Introduction to Irys Crypto

Traditional blockchains often separate data storage from execution, leading to high costs and limited interoperability for AI and dApps. Irys addresses this as the first programmable datachain, storing data faster and cheaper while embedding instructions for onchain actions like automating AI workflows or triggering smart contracts. With hybrid Useful Proof of Work and Stake (uPoW/S) consensus, it supports instant data retrieval and infinite scaling by adding validators. The IRYS token powers fees, rewards, and security. Learn how Irys works, its 2025 performance, and how to trade IRYS securely on Phemex.

Quick Facts About IRYS Price and Supply

| Current Price (USD) | $0.03790 |

| 24h Change | +25.03% |

| All-Time High | $0.05482 (November 27, 2025) |

| All-Time Low | $0.01258 (November 25, 2025) |

| Market Cap | $75.8M |

| Fully Diluted Valuation | $379.02M |

| Circulating Supply | 2B IRYS |

| Total Supply | 10B IRYS |

| Availability on Phemex |

IRYS Futures (IRYSUSDT Perpetual):

|

Data as of November 28, 2025.

What Is Irys Blockchain?

Irys is a Layer 1 datachain optimized for onchain data storage and utility, bridging smart contract platforms with data-focused networks. It enables developers to store large datasets at at-cost pricing—cheaper than Web2 cloud or other Web3 options—while making data programmable for direct use in smart contracts and AI services.

Key Features of Irys

- Programmable Data Primitives: Via IrysVM (EVM-compatible), data includes embedded instructions for execution, such as automating transactions or AI model updates.

- Flexible Storage Options: Term storage (temporary, duration-based) or permanent (one-time fee for perpetual retention), with instant retrieval.

- Composable Utilities: Data and services integrate across ecosystems, supporting shared foundations for AI, IP, and consumer apps.

- Scalability: Horizontal scaling adds validators for unlimited capacity without compromising decentralization.

- Cost Efficiency: Stable pricing across storage, execution, and programmable data transactions, eliminating volatility.

How Does IRYS Work?

IRYS powers the Irys network as a utility token for:

- Onchain Data Storage and Execution: Store data at low costs and execute via IrysVM, ideal for data-intensive dApps.

- Programmable Data: Embed rules into data for onchain enforcement, like ownership verification or smart contract triggers.

- Composable Ecosystem: Utilities interact permissionlessly, enabling interconnected services across AI and beyond.

- Consensus and Security: Hybrid uPoW/S combines mining and staking for secure, scalable operations.

Use cases include AI workflow automation, decentralized content platforms, and data marketplaces, all leveraging cost-efficient, programmable storage.

IRYS Tokenomics

IRYS is the native token for the Irys datachain, incentivizing participation and securing the network. The initial supply is 10,000,000,000 tokens, with a circulating supply of approximately 2,000,000,000 tokens at the Token Generation Event (TGE), representing 20.0% of the maximum supply.

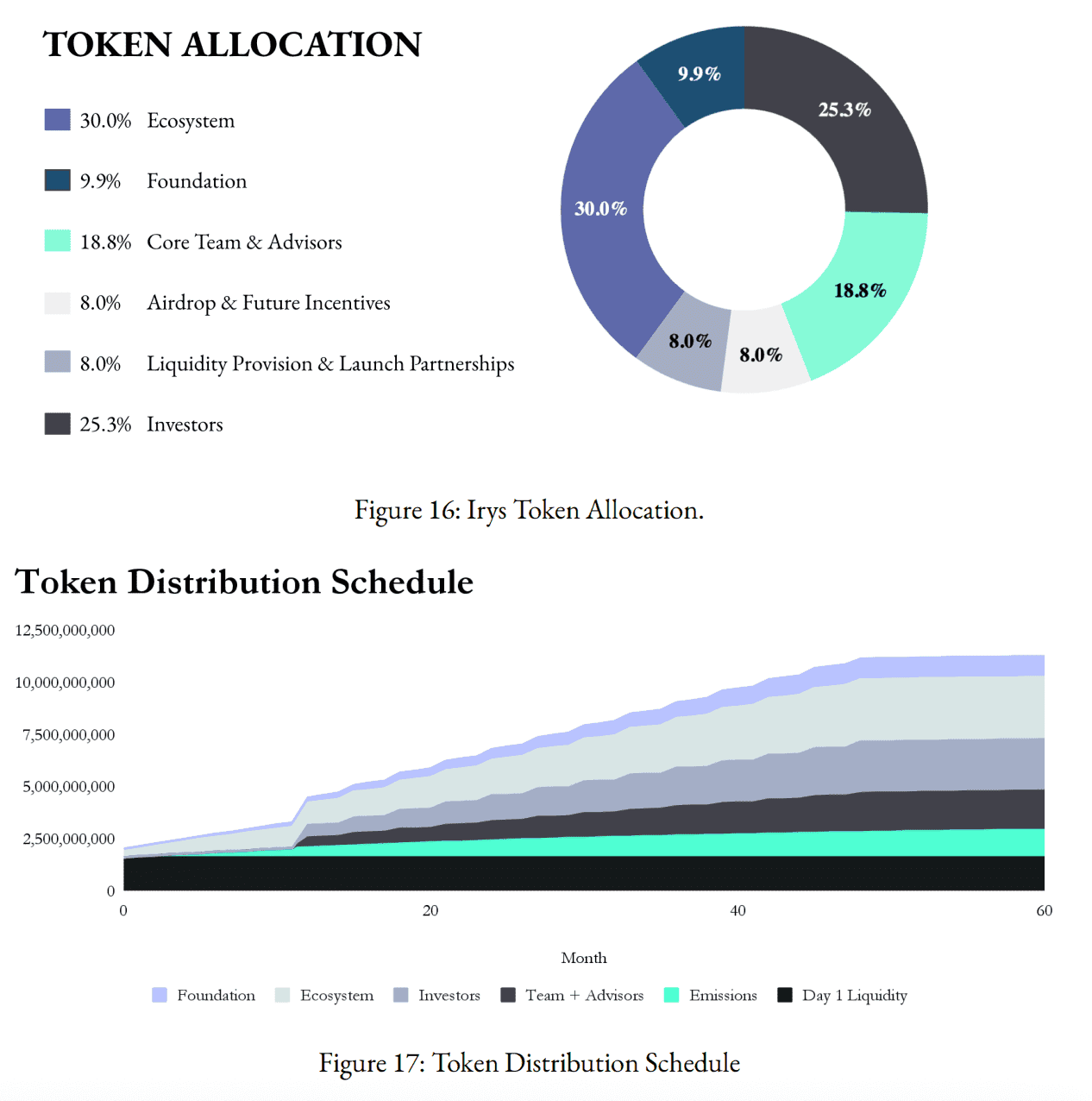

Token Allocation Breakdown

| Category | Percentage | Amount (IRYS) | Description |

|---|---|---|---|

| Ecosystem | 30% | 3,000,000,000 | For Irys initiatives, including dApps, cross-chain efforts, and partnerships. Held in secure multisig wallet. |

| Investors | 25.3% | 2,530,000,000 | Token rights for investors supporting protocol development. |

| Core Team and Advisors | 18.8% | 1,880,000,000 | Distributed to core contributors and advisors. |

| Airdrop and Future Incentives | 8% | 800,000,000 | Recognizes contributions; reserves for future developer/user incentives. |

| Liquidity, Market Stability, and Launch Partnerships | 8% | 800,000,000 | For market makers and launch partners to ensure liquidity on CEX/DEX. |

| Foundation | 9.9% | 990,000,000 | Funds development, audits, and initiatives to reduce centralized storage reliance. |

Additional Token Details

- Utility: Pays for storage fees, execution, programmable transactions, staking, and mining rewards (initial annualized inflation ~2%, halving every 4 years to a terminal 0.25%).

- Deflationary Mechanisms: 50% of execution fees burned; long-term storage fees (>2 weeks) locked in endowment for permanence; base fees for programmable transactions to treasury. These create net deflation with increased activity.

IRYS vs. Arweave: Key Differences

Irys and Arweave both focus on decentralized storage but differ in programmability and execution.

| Feature | Irys (IRYS) | Arweave (AR) |

|---|---|---|

| Use Case | Programmable datachain: storage + EVM execution for AI/dApps | Permanent storage for immutable "permaweb" |

| Consensus | Hybrid uPoW/S | Proof of Access (PoA) |

| Storage Options | Term or permanent, at-cost | One-time permanent fee |

| Market Cap (Nov 2025) | $75.8M | ~$273M |

| Key Differentiator | Composable, executable data via IrysVM | Censorship-resistant, long-term preservation |

Irys excels in dynamic, AI-driven applications with integrated execution, while Arweave prioritizes immutability and Celestia focuses on lightweight data posting.

Technology Behind Irys

- Core Architecture: Unifies storage and execution with programmable primitives for data interaction in smart contracts.

- IrysVM: EVM-compatible layer for Ethereum-style contracts on the datachain.

- Consensus: uPoW/S for secure, efficient validation and rewards.

- Innovations: Instant retrieval, horizontal scaling, and multi-revenue fees (storage, execution, programmable txns).

Team and Origins

Founded in 2023 by Josh Benaron (UK-based), who previously scaled Bundlr on Arweave to handle 95% of its data transactions. Irys raised $10 million in an extended seed round in 2024 and $10 million in Series A in 2025. Backers include Lemniscap, Primitive Ventures, and Smokey The Bera.

IRYS News and Milestones (Up to 2025)

- 2023: Founded by Josh Benaron with focus on programmable datachain for AI.

- 2024: $10M extended seed funding; testnet launch.

- 2025: $10M Series A; mainnet launch with 99% token surge to $88M market cap; IRYS token listings on exchanges including Phemex futures; airdrop applications opened November 25–December 25 for Galxe users and Genesis NFT holders.

- November 2025: All-time high of $0.05482 on November 27; active development continues.

Factors Affecting IRYS Price in 2025–2030

Bullish Factors

- Adoption Growth: Demand for programmable data in AI could drive usage, increasing token demand via fees and burns.

- Technical Upgrades: IrysVM and scaling enhancements support higher throughput.

- Deflationary Burns: 50–95% fee burns reduce supply as activity rises.

- Funding and Listings: $20M total raised; recent Phemex integration boosts liquidity.

Bearish Factors

- Regulatory Risks: Evolving rules on data privacy or crypto could impact global adoption.

- Technical Risks: Potential vulnerabilities in uPoW/S or scaling, despite safeguards.

- Competition: Rivals in Layer 1 storage/execution may erode market share.

- Volatility: Recent 195% rise from ATL but -32% from ATH shows swings.

IRYS price will hinge on ecosystem expansion and market conditions.

Is IRYS a Good Investment?

Assessing IRYS’s investment potential in 2025 involves evaluating its current advantages, growth opportunities, and risks to help investors make informed decisions.

- Growth Opportunities: IRYS leverages strong fundamentals, including $20M in funding from investors like Lemniscap and Primitive Ventures, and a multi-revenue model blending storage, execution, and programmable data fees. Its programmable datachain architecture via IrysVM enables seamless AI workflows and dApps, targeting the booming DePIN market projected at $3.5T by 2028. Deflationary burns (50% of execution fees, up to 95% of term storage) reduce supply, while horizontal scaling and EVM compatibility drive developer adoption, positioning IRYS for explosive growth in data-intensive ecosystems.

- Risks and Considerations: As a nascent Layer 1, IRYS faces high volatility, with a 22% post-mainnet crash on November 26, 2025, and airdrop concentration risks—20% of initial allocation claimed by one entity, potentially enabling whale dumps. Security vulnerabilities in its uPoW/S consensus require ongoing audits, and regulatory scrutiny on data privacy could hinder adoption. Limited historical data and competition from Arweave/Celestia add pressure, while token unlocks (e.g., 25.3% for investors vesting over 4 years) may introduce selling overhang.

- Community and Analyst Sentiment: Discussions on X and crypto media show cautiously optimistic vibes, with analysts predicting $1 by Q1 2026 if AI adoption surges, amid a Greed-index of 68. The 76% price pump post-mainnet (November 25, 2025) and airdrop rewards boosted hype, though airdrop sell-offs sparked whale concerns. Community leans bullish on its data-AI edge, with active Discord engagement and testnet vibes, but short-term dips persist; ongoing airdrops and mainnet upgrades aim to sustain momentum.

How to Trade IRYS on Phemex

Phemex offers global users secure, high-leverage IRYSUSDT perpetual futures trading with deep liquidity, low fees (0.01% maker / 0.06% taker), and up to 20x leverage.

- Sign Up: Create a Phemex account and complete KYC verification.

- Fund Your Account: Deposit USDT or other crypto instantly, or buy crypto directly via credit card, Apple Pay, Google Pay, or bank transfer. Transfer funds to your futures wallet.

- Trade IRYS Futures (IRYSUSDT Perpetual):

- Trading pair: IRYSUSDT

- Tick size: 0.000001

- Max Leverage: 20X

- Supports hedge mode (hold long & short positions simultaneously)

Summary: Why Irys Matters in 2025

Irys revolutionizes onchain data with programmable primitives, flexible storage, and cost-efficient scaling for AI and beyond. At $0.03790 with strong funding and listings, IRYS positions for growth in data-driven Web3. Trade IRYS futures on Phemex to explore this datachain innovation.

Frequently Asked Questions (FAQ)

Q: What is Irys crypto? Irys is a Layer 1 datachain for affordable, programmable onchain data storage and EVM execution, targeting AI and dApps with composable utilities for seamless integration.

Q: How does IRYS work? IRYS pays fees for storage/execution; network uses uPoW/S consensus with burns for deflation, enabling scalable, secure data operations across ecosystems.

Q: What are main IRYS use cases? AI automation, smart contract triggers, composable data services for dApps, content platforms, and marketplaces requiring efficient onchain data handling.

Q: Where to buy IRYS? On Phemex via futures IRYS/USDT pairs, offering low-fee trading for global users with easy deposits and instant execution.

Q: What sets Irys apart? Unifies storage and execution with programmable data, unlike execution-only or storage-only chains, providing cost-efficient, flexible options for AI-driven innovation.

Q: What are IRYS investment risks? Volatility, regulation, technical issues—DYOR, consider market trends and diversify to mitigate potential downsides in the crypto space.