The wait is over. On December 16, 2025, Phemex officially opened the doors to its Spot Innovation Zone, a specialized trading environment designed to capture early market opportunities.

For years, traders seeking the next "100x gem" were forced to navigate complex decentralized exchanges (DEXs), dealing with high gas fees and smart contract risks. Phemex has changed the game by bringing these early-stage, high-potential projects—like Limitless (GUA)—directly to a secure, centralized platform.

However, with great volatility comes the need for great discipline. This guide explores the debut lineup of the Innovation Zone and provides a strategic framework for trading these high-risk, high-reward assets.

What is the Phemex Spot Innovation Zone?

The Spot Innovation Zone is distinct from the Phemex Main Board (where you find assets like BTC or ETH). It is dedicated to listing tokens that are in the early stages of development.

While mainstream assets offer stability, assets in the Innovation Zone are characterized by:

-

Higher Volatility: Prices can fluctuate drastically in minutes.

-

Emerging Narratives: These projects often lead new market trends (e.g., AI, Prediction Markets, DePIN).

-

Risk Isolation: Phemex employs a unique mechanism to ensure that trading these volatile assets does not impact your broader portfolio stability.

Analyzing the Debut Lineup: AI, Prediction Markets, and DeFi

The Innovation Zone launched with four distinct projects, each representing a key narrative in the current crypto cycle. Understanding what you are buying is the first step to successful trading.

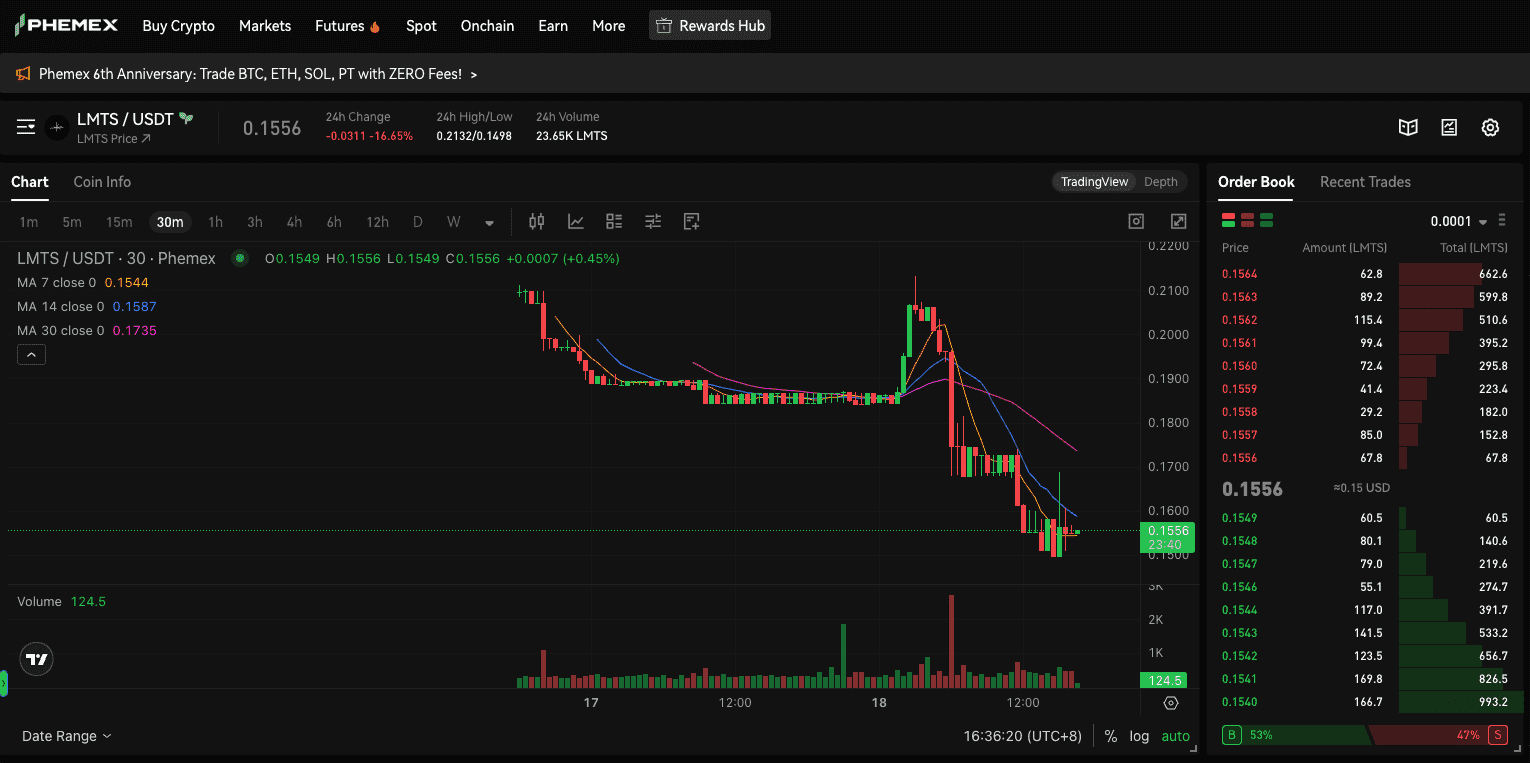

1. The Prediction Market Play: Limitless ($LMTS)

Narrative: Forecasting & Risk Engine

Prediction markets are exploding in popularity. Limitless Exchange takes this further by allowing natural language expressions of market conditions.

-

Why it’s trending: It democratizes hedging. Users can trade on arbitrary market conditions freely, creating a dynamic forecasting engine for the global economy.

-

Trading Angle: $LMTS price action is often correlated with major global events or market volatility.

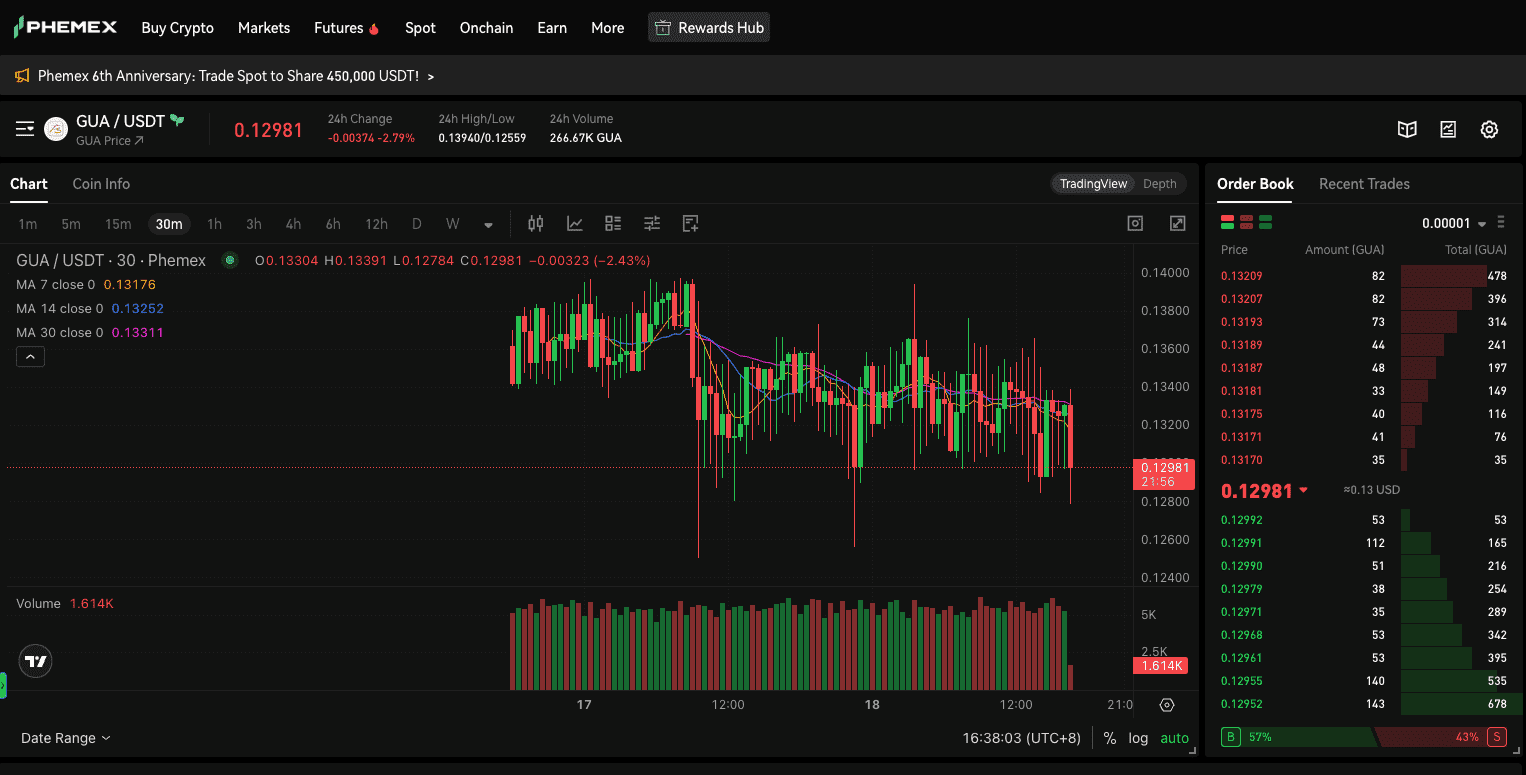

2. The AI x Metaphysics Play: SUPERFORTUNE ($GUA)

Narrative: AI Consumer App / Meme Potential

Incubated by Manta Labs, SUPERFORTUNE is one of the most unique listings in the crypto space. It is an AI-powered engine that blends Chinese metaphysics (Feng Shui/fortune telling) with crypto market data to identify patterns.

-

Why it’s trending: It sits at the intersection of AI technology and viral cultural phenomena.

-

Trading Angle: Assets like $GUA often trade on social sentiment and community engagement.

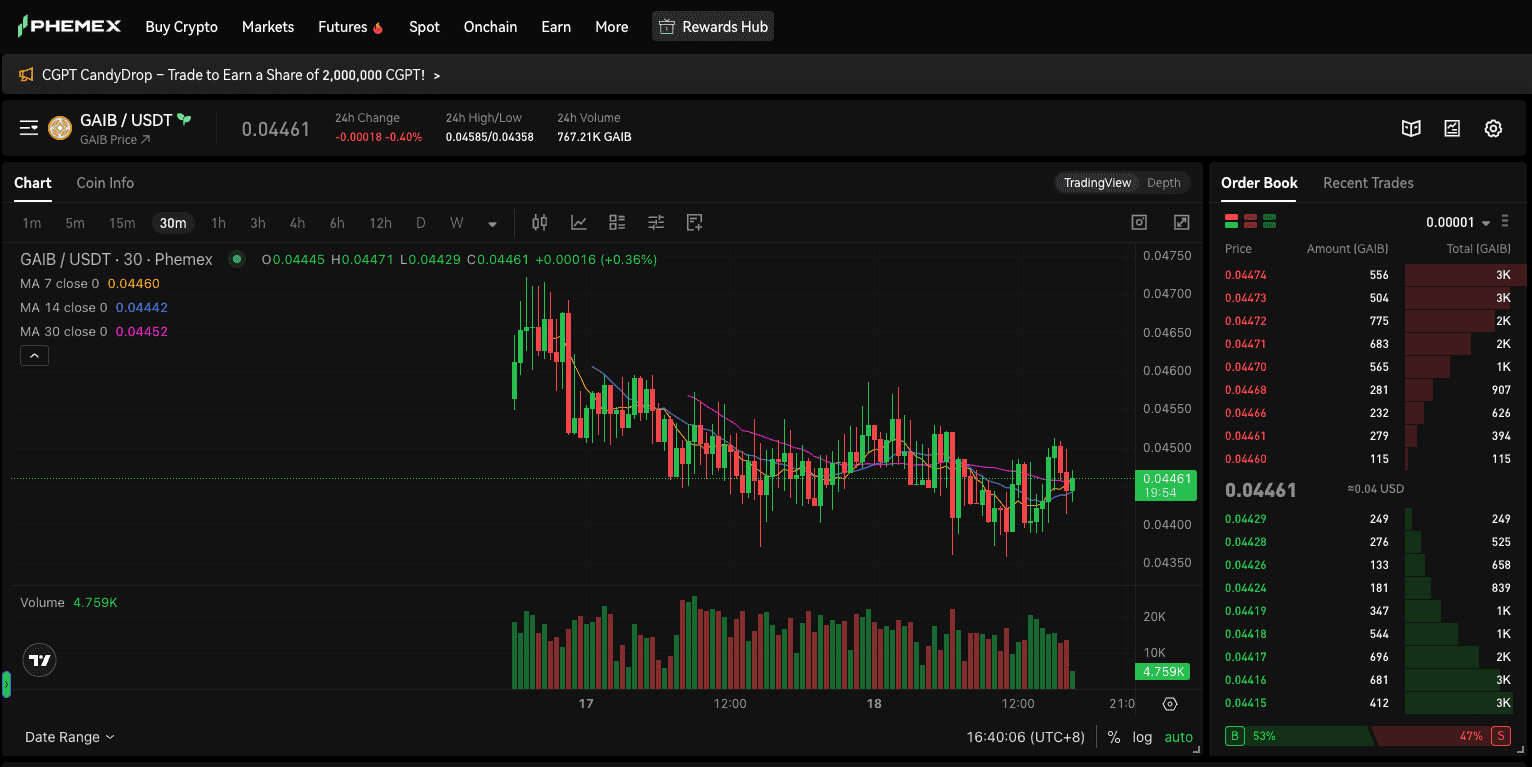

3. The Infrastructure Play: GAIB ($GAIB)

Narrative: AI, GPU, & Blockchain (DePIN)

GAIB positions itself as the "Economic Layer for AI infrastructure." It is a blockchain-agnostic protocol focused on the GPU economy.

-

Why it’s trending: As the demand for AI compute power grows, decentralized GPU networks are becoming critical infrastructure.

-

Trading Angle: This is a fundamental play on the growth of the AI hardware sector.

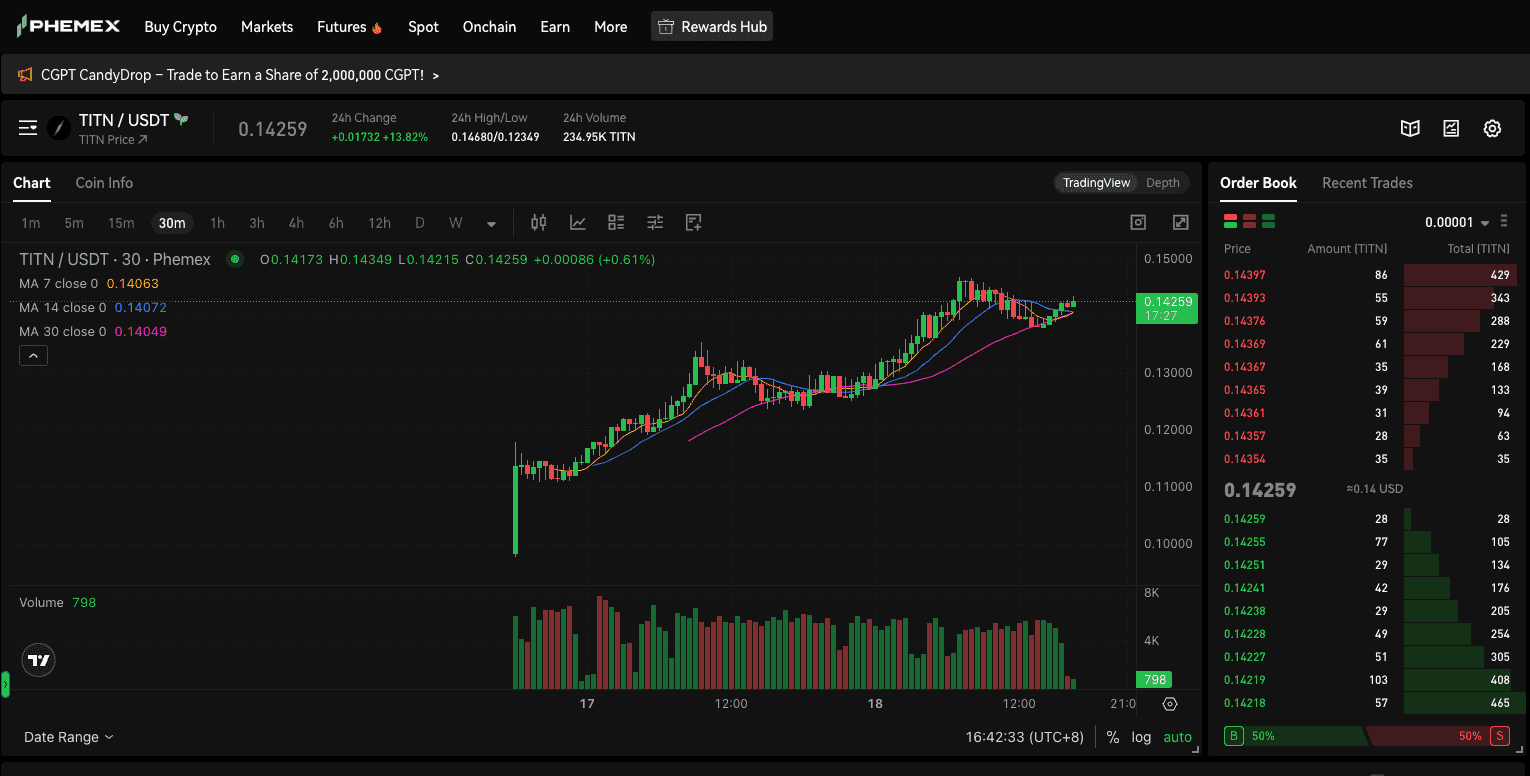

4. The Self-Custody Play: THORWallet ($TITN)

Narrative: Cross-Chain DeFi

THORWallet offers a mobile-first DeFi experience that emphasizes true self-custody. Unlike centralized competitors, $TITN powers an ecosystem where users retain full ownership of their assets.

-

Why it’s trending: Following industry-wide concerns about custody, self-custodial solutions are seeing renewed interest.

The "Safety Airbags": Understanding Trading Restrictions

Trading in the Innovation Zone is not like trading Bitcoin. To protect users from "High Price Volatility" and "Insufficient Liquidity," Phemex has implemented specific risk control measures.

Rather than viewing these as limitations, smart traders view them as safety airbags.

1. Daily Buy Limit (FOMO Protection)

Phemex enforces a limit on the cumulative net purchase amount per user within a 24-hour period (00:00:00 to 23:59:59 UTC).

-

Strategy: This prevents emotional "all-in" trading during a pump. Plan your entries carefully. If you hit your limit, take it as a sign to step back and let the market settle.

2. Single Order Limit (Slippage Protection)

There is a cap on the maximum value of a single order.

-

Strategy: Early-stage tokens may lack the market depth of ETH. A massive market order could cause high slippage (buying at a much higher price than intended). This limit forces you to break up large trades, ensuring better average entry prices.

3. Delisting Risk Awareness

Projects in this zone are subject to periodic reviews. If a project fails to meet liquidity or development standards, it may be delisted.

-

Strategy: Stay active. This is not a "buy and forget for 10 years" zone. Monitor Phemex announcements regularly.

3 Strategic Rules for the Innovation Zone

To navigate this high-volatility environment successfully, consider these three rules:

-

The 90/10 Allocation Rule:

Consider allocating the majority (e.g., 90%) of your portfolio to Main Zone assets or Phemex Earn, and use a smaller portion (e.g., 10%) for Innovation Zone plays like $GUA or $TITN. This allows you to capture upside without risking total value loss. -

Master the Limit Order:

Due to potential liquidity fluctuations mentioned in the risk warning, avoid Market Orders. Always use Limit Orders to set the exact price you are willing to pay. This protects you from unexpected price wicks. -

Differentiate by Narrative:

Don't just buy everything.

Conclusion

The Phemex Spot Innovation Zone is now live, bridging the gap between on-chain alpha and off-chain security. Whether you are analyzing the metaphysics of GAIB, the opportunities are vast—but they require a disciplined approach.

Ready to explore?

Trade $LMTS/USDT | Trade $GUA/USDT | Trade $TITN/USDT | Trade $GAIB/USDT

Disclaimer: Cryptocurrency trading involves significant risk. The Innovation Zone assets are prone to high volatility and potential total value loss. Please ensure you fully understand the risks and research the projects independently before trading.