What is Funding Rate Arbitrage?

Funding rate arbitrage is a trading strategy that allows traders to hedge their positions in the contract market by opening an opposite position in the spot market for the same trading pair.

This strategy involves simultaneously opening long and short positions across different markets to capture profits from funding fees. As a delta-neutral approach, it enables traders to hedge exposure: any losses incurred in the contract market can be offset by gains in the spot market, and vice versa, while also earning funding fees.

Before exploring how this strategy works and why it is relevant to crypto contract markets, let’s first understand the fundamentals of perpetual contracts.

What is a Perpetual Contract?

A perpetual contract is an agreement to buy or sell an asset without an expiry date or a predetermined settlement date. While similar to traditional futures contracts, the key difference is that perpetual contracts have no expiration or settlement date.

Since they do not expire, perpetual contracts rely on a funding rate mechanism to balance long and short positions. This mechanism ensures that the perpetual contract price closely tracks the underlying asset price.

The funding rate determines who pays and who receives funding fees, depending on market conditions:

-

When the funding rate is positive (the contract price is above the spot price), longs pay funding fees to shorts.

-

When the funding rate is negative (the contract price is below the spot price), shorts pay funding fees to longs.

Funding rate arbitrage takes advantage of these payments by opening equal-sized positions in both the spot and contract markets for the same trading pair.

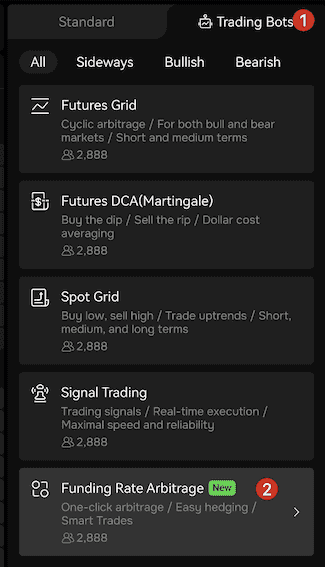

How Does the Funding Rate Arbitrage Bot Work?

The Funding Rate Arbitrage Bot automatically opens opposite positions in two markets.

- When the cumulative funding rate is positive (longs pay shorts), the bot will short the perpetual contract while simultaneously buying the equivalent amount of the asset in the spot market.

Funding rates fluctuate at each interval (typically every 8 or 4 hours). With the bot, traders can profit from these fluctuations without having to constantly monitor the market.

Example:

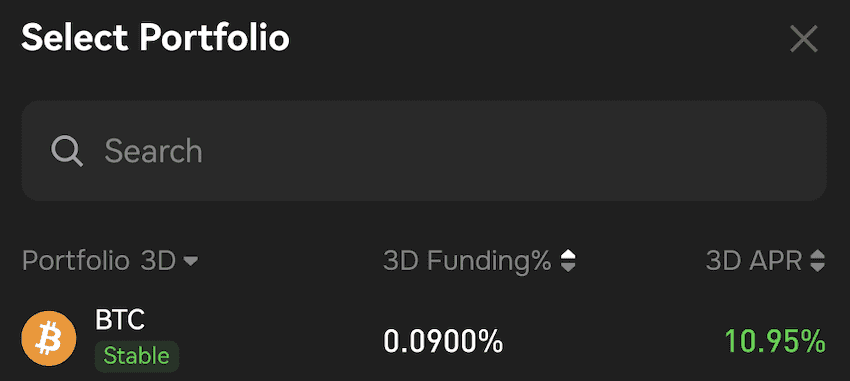

Assume the funding rate is positive at 0.0900% over three days, meaning longs pay shorts. A trader uses the bot to run an arbitrage strategy on the BTCUSDT pair in the USDT-margined contracts market.

-

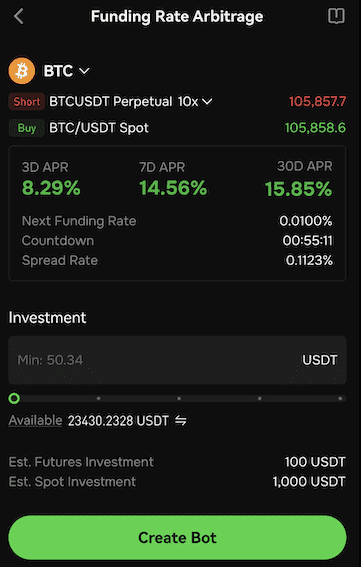

The trader invests 1,100 USDT into the bot strategy and sets a 10x leverage on the contract position.

-

The bot opens a 100 USDT short on the BTCUSDT perpetual contract while buying 1,000 USDT worth of BTC in the spot market.

Outcome:

-

If BTC price rises, the short contract incurs losses, but the spot position gains. The spot profit offsets the contract losses.

-

If BTC price falls, the short contract profits while the spot position loses value. The contract profit offsets the spot losses.

With a funding rate of 0.09%, after three days the trader earns 0.9 USDT (1,000 × 0.09%) as funding income. This translates to an annualized return of 10.95% (assuming the funding rate remains constant, resulting in an annual profit of 100.95 USDT).

Key Advantages of Funding Rate Arbitrage

-

Passive Income Potential: Earn steady funding fees with minimal active management.

-

Reduced Risk Exposure: By holding offsetting long and short positions across spot and contract markets, traders can hedge against market volatility, where profits in one market compensate for losses in the other.