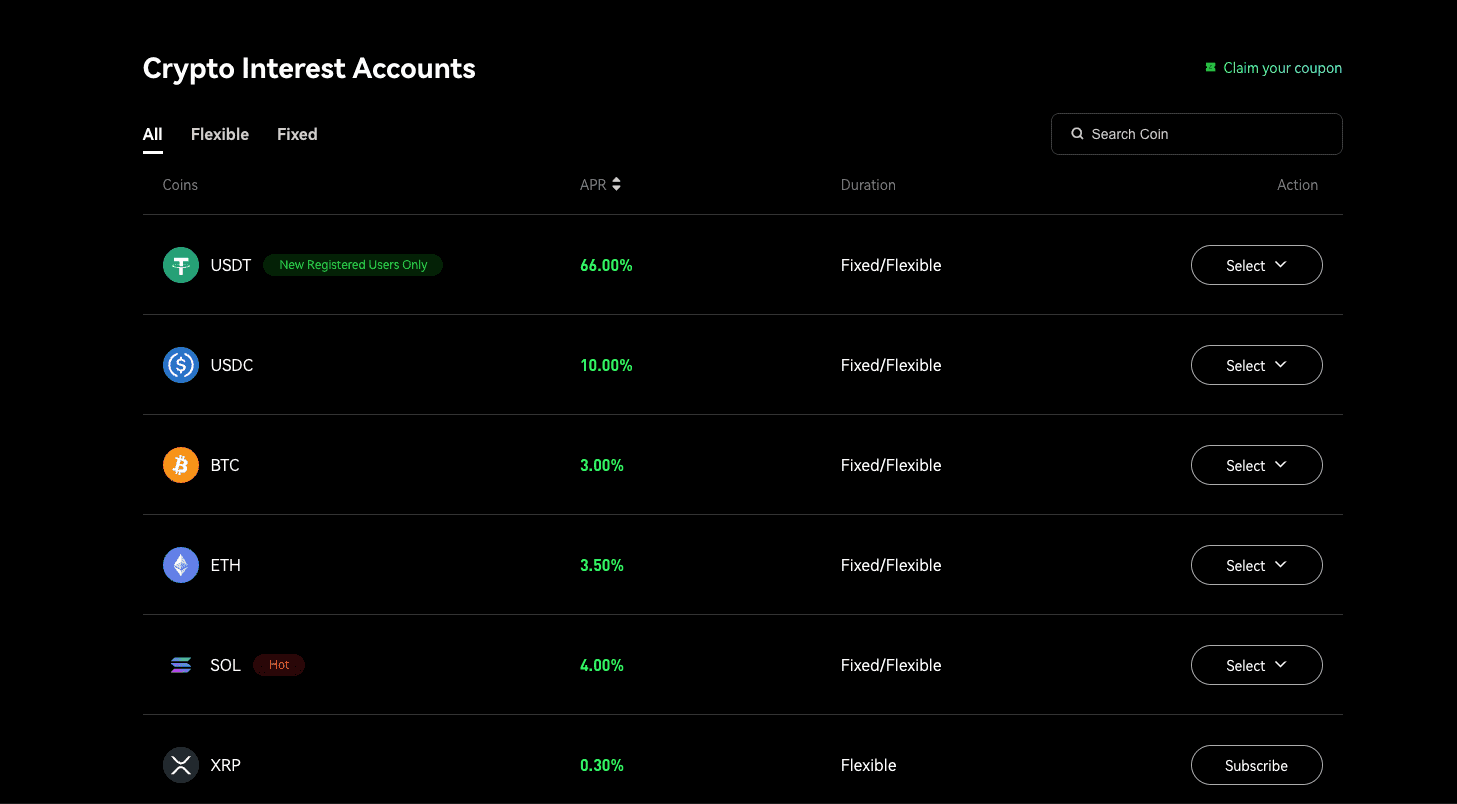

Strategy C: The Stablecoin Preserver

Tool: Phemex Savings (Fixed/Flexible)

Volatility is the price of admission in crypto. Sometimes, the smartest trade is to sit in cash (USDT/USDC).

-

Flexible: Earn daily interest but withdraw instantly to buy a dip.

-

Fixed: Lock in higher rates for 7, 14, or 30 days.

-

Use Case: This is your "Dry Powder." Instead of sitting in a zero-interest wallet, your standby capital fights inflation until you are ready to deploy it.

Risk Management & FAQ

We know you have questions. Here are the honest answers to the most trending queries.

1. Is staking 100% safe?

No investment is risk-free.

-

Slashing Risk: In On-Chain staking, if a validator fails, funds can be penalized. Mitigation: Phemex uses professional, distributed validator setups to minimize technical failure risks near zero.

-

Price Risk: While you stake, the price of the token (e.g., SOL) could drop. The APY might be 7%, but if the token drops 10%, you are down in fiat terms.

2. Can I lose my crypto if I stake?

In decentralized DeFi protocols, smart contract hacks are a risk. When using a Centralized Exchange (CEX) like Phemex, the risk shifts to platform security.

-

Why Phemex? Phemex publishes monthly Merkle-Tree Proof of Reserves, proving 1:1 backing of client funds. We don't play games with your collateral.

3. What is the difference between APR and APY?

-

APR (Annual Percentage Rate): Simple interest.

-

APY (Annual Percentage Yield): Compound interest (interest earning interest).

-

Tip: Phemex Earn products typically calculate payouts daily, allowing for faster compounding effects.

Practical Guide - How to Start Earning

From "What" to "How"

Ready to optimize your portfolio for 2026? Here is the workflow on Phemex.

Step 1: Navigate to the "Earn" Hub

Log in to your Phemex account. On the top navigation bar, hover over "Earn". You will see a dropdown menu.

-

Select "On-Chain Earn" for ETH, SOL, and polkadot (DOT).

-

Select "Savings" for USDT, USDC, and other altcoins.

-

Select "BTC Vault" for Bitcoin specific yield.

Step 2: Choose Your Duration

-

Flexible: Lower APY, but you can "Redeem" funds instantly. Ideal for traders.

-

Fixed: Higher APY. Your funds are locked for the duration (e.g., 30 days). Ideal for long-term holders.

Step 3: Monitor and Auto-Subscribe

Once subscribed, your interest pays out daily into your Spot Wallet (for Flexible) or accumulates (for Fixed).

-

Pro Tip: Turn on "Auto-Subscribe" for your Flexible Savings. This ensures that any interest you earn today is automatically added to the principal tomorrow, creating a compounding snowball effect.

Conclusion: The Era of "Smart Yield"

The search query "what does it mean to stake crypto" spiked this week because the world is waking up to a reality: Money has changed.

In the traditional banking world, 0.5% interest is considered normal. In the crypto world, we are building a financial layer where you are paid for the value you provide—whether that is securing a network (Staking) or providing liquidity (Savings).

As we move into 2026, the winning strategy isn't just about buying the right coin; it's about holding it in the right place.

-

Transparency.

-

On-Chain Access.

-

Structured Safety.

This is the promise of Phemex Earn. Don't just hold crypto. Make your crypto work.

Explore Phemex On-Chain Earn Rates | View BTC Vault

Disclaimer: The information provided in this article is for educational purposes only and does not constitute financial advice. Cryptocurrency investments are subject to market risks. Annual Percentage Yields (APY) are subject to change based on market conditions. Please do your own research (DYOR) before investing.