Summary Box (Quick Facts)

-

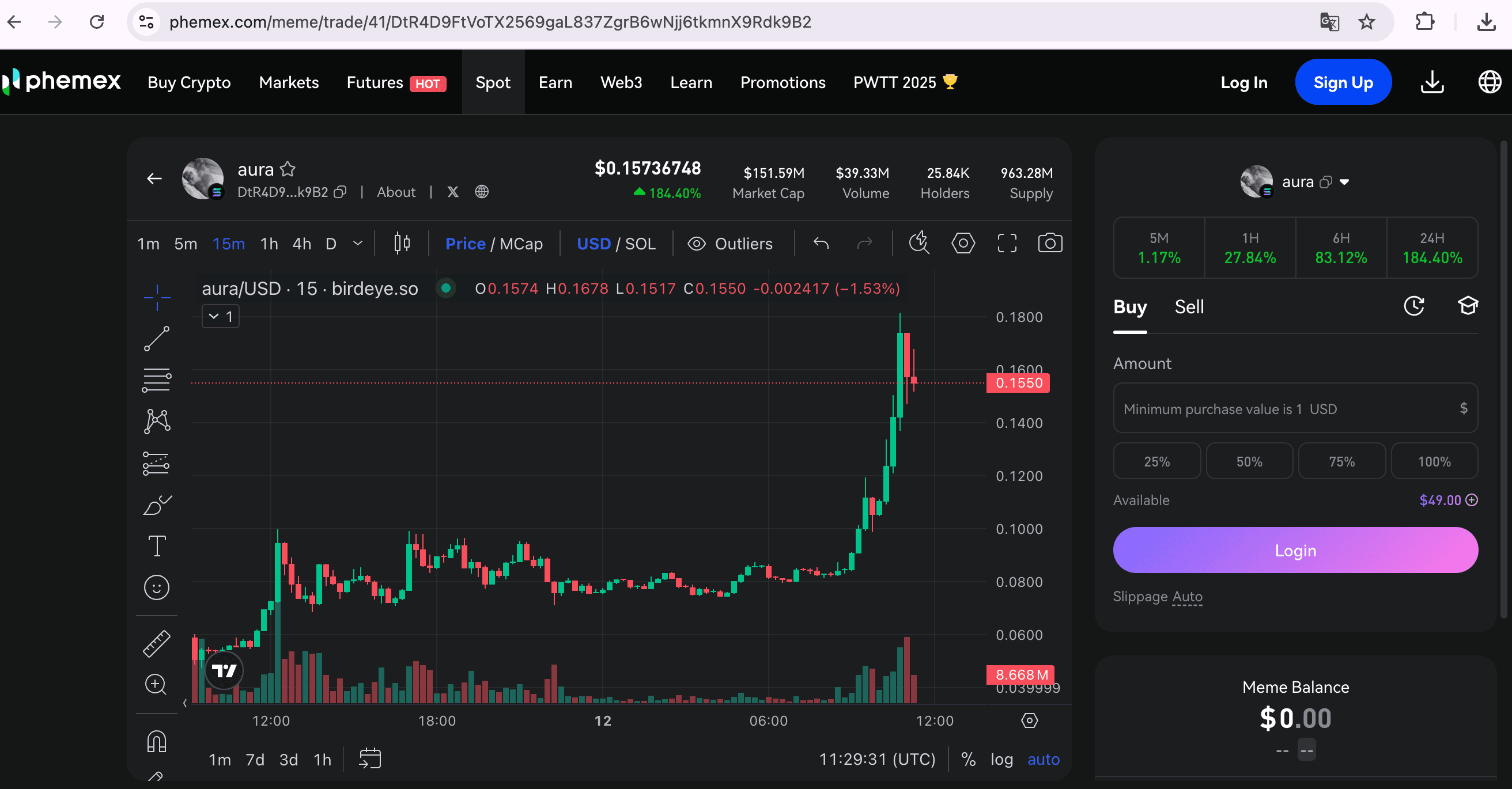

Ticker Symbol: AURA

-

Chain: Solana

-

Contract Address: DtR4D9FtVoTX2569gaL837ZgrB6wNjj6tkmnX9Rdk9B2

-

Circulating Supply: ≈ 965.38 million

-

Max Supply: 965.38 million

-

Primary Use Case: On‑chain DeFi yield aggregator & meme‑token community play

-

Current Market Cap: ≈ $150 million (varies with price surge)

-

Availability on Phemex: Yes – via Phemex MemeX

❓ What Is Aura? (Aura explained)

Aura is a Solana‑based token that blends meme‑style community energy with serious DeFi mechanics. Think of it as part social movement, part yield‑aggregator. The core premise: “hold $AURA, gain aura”—a slogan that feels as much about status as on‑chain returns .

Its DNA combines the rapid‑fire trading and virality of meme coins—50× pumps overnight—and the underpinnings of real utility. What problem does it solve? For one, liquidity: Aura offers deep on‑chain pools for high‑APY staking and fee‑sharing. For another, community: it’s democratising DeFi by packaging serious yield strategies in meme‑friendly branding. So, what is Aura? It’s a bridge—a gateway to accessible yet potent DeFi on Solana, made attractive by a spirited brand experience.

? How Many Aura Are There?

-

Max vs Circulating Supply: As of June 2025, about 965.3 million AURA are circulating, with a max supply of 965.3 million

-

Inflationary or deflationary? Primarily non‑inflationary: new issuance is capped, but supply remains dynamic due to on‑chain staking rewards.

-

Burning/Minting mechanisms: No formal burning mechanism observed, but occasional on‑chain yield re‑investments may reduce net supply from liquidity fees.

In short, Aura behaves like a capped token, with circulating supply evolving naturally via ecosystem activity, not artificial inflation.

? What Does Aura Do? (Aura use case)

Aura lives at the intersection of community dynamics and financial utility:

-

Yield Aggregator: Through integrations on Solana, it offers high-yield pools where users stake AURA or LP tokens.

-

Fee & Token Governance: Holders likely share in trading fee revenue or governance privileges, shaping protocol incentives and future decisions.

-

Social Meme Utility: With rapid surges—50× in a day—it attracts traders chasing both adrenaline and yield .

-

On‑chain integration: Active on Raydium, Meteora, Orca with AURA/SOL pairs command significant volume.

In essence: Aura use case spans DeFi yield, governance, and viral tokenomics—each reinforcing the next.

⚔️ AURA vs Bitcoin

| Feature | AURA (AURA) | Bitcoin (BTC) |

|---|---|---|

| Launch Year | 2024 (est.) | 2009 |

| Blockchain | Solana (Immutable, Layer-1) | Native Bitcoin blockchain (PoW Layer-1) |

| Consensus Mechanism | Proof of Stake + Proof of History (Solana) | Proof of Work (SHA-256) |

| Speed | ~400 ms block times | ~10 minutes per block |

| Transaction Fees | ~$0.0001 (ultra-low) | ~$1–$20 depending on network congestion |

| Primary Use Case | Meme + DeFi yield aggregator | Store of value, censorship-resistant money |

| Token Utility | Yield staking, governance, trading | Digital gold, payment rails |

| Volatility | Extremely high (50× pump possible) | Moderate (relative to alts) |

| Supply Cap | 1 billion AURA | 21 million BTC |

| Security | Relies on Solana validator set | Most secure, decentralized crypto network |

| Decentralization | Semi-decentralized (validator concentration risk) | Highly decentralized with global miner distribution |

| Cultural Identity | Meme-savvy, edgy, high-APY seeker | Conservative, legacy holder, anti-inflation hedge |

So, Aura vs Bitcoin: completely different animals—store‑vs‑move; prudent vs fast‑fluid; durable vs playful.

?️ The Technology Behind Aura

Aura sits on Solana, leveraging its high-throughput layer with sub-second finality. It likely uses:

-

Consensus: Solana’s PoH + PoS, enabling ultra-fast block times and low fees.

-

Innovations: Custom Solana programs handling AURA-specific governance, staking rewards, and LP integration.

-

Infrastructure & Partnerships: Deployed across Raydium, Meteora, and Orca. Interactions boost APY via pooled liquidity benefits.

Aura isn’t a layer-2—it’s a purpose‑built token in Solana’s high-octane ecosystem.

? Team & Origins

Details scarce. Aura’s branding is meme-centric. Official profiles (e.g. @AuraFinance) hint at DeFi heritage tied to Balancer network—suggesting an experienced background . But:

-

Founders/Developers: Not fully public—likely pseudonymous.

-

Launch Timeline: Early 2024 on Solana is probable.

-

Backing: Unclear—no visible VC logos. Momentum appears purely community-driven.

If anonymity raises eyebrows, it’s balanced by transparency in on‑chain code and DeFi mechanics.

?️ Key News & Events

-

? 50× Price Surge: Recent “parabolic run” saw AURA explode 50× in one day, on fatigue of meme cycles.

-

? Volume Blitz: Soaring trading volumes on Raydium, Meteora; token surged 180%+ in 24 hr.

-

? Phemex MemeX: Listed on Phemex’s Solana-based MemeX platform as part of expanding access.

-

? Community hooks: Discord, X account, organic viral campaigns linked from auramaxxing.xyz and auramash.

? Is Aura a Good Investment? (Aura investment potential)

Not financial advice, but here’s the balanced view:

✅ Upside potential:

-

Explosive momentum: rapid gains show appetite for high-volatility DeFi + meme combos.

-

Strong ecosystem fit: integrates with key Solana platforms—pooling liquidity and yield.

-

Viral brand play: meme energy continues to lure trading capital.

⚠️ Risks:

-

Volatility: 50× ramp implies 90%+ corrections are likely.

-

Regulatory & anonymity concerns: developer opacity could spook conservative capital.

-

Tech & ecosystem risk: Solana downtimes or DeFi hacks could disrupt performance.

? Verdict: Aura is high-risk, high-reward. If you thrive on fast-paced DeFi with appetite for swift trades, it's attention-worthy. For capital preservation, proceed cautiously.

? How to Buy Aura on Phemex MemeX

Aura is already available via Phemex MemeX, the on‑chain Solana token marketplace integrated into Phemex.

To find “How to buy AURA”, simply search “AURA” or its contract address in MemeX. If found, ready—click to trade.

Quick steps:

-

Log into Phemex and navigate to MemeX

-

Search for AURA

-

Choose your trading pair (e.g. SOL/AURA)

-

Execute spot/limit orders

-

Optionally stake or hold on‑chain after withdrawal

? Final Thoughts: Aura's Place in Crypto Culture

Aura offers the rare thrill of meme-coin velocity with DeFi yield backbone. It looks flashy but comes with functional clout: staking, governance, liquidity partnerships—all powered by Solana’s lightning base.

If you're in tune with fast-paced, trend-driven crypto and aren't afraid of volatility, Aura is a pulse-check. You can Buy AURA easily via Phemex MemeX, stake on-chain, Trade AURA with momentum, and stay ahead of News about AURA via its growing community presence. Just be smart—don’t bet more than you're prepared to lose.

This isn’t financial advice—consider its strong yield-aggregator utility vs meme volatility, assess Aura investment potential, and decide if it's a fit for your portfolio.

Aura occupies an electrifying corner of crypto: a token that’s as much about swagger as substance. For those chasing DeFi thrills, meme hype, and yield aggregation rolled into one, it’s worth watching. But across these waves, discipline is essential: DCA wisely, secure your holdings, and let the on‑chain journey unfurl.