In the competitive landscape of blockchain scalability, a new project is capturing the market's full attention, not just for its technology but for its elite backing and recent major milestone. Caldera, a Rollup-as-a-Service (RaaS) platform backed by industry giants like Sequoia Capital and Dragonfly, has officially launched the community airdrop for its native token, $ERA.

This launch unveils an audacious goal: to become a universal, omnichain gas token, fundamentally changing how users interact with the burgeoning ecosystem of app-specific rollups. For those tracking the evolution of Layer 2s and the modular thesis that powered projects like Celestia (TIA), understanding Caldera is essential. This comprehensive guide will explain the project, its newly launched token, and the significant opportunity it represents.

Summary Box (Quick Facts)

-

Project Name: Caldera

-

Ticker Symbol: ERA

-

Chain: Omnichain (functions across Caldera's network of rollups, settling on Ethereum)

-

Contract Address: Not yet publicly distributed (pending airdrop claim process)

-

Initial Circulating Supply (at TGE): 70,000,000 ERA (7% Airdrop)

-

Total Supply: 1,000,000,000 ERA

-

Primary Use Case: Serving as an omnichain gas token to power cross-chain transactions, network security, and governance.

-

Current Market Cap: Not applicable (Token not yet fully circulating)

-

Availability on Phemex: NO (As of writing)

What Is Caldera?

So, what is Caldera, and why is it considered a next-generation platform? At its core, Caldera is a network of interconnected, purpose-built blockchains that settle on Ethereum. In simpler terms, it provides the infrastructure for developers to launch their own customized, high-performance blockchains—known as app-rollups—with incredible ease.

This solves a critical problem for developers. Instead of being forced to compete for blockspace on a congested, shared Layer 2, an application (like a game or DeFi protocol) can have its own dedicated chain. This ensures exceptionally high throughput and stable, low transaction fees, leading to a vastly superior user experience. All this is achieved while inheriting the robust, decentralized security of the Ethereum mainnet.

The recent launch of the ERA token is what elevates Caldera's model. ERA acts as the unifying economic layer for this entire network of rollups. Its design aims to create a fluid, interconnected "internet of rollups," abstracting away the complexities of cross-chain interactions that plague the current user experience in Web3.

How Many ERA Tokens Are There? Full Tokenomics Explained

With the official launch, the Caldera Foundation has unveiled the full tokenomics for ERA, providing a clear, transparent picture of its distribution and long-term supply dynamics. The total supply of ERA is fixed at 1,000,000,000 tokens.

The entire distribution is built around a core principle: the value of the network should belong to those who build, secure, and use it. This philosophy is reflected in a model that prioritizes long-term ecosystem growth over short-term speculation.

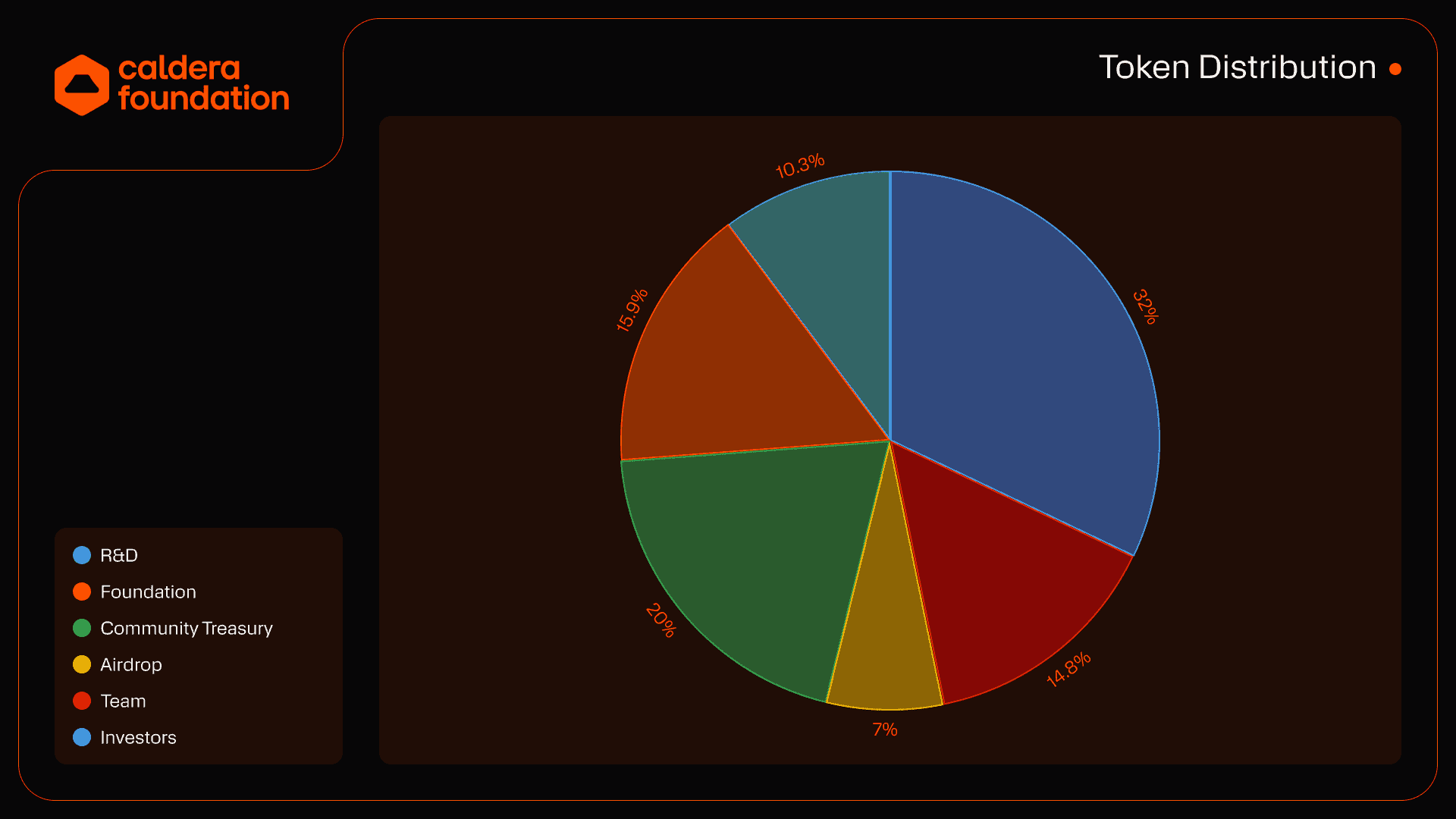

Token Distribution

Here is the final allocation of the total ERA supply across key stakeholder categories:

| Category | Allocation | Total Tokens |

| Early Backers & Investors | 32.06% | 320,600,000 |

| Community Treasury | 21.00% | 210,000,000 |

| Foundation | 14.94% | 149,400,000 |

| Core Team | 14.75% | 147,500,000 |

| R&D | 10.25% | 102,500,000 |

| Airdrop | 7.00% | 70,000,000 |

| Total | 100.00% | 1,000,000,000 |

A significant portion—over 46% combined—is allocated to the Community Treasury, Foundation, and R&D, signaling a powerful commitment to funding future development and ecosystem growth.

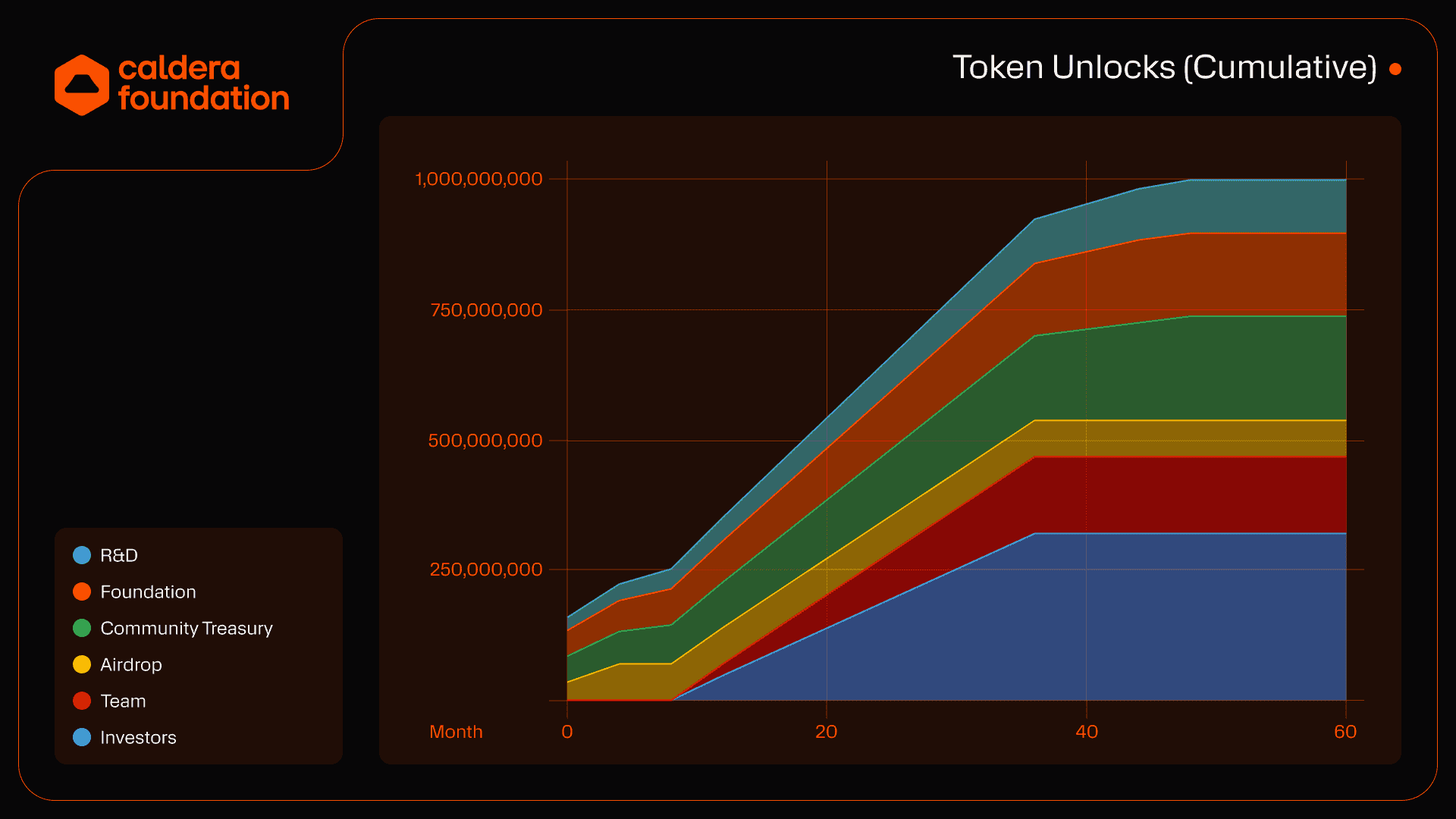

Token Unlock Schedule

The token release schedule is strategically designed to ensure network stability and align all parties for the long term.

-

Core Team & Early Backers/Investors: This group is subject to a 1-year lockup (cliff). This means they cannot sell a single token for an entire year after launch. Following the cliff, 15% of their allocation unlocks, with the remainder vesting linearly over the next 24 months. This is a powerful signal of long-term confidence from the project's insiders.

-

Foundation & R&D: 25% of their allocations unlock at the Token Generation Event (TGE) to fund initial operations, with the remaining 75% unlocking linearly over 48 months.

-

Community Treasury: Similar to the Foundation, 25% unlocks at TGE to bootstrap ecosystem initiatives, with the rest vesting over a 4-year period.

This staggered release is designed to prevent immediate sell pressure and foster a sustainable market for the token, rewarding long-term vision over short-term trading.

What Does ERA Do? The Omnichain Use Case

The ERA use case is centered around its innovative function as an omnichain gas token, a powerful solution to a major Web3 pain point.

-

Omnichain Gas Fees: This is ERA's flagship feature. It allows a user to pay for a transaction on any rollup within the Caldera network using ERA, regardless of which rollup they hold their assets on.

-

Staking for Network Security: To ensure the integrity of the network, key infrastructure operators will be required to stake ERA.

-

Powering Cross-Chain Transactions: ERA serves as the underlying fuel for interoperability between all Caldera chains.

-

Decentralized Governance: ERA grants its holders the power to participate in the protocol's governance.

Caldera Rollups vs. Ethereum

Caldera does not compete with Ethereum; it complements and enhances it. An application built on a Caldera rollup gains significant advantages over one deployed directly on the Ethereum mainnet.

| Feature | Caldera-Powered Rollup | Ethereum Mainnet (Layer 1) |

| Technology | A flexible, high-performance Layer 2 execution environment built with best-in-class rollup tech (OP Stack, Arbitrum Orbit). | A monolithic, general-purpose Layer 1 that often acts as a bottleneck for high-throughput applications. |

| Transaction Speed | Exceptionally high throughput, capable of handling thousands of transactions per second for demanding applications. | Low throughput (approx. 15-30 TPS), leading to network congestion and slow confirmation times during peak usage. |

| Transaction Fees | Significantly lower fees, made even more seamless by the ability to pay with the universal ERA omnichain gas token. | High and volatile gas fees that can make many on-chain actions prohibitively expensive for the average user. |

| Use Case | Ideal for next-generation applications in gaming, DeFi, and SocialFi that require a custom, scalable, and interoperable home. | The global settlement layer, acting as the ultimate source of security and trust for the entire digital asset economy. |

The Technology Behind Caldera

Caldera's performance is built on an intelligent, modular architecture. It combines the best of the OP Stack and Arbitrum Orbit for execution, Ethereum for settlement, and specialized DA layers like Celestia for cost efficiency. The ERA token unifies this stack at the interoperability layer.

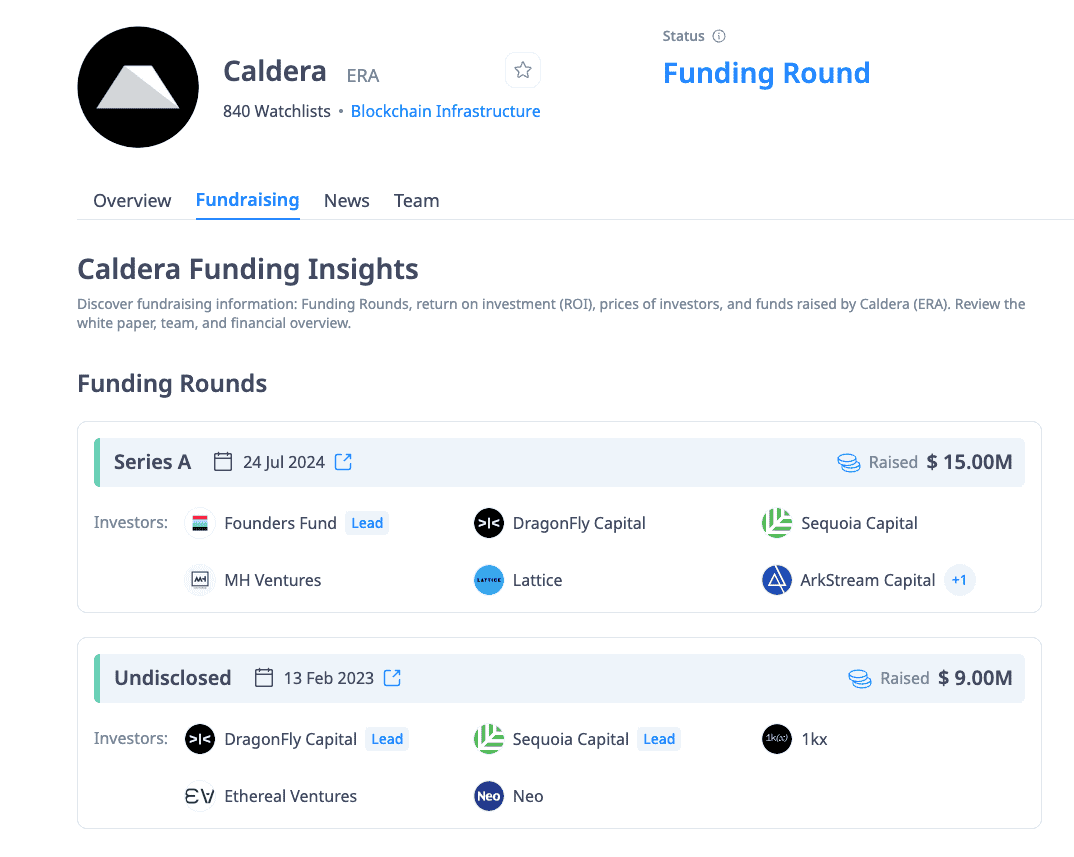

Team & Origins: The Sequoia and Dragonfly Backing

Caldera was founded by Matt Katz and Parker Jou, who bring expertise from Stanford University and the finance industry. Their vision secured a $9 million seed round co-led by Sequoia Capital and Dragonfly, signaling elite confidence in the project's potential.

Key News & Events

-

February 2023: Caldera announces its $9 million seed funding.

-

Throughout 2023: Onboards major clients like Celo and Injective.

-

Late 2025: Launches the ERA token via a 7% community airdrop and reveals its full, long-term tokenomics, sparking massive interest to trade ERA.

Is Caldera (ERA) a Good Investment?

With the full tokenomics now public, a clearer analysis of the ERA investment potential is possible.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile and risky. Always conduct your own research before making any investment decisions.

The Bull Case (Potential Upsides):

-

Powerful, Clear Narrative: The "omnichain gas token" concept is an elegant solution to a real problem in Web3.

-

Elite VC Backing: The involvement of Sequoia Capital and Dragonfly provides a level of credibility and strategic support that few projects possess.

-

Thoughtful, Long-Term Tokenomics: The 1-year cliff for insiders and the extended vesting schedules demonstrate a focus on sustainable growth over short-term hype, aligning the team with long-term holders. This is a massive confidence signal.

-

Airdrop-Fueled Community Growth: The airdrop has created a large, decentralized community of stakeholders from day one.

The Bear Case (Risks to Consider):

-

Adoption Dependency: ERA's success is directly tied to the Caldera platform's ability to attract a large ecosystem of developers and users.

-

Intense Competition: The Layer 2 and RaaS sectors are highly competitive.

-

Market Volatility: As a new altcoin, ERA's price will be susceptible to the volatility of the broader cryptocurrency market.

In conclusion, Caldera stands out as a project with a clear vision, elite backing, and now, a transparent and well-designed tokenomic model. The launch of ERA is a major catalyst, and as the token becomes more widely available, the key will be to monitor the growth of its rollup ecosystem. For those looking to participate, learning how to buy ERA on a trusted exchange will be the next critical step.