Trade traditional financial assets such as stocks and precious metals directly on Phemex using the same interface, tools, and margin system you already use for crypto futures. TradFi futures are available 24/7, including periods when traditional stock markets are closed.

👉 Start Trading TradFi Futures →

What Are TradFi Futures?

TradFi futures are derivative products that track the prices of traditional financial assets, including stocks and precious metals like gold and silver. These futures follow the same trading mechanics used for Phemex crypto perpetual futures, which makes them familiar to existing futures traders.

Key characteristics:

-

Price-based derivatives, you trade price movements rather than owning the underlying asset

-

No spot trading or ETFs involved, these products are purely derivatives

-

The same core mechanics as crypto futures, including margin, leverage, and liquidation logic

If you already trade perpetual futures on Phemex, the learning curve here is minimal.

What Assets Are Available?

At launch, TradFi futures on Phemex support a focused set of traditional assets:

|

Asset Type

|

Examples

|

|

Stocks

|

Select equity futures

|

|

Precious Metals

|

Gold, Silver

|

Additional asset categories are planned for future updates as the product expands.

Key Features

1)24/7 Trading

TradFi futures can be traded at any time, regardless of traditional stock market hours. This includes periods that normally limit access to equities, such as:

-

US stock market open and close times

-

Pre-market and after-hours sessions

-

Weekends and public holidays

You can place orders, hold positions, and manage risk continuously within the Phemex futures system.

2)Margin-Based Trading

TradFi futures use a margin trading model similar to crypto perpetuals:

-

There is no need to purchase the full notional value of an asset

-

Leverage can be applied to increase position size

-

Both long and short positions are supported

Margin levels and liquidation risk depend on your margin ratio and Phemex’s platform risk controls. As with any leveraged product, risk management plays a central role.

3)Unified Futures Experience

TradFi futures use the same interface, order types, and risk logic as crypto futures on Phemex. This means:

-

No separate trading interface to learn

-

Familiar order types such as Market, Limit, and Conditional

-

The same margin and liquidation framework

For users already active in crypto futures, this consistency removes unnecessary friction.

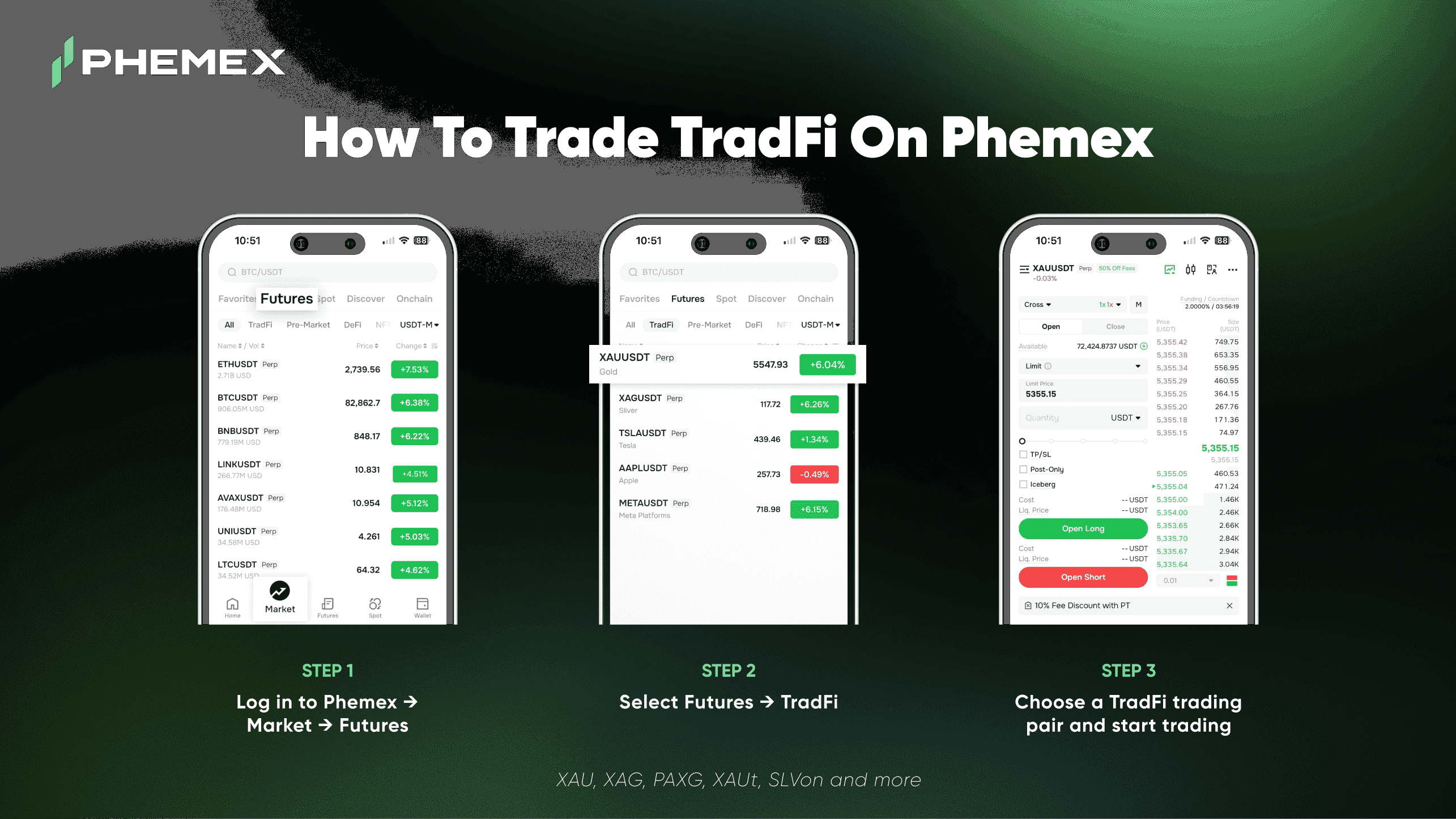

How to Start Trading TradFi Futures

Step 1: Enter TradFi Futures

Log in to Phemex, navigate to Futures, then select TradFi.

Step 2: Select a Trading Pair

Choose a supported TradFi futures pair based on the asset you want to trade, such as stocks or precious metals.

Step 3: Set Trade Direction and Parameters

Select Long or Short, then configure:

-

Order type (Market, Limit, Conditional)

-

Quantity

-

Leverage

Step 4: Place and Manage Your Position

Once the order is placed, you can manage the position in real time. This includes adjusting position size, setting Stop Loss or Take Profit levels, and adding or reducing margin as needed.

Strategy Trading and Copy Trading Support

Strategy trading is currently supported for TradFi futures. Existing futures strategies can be applied across both crypto and traditional markets within the same trading system.

Copy trading is not yet available for TradFi futures, but support will be introduced gradually in future updates.

Who Are TradFi Futures Suitable For?

TradFi futures are designed for:

-

Users with prior experience trading crypto futures

-

Traders who want exposure to both crypto and traditional assets on a single platform

-

Users who understand margin requirements and leverage risk

They may be less suitable for users who are new to leveraged trading or unfamiliar with futures mechanics.

Risk Warning

TradFi futures are high-risk derivative products. Before trading, make sure you:

-

Understand how margin and leverage work

-

Use only capital you can afford to lose

-

Apply risk management tools such as Stop Loss and Take Profit

Liquidation can occur if margin requirements are not met.

Frequently Asked Questions

-

What are TradFi futures?

TradFi futures are derivative products that track the prices of traditional financial assets such as stocks and precious metals. They function the same way as crypto perpetual futures on Phemex, focusing on price movement rather than asset ownership. -

Can I trade stocks on Phemex?

Yes, through TradFi futures. These products allow you to trade stock price movements without purchasing actual shares. Trading is available 24/7 and positions are settled in USDT. -

Are TradFi futures available 24/7?

Yes. TradFi futures on Phemex can be traded at any time, including weekends, holidays, and outside traditional market hours. -

What margin do TradFi futures use?

TradFi futures use USDT margin, the same balance used for crypto perpetual futures on Phemex. -

Is copy trading available for TradFi futures?

Strategy trading is currently supported. Copy trading functionality will be added in future updates. -

What leverage is available?

Leverage varies by trading pair. Always check the specific TradFi futures for current leverage limits.

TradFi futures involve substantial risk of loss. Leverage amplifies both gains and losses. This guide is for informational purposes only and does not constitute financial advice. Always assess your risk tolerance before trading.