How to use Phemex Tax Reporting Service ?

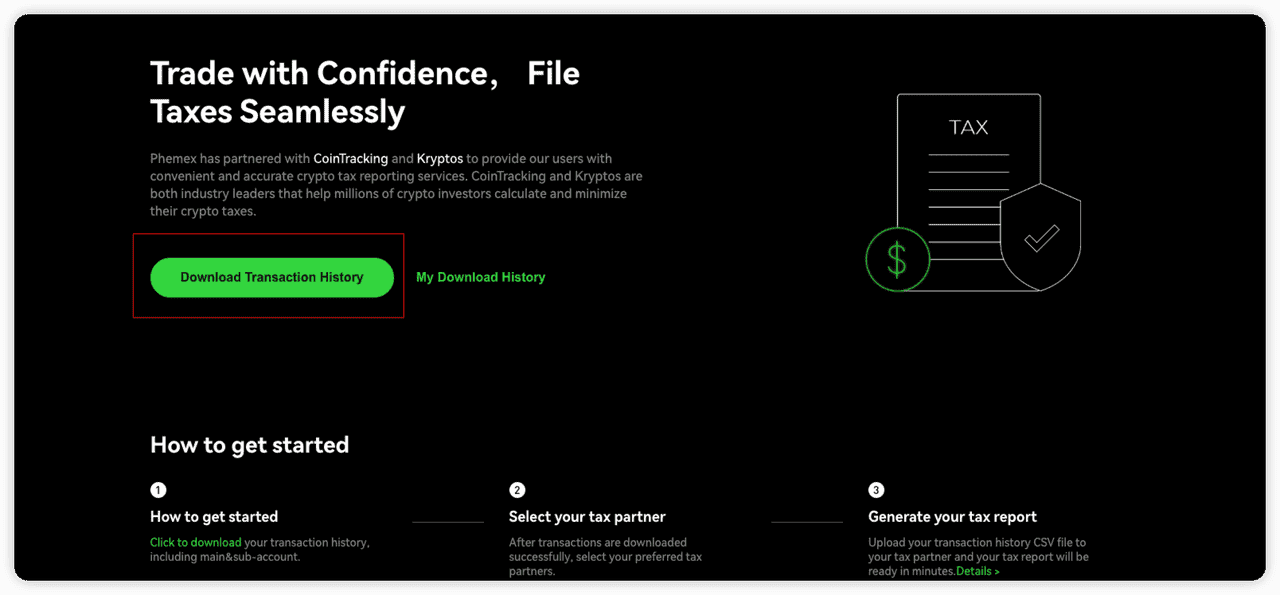

Phemex has partnered with CoinTracking and Kryptos to provide our users with convenient and accurate crypto tax reporting services. CoinTracking and Kryptos are both industry leaders that help millions of crypto investors calculate and minimize their crypto taxes.

Crypto trading can be very rewarding, but tracking portfolio details and reporting taxes can be a hassle without the right support. CoinTracking and Kryptos are both industry leaders that help millions of crypto investors calculate and minimize their crypto taxes.

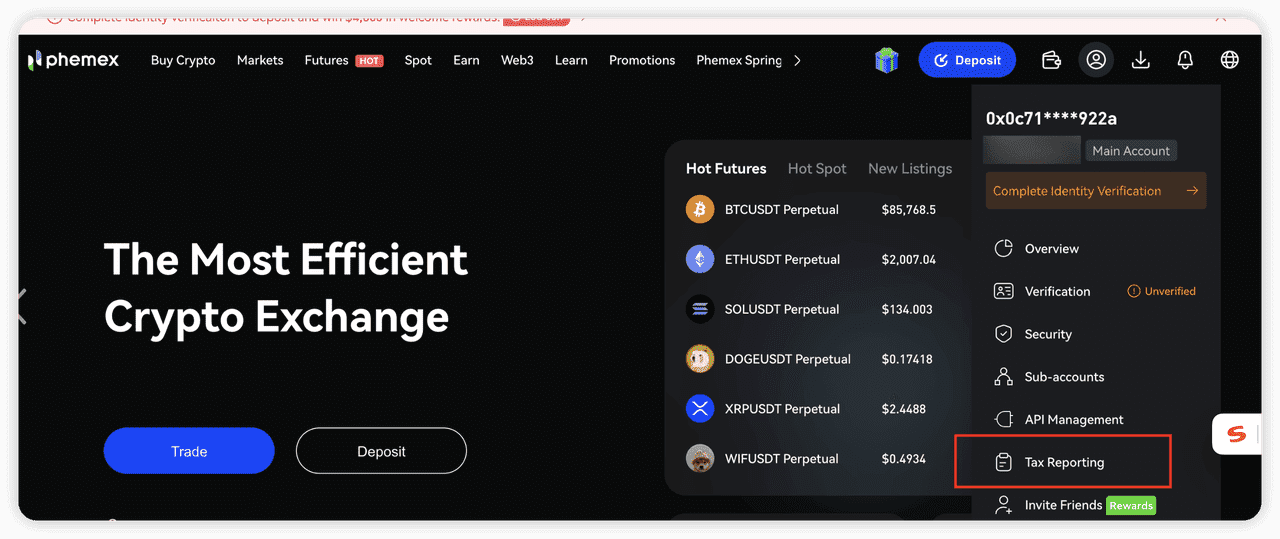

Now you can enter the Phemex Tax Reporting Service and follow the steps to complete your tax report.

Start your tax reporting process with Phemex

Step1. Download your transaction files for all years of trading.

-

Enter thePhemex Tax Reporting Service , Simply click on "One Click Download" under CoinTracking

-

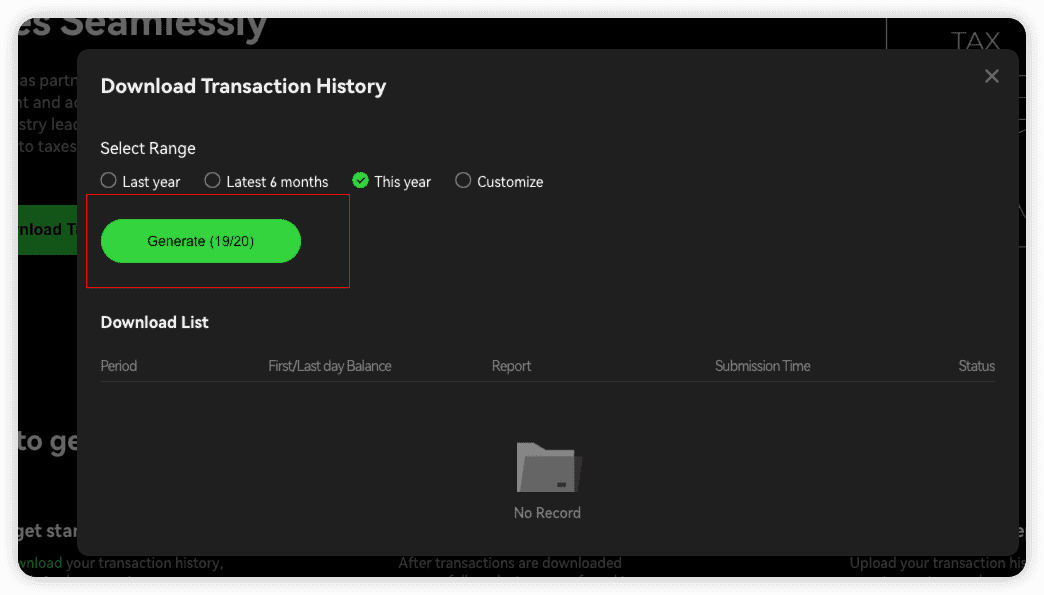

Select the period to generate the report. The default is Last Year. If you have special needs, you can choose other periods.

-

It takes about 5 minutes to generate the report, and you can download it after the status changes from Generating to Generated.

-

Due to server capacity constraints, each user can generate up to 20 times per month, Please download with caution.

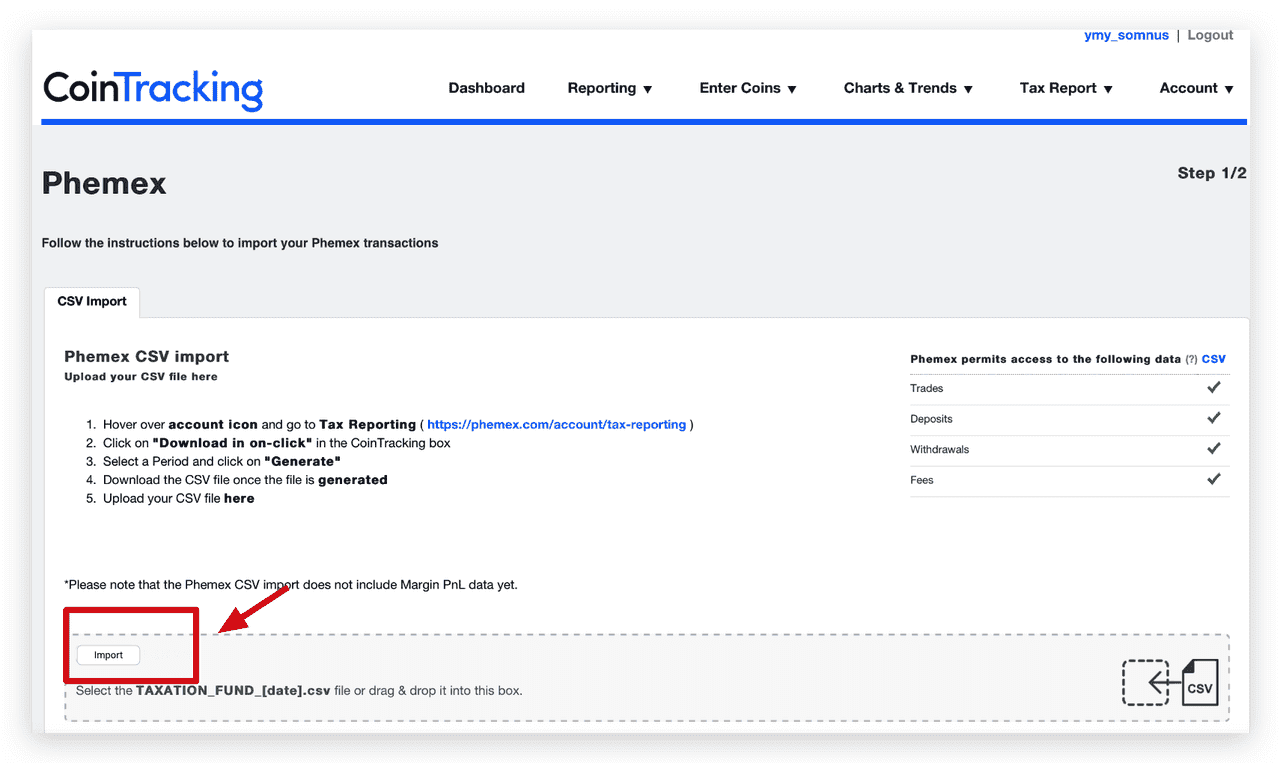

Note: Phemex CSV import does not include Margin PnL data yet.I f you need it go here to export it.

Step2. Select your tax partner

Step3. Upload your transaction history CSV file to your tax partner

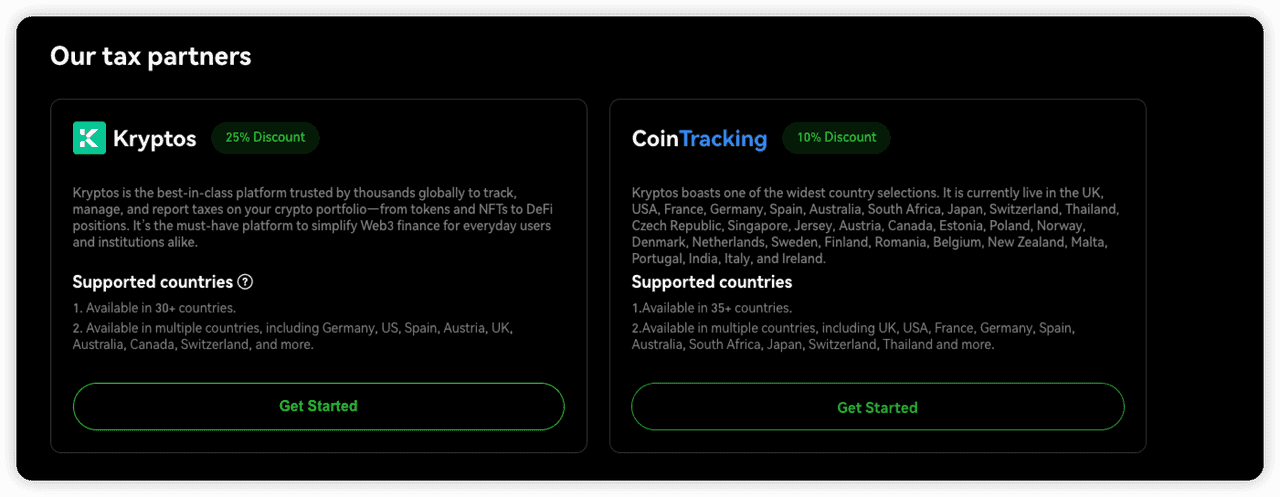

Partner1: Cointracking

-

After getting the Phemex transaction history, enter CoinTracking to upload it.

-

Wait until it is processed, then you can review and download the report.

-

Please enter Cointracking's User guide for details.

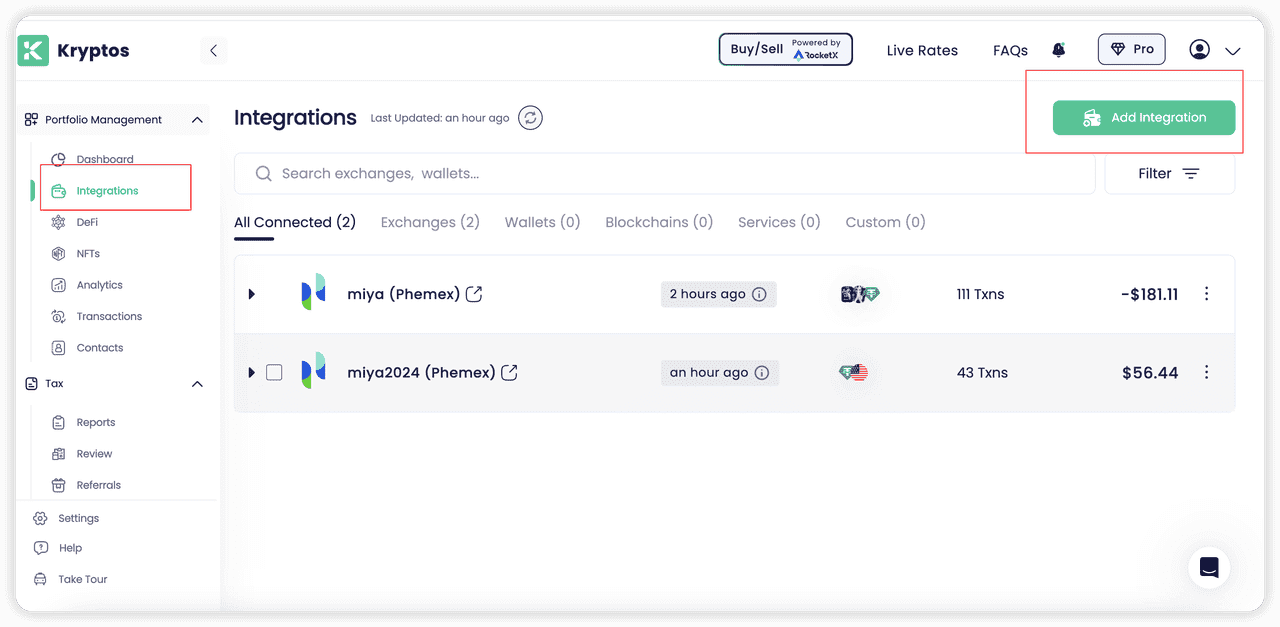

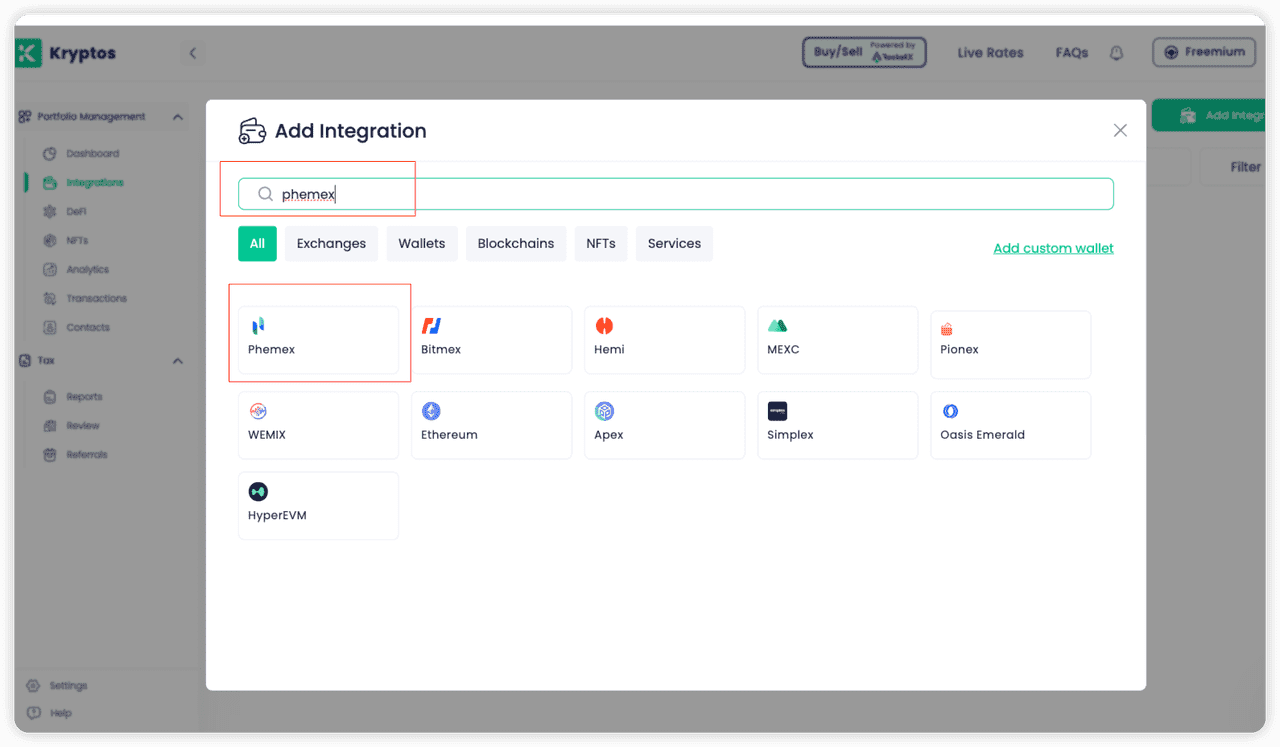

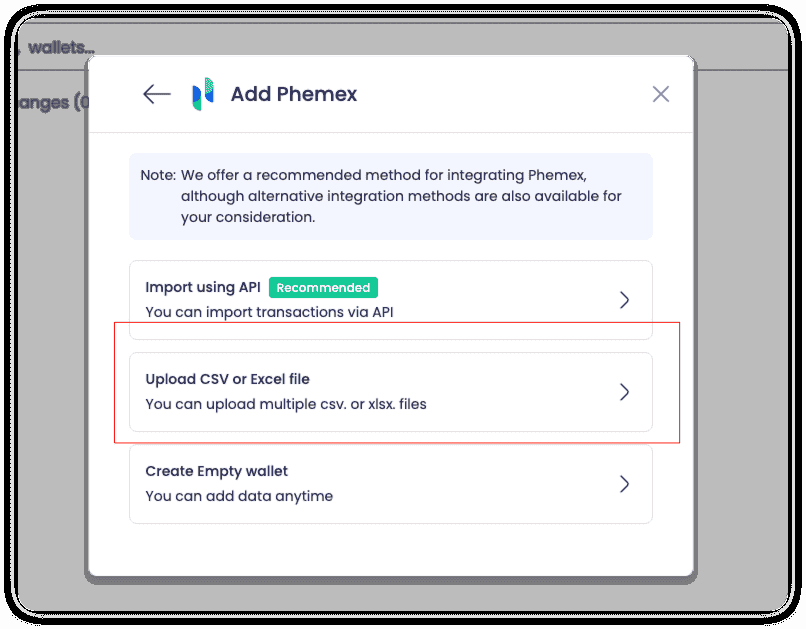

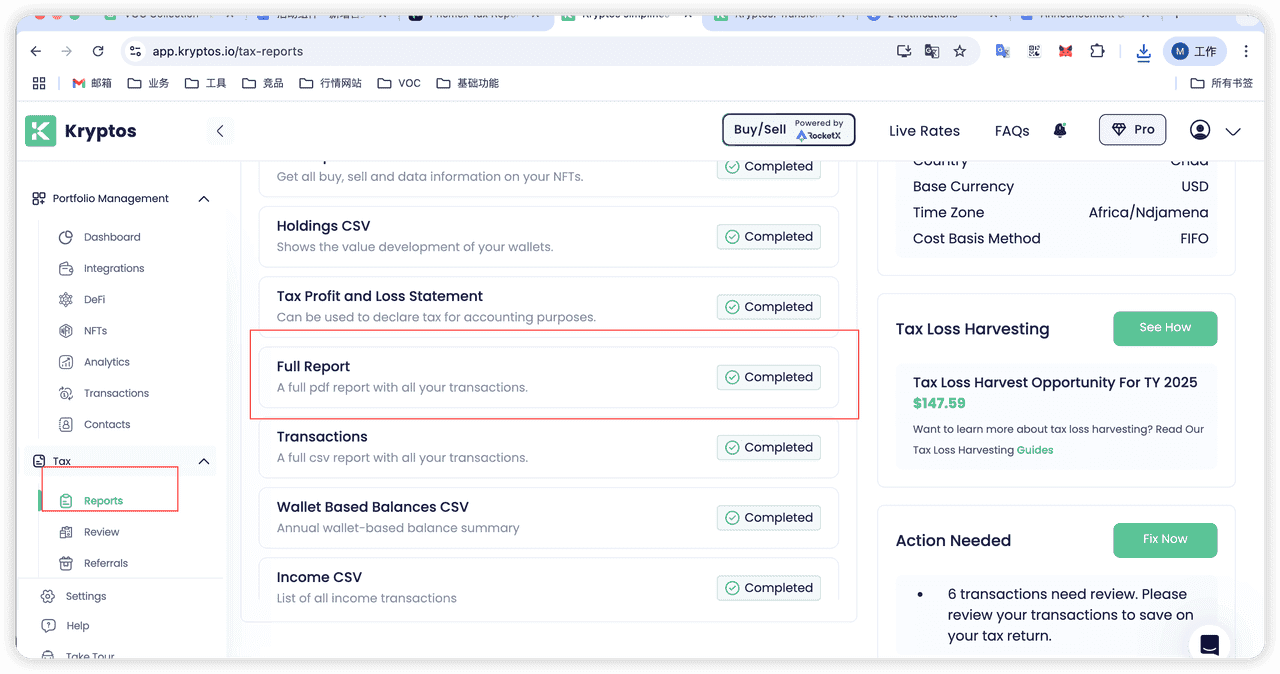

Partner2: Kryptos

-

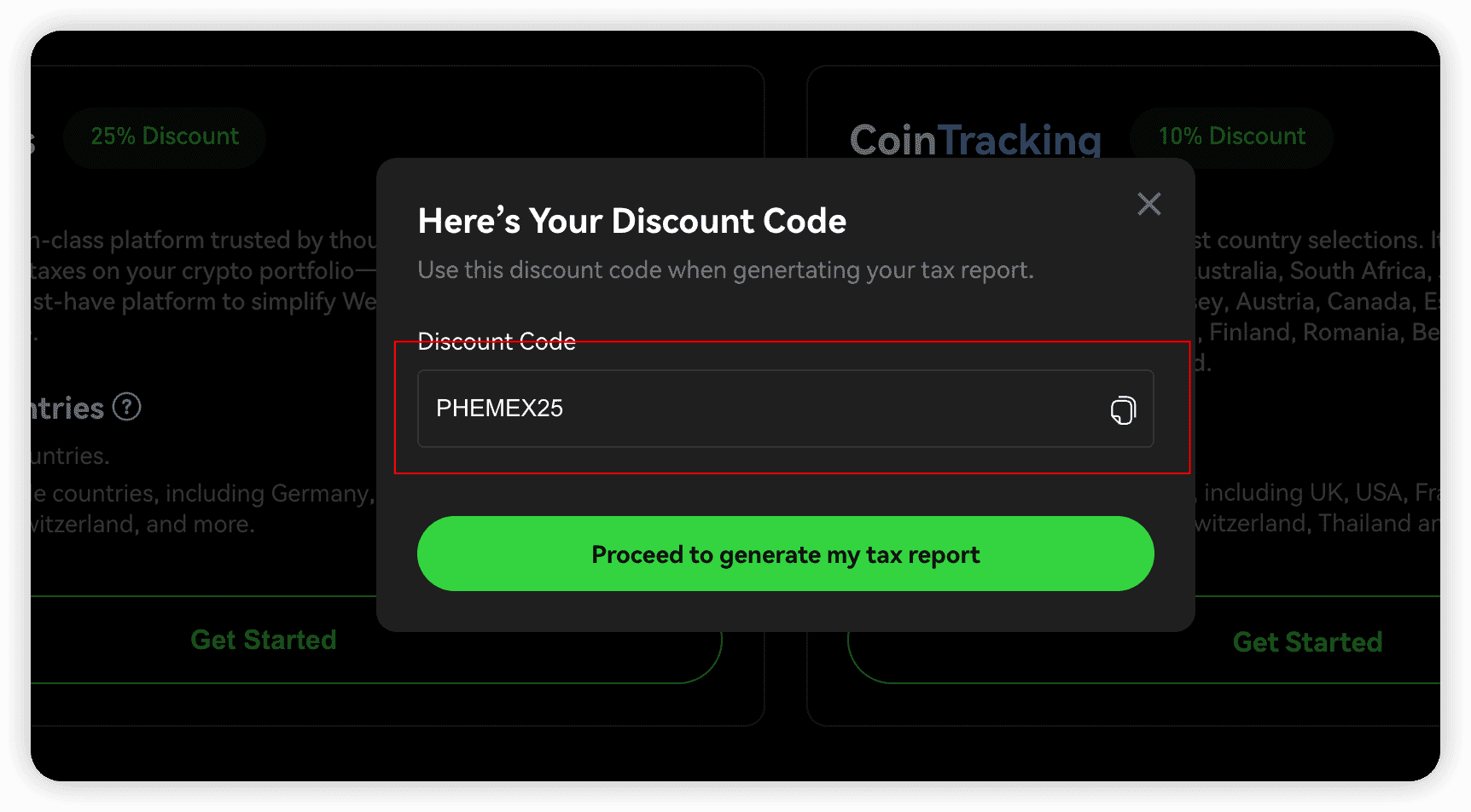

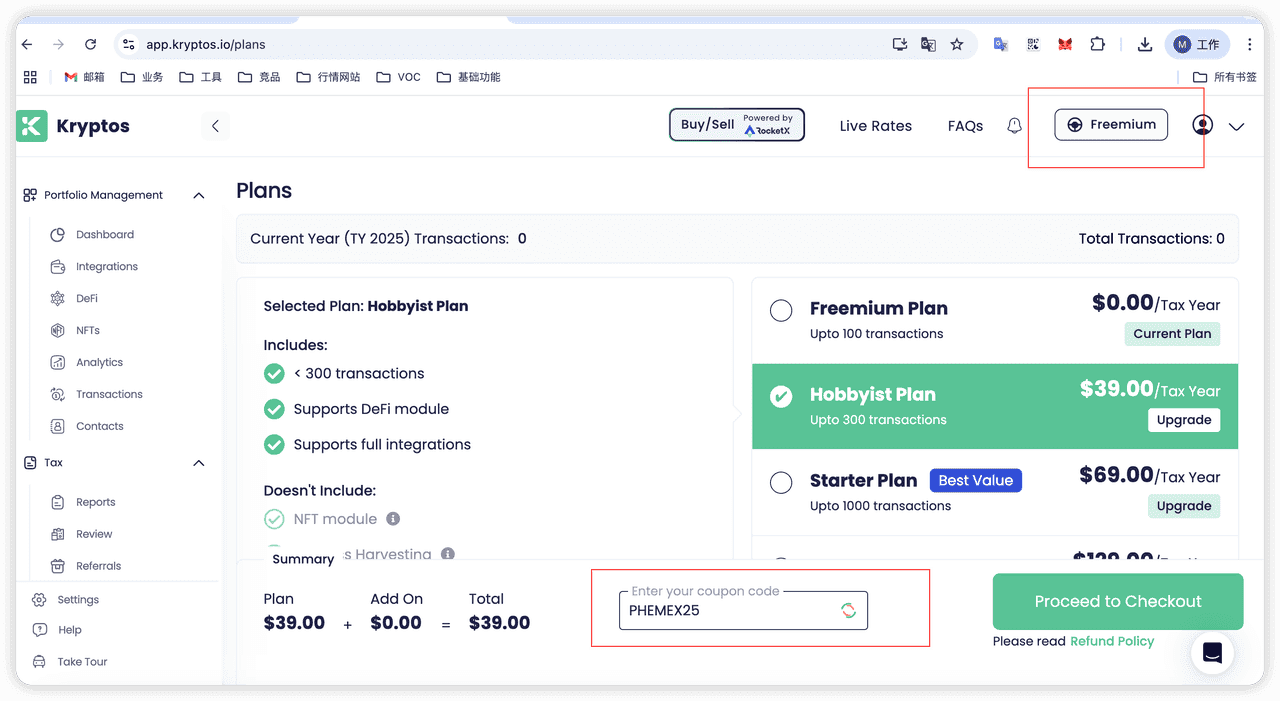

Copy the discount code on Phemx first, then go to the Kryptos tax declaration page. Tax preparation fees may be discounted.

-

Enter Kryptos and complete your tax return step by step

What if the tax agency I use is not a Phemex partner?

If your tax filing agency is not a Phemex Partner, you can go to Funds History (Contract Trade Accounts,Spot Account,Investment Account),Spot History(Trade History),Deposit & Withdraw History(Withdraw) and download your transaction files for all years of trading. And then upload these documents on your tax agency page.

Step1. Download your transaction files for all years of trading.

-

Contract History report

-

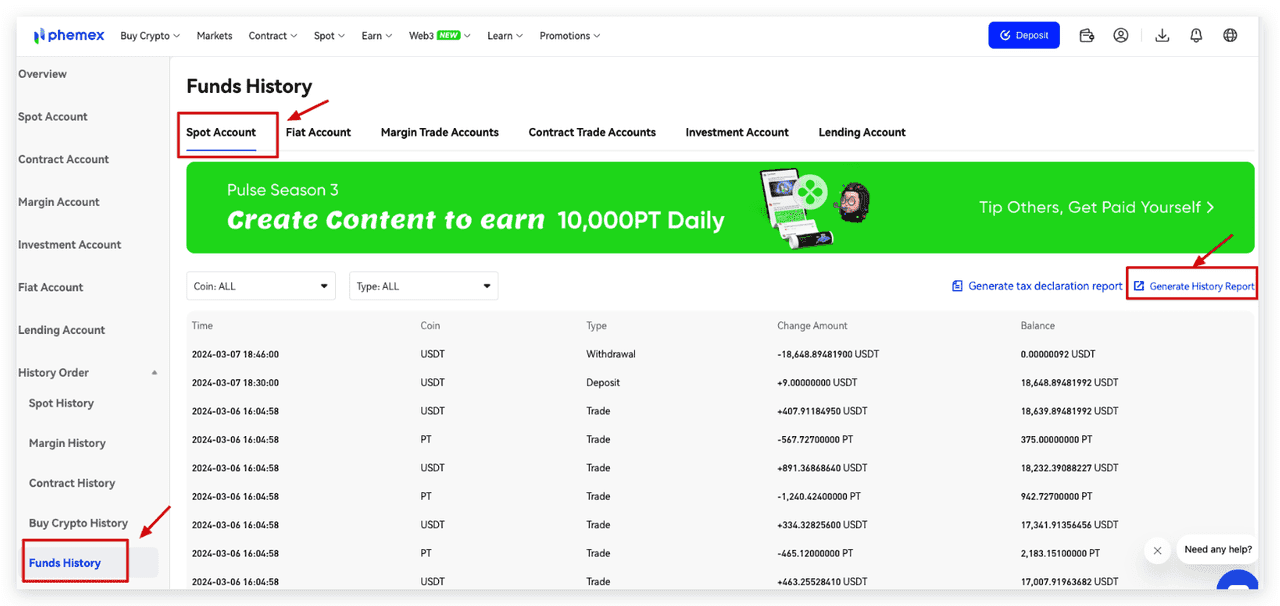

Enter Funds History

-

Select "Contract Trade Accounts"

-

Select "Generate History Report"

-

-

Spot History Report

-

Enter Funds History

-

Select "Spot Account"

-

Then select "Generate History Report"

-

-

Spot Trading report

-

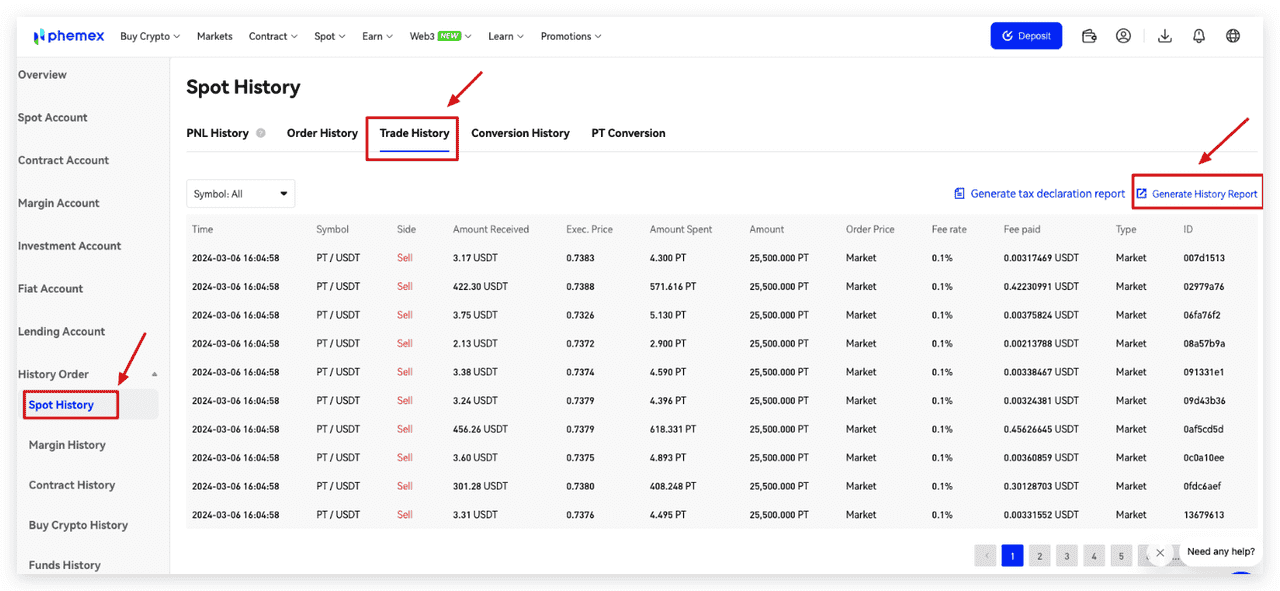

Enter Spot History

-

Select "Trade Histtory"

-

Select "Generate History Report"

-

-

Investment History report

-

Enter Funds History

-

Select " Investment Account "

-

Then select "Generate History Report"

-

-

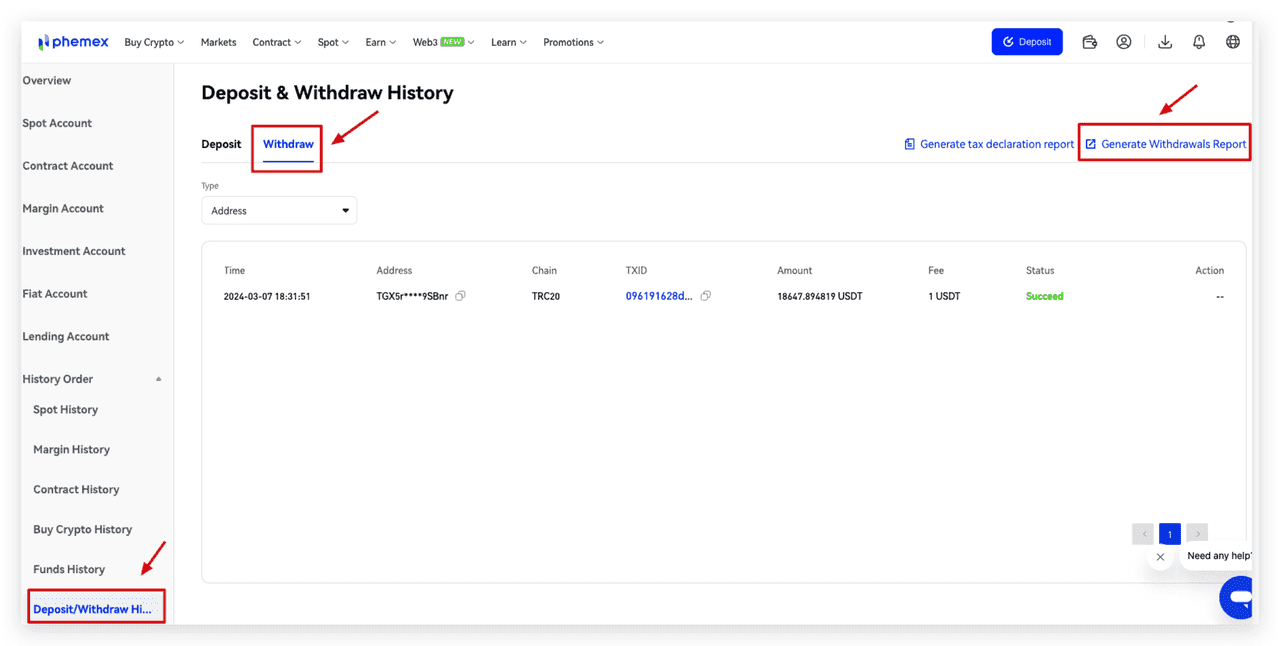

Withdrawals Report

-

Select "Withdraw"

-

Select "Generate Withdrawals Report"

Step2. Upload the CSV files of Phemex transaction history to the tax agency.

Phemex offers simple ways to generate all the information you need to do your crypto taxes. You can export account statements into CSV files, then import them to CoinTracking and Kryptos to perform tax declaration.