In the complex and rapidly evolving world of Web3, the infrastructure that powers decentralized applications, blockchains, and AI is often as intricate as the technologies themselves. For developers and protocols, managing this underlying "compute" layer can be a significant barrier to innovation. Addressing this challenge head-on is NodeOps, a project positioning itself as a foundational layer for the next wave of decentralized development.

NodeOps aims to be a leading DePIN (Decentralized Physical Infrastructure Networks) coordination protocol, designed to streamline and simplify the management of cloud infrastructure. With its native token, NODE, at the center of its economy, the project provides a suite of tools for node operators, developers, and entire protocols. This article offers a neutral, educational overview of NodeOps, explaining its technology, purpose, and role within the broader Web3 ecosystem.

Quick Facts: NodeOps (NODE) at a Glance

-

Ticker Symbol: NODE

-

Chain: Ethereum

-

Contract Address: 0x2f714d7b9a035d4ce24af8d9b6091c07e37f43fb

-

Circulating Supply at Launch: ~133.4 Million

-

Total Supply at Genesis: ~678.8 Million (Note: This is a dynamic supply, not a hard cap)

-

Primary Use Case: A DePIN coordination protocol for verifiable, general-purpose compute.

-

Current Market Cap: /

-

Availability on Phemex: Not yet available (as of writing).

What Is NodeOps? An Explanation

To put it simply, NodeOps is a specialized platform that helps manage the computer resources (known as "compute") needed to run blockchains and decentralized applications. Blockchains rely on a network of computers, or "nodes," to function securely. Setting up and maintaining these nodes is technically demanding and resource-intensive, creating a bottleneck for many projects.

NodeOps seeks to solve this by creating a permissionless, chain-agnostic network that coordinates these resources. The project’s mission is to enhance the builder experience, allowing developers to focus on innovation rather than operational complexities.

A helpful analogy provided by the project explains it this way: The NodeOps Network is like a large, safe playground. Protocols and dApps are the "parents" who bring their "kids" (nodes, applications) to play. These parents rent "toys" (compute resources) from the playground's store (the NodeOps marketplace) using "pocket money" (tokens). "Guardians" (monitoring systems) watch over everything to ensure it's safe and functional.

The entire NodeOps ecosystem is organized around four key pillars:

-

The NodeOps Network: A DePIN orchestrator for general-purpose compute, secured by Actively Validated Services (AVS).

-

A Suite of Core Services: A collection of products for developers, node operators, and users.

-

The NodeOps Foundation: The governance layer centered around the NODE token, which underpins the network.

-

An Ecosystem of Partners: The providers and consumers of compute that form the lifeblood of the network.

Through these pillars, NodeOps provides a platform designed to abstract away the infrastructure challenges of decentralized computing.

How Many NODE Tokens Are There? A Look at the Tokenomics

The tokenomics of NODE are designed to be dynamic and responsive to network activity, a departure from models with a fixed maximum supply.

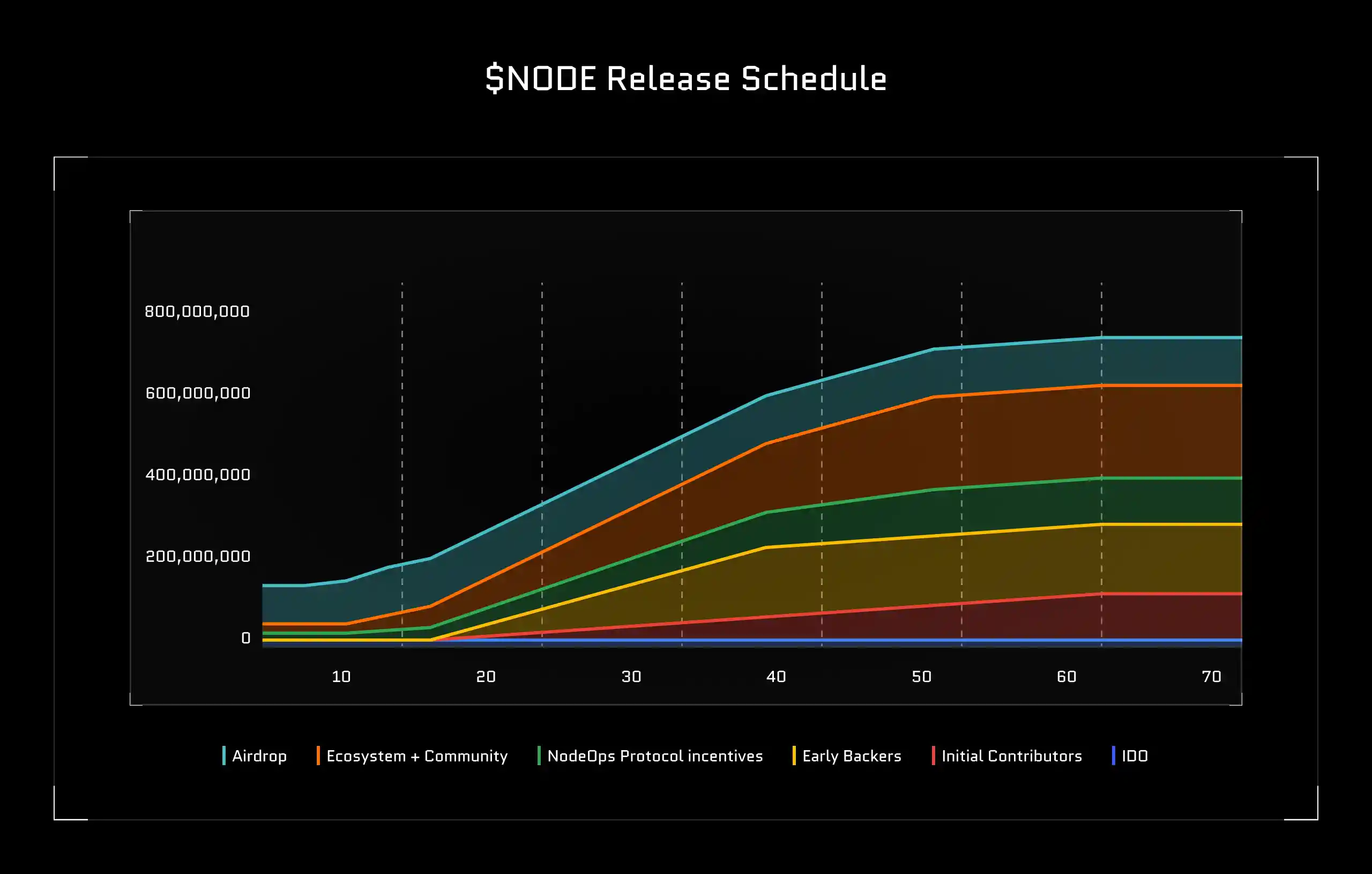

At its Token Generation Event (TGE), the total supply at genesis was 678,833,730 NODE, with an initial circulating supply of 133,390,828 NODE (approximately 19.65%).

A core feature of its economic model is a dynamic mint and burn mechanism. This system, inspired by the Burn-and-Mint Equilibrium (BME) framework popular in DePIN, ties the creation of new tokens directly to onchain revenue. When users pay for services on the network, a portion of the NODE tokens they use is burned (permanently removed from circulation). A corresponding amount of new tokens is then minted and distributed as rewards to network participants, governed by a "burn/mint ratio." This ensures that token inflation is backed by real economic activity, creating a sustainable model where supply expands only in response to genuine demand.

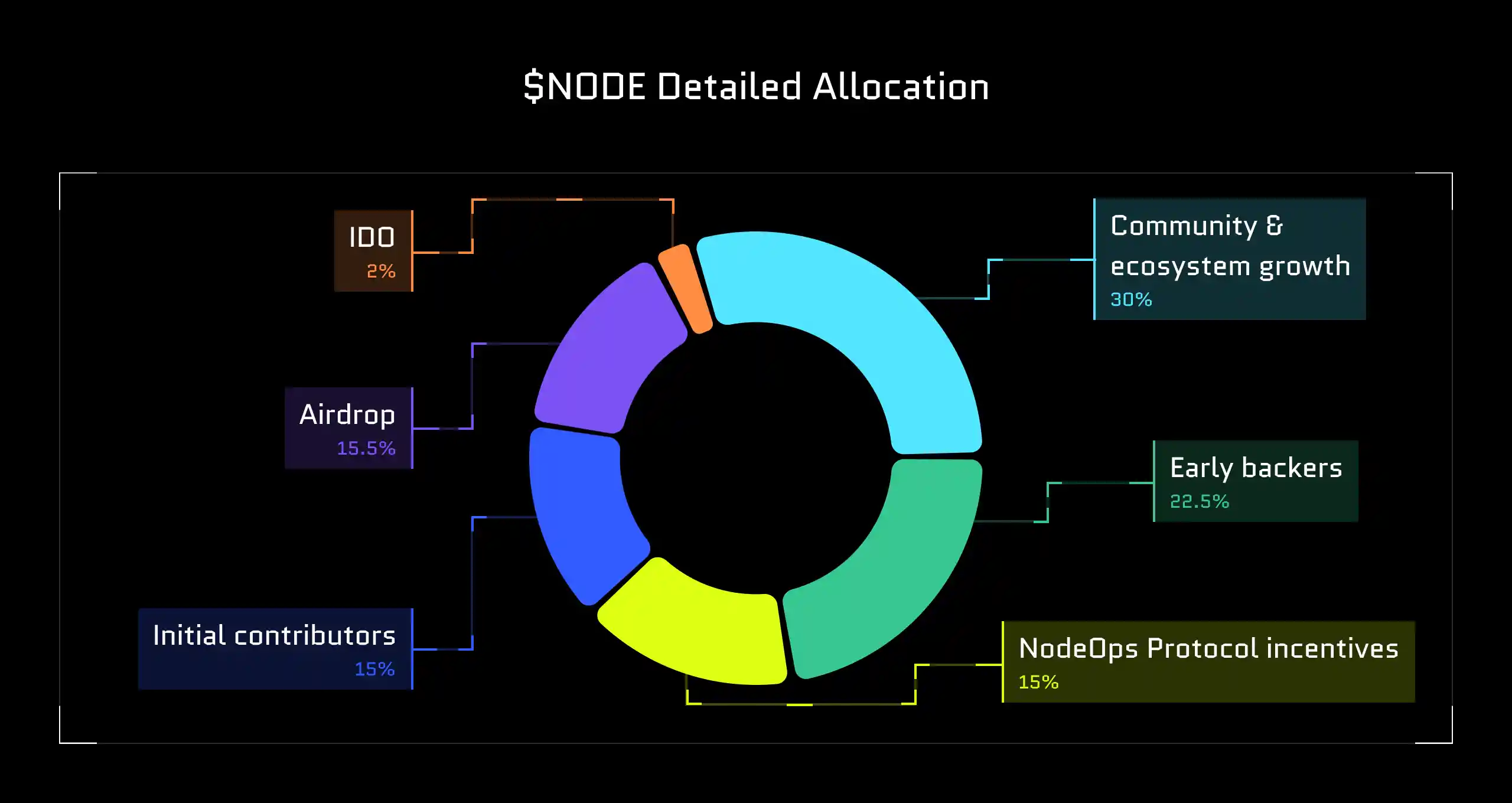

The initial distribution of the genesis supply is allocated as follows:

-

Community & Ecosystem (47.5% total):

-

Ecosystem Growth (30%): The largest allocation, for contributor incentives, partnerships, and marketing, with a 10% unlock at TGE followed by a 6-month cliff and 60-month linear vesting.

-

Airdrop (15.5%): To reward early supporters and community members, with 80% unlocked at TGE.

-

IDO (2%): For the initial public sale, 100% unlocked upon completion.

-

-

Protocol Incentives (15%): To power the core reward systems for compute providers and stakers.

-

Initial Contributors (15%): For the core team, with a 12-month cliff and 60-month vesting to align long-term interests.

-

Early Backers (22.5%): For investors who provided seed capital, with a 12-month cliff and 36-month vesting.

This structured allocation and dynamic supply model aim to balance initial growth incentives with long-term economic stability, directly linking the NODE price and supply to the platform's utility.

What Does the NODE Token Do? The Engine of the Ecosystem

The NODE token is integral to the platform's function, serving multiple roles beyond simple speculation. Its design establishes it as the primary economic engine of the NodeOps Network. The core NODE use case can be understood through four main functions:

-

Access to Services (Burn and Mint Credits): All services on the NodeOps platform are priced in USD. To access them, users burn an equivalent amount of NODE tokens and receive non-transferable credits. This directly ties platform usage to token demand.

-

Compute Bonding: To contribute resources to the network, compute providers must "bond" or stake NODE tokens. This creates an economic threshold for participation, ensuring providers have skin in the game and are aligned with the network's health.

-

Securing the Network (Verifiable Compute): NodeOps integrates with AVS ecosystems like EigenLayer. This allows NODE to be restaked to provide economic security guarantees for compute workloads. If a provider fails to meet performance or integrity standards, their staked tokens can be "slashed" or forfeited as a penalty.

-

Governance: NODE holders can participate in protocol governance, voting on key parameters like the burn/mint ratio, reward policies, and other operational decisions that shape the network's future.

NodeOps' Core Products and Services

The utility of NODE is made tangible through its suite of products:

-

Agent Terminal: A developer sandbox for building and deploying AI solutions.

-

NodeOps Cloud: A permissionless DePIN marketplace for verifiable compute.

-

NodeOps Console: The original Node-as-a-Service (NaaS) dashboard for no-code node deployment.

-

Security Hub: An AI-powered tool for scanning code and applications for vulnerabilities.

-

Staking Hub: A platform allowing users to pool their tokens to meet minimum requirements for running a validator node.

-

NodeOps Enterprise: B2B services for enterprise-grade RPC and validator nodes.

For those looking to trade NODE, understanding this deep utility is key to assessing its role in the market.

NodeOps (NODE) vs. Ethereum (ETH): A Tale of Two Layers

Comparing NodeOps to an industry giant like Ethereum is useful not because they are direct competitors, but because it clarifies their distinct, symbiotic relationship. Understanding this difference is key to grasping where NodeOps fits within the Web3 architecture.

| Feature | NodeOps (NODE) | Ethereum (ETH) |

| Primary Use Case | A DePIN coordination layer for deploying and managing decentralized compute resources. | A general-purpose, decentralized smart contract platform for building DApps. |

| Technology | An Actively Validated Service (AVS) built upon EigenLayer, which leverages Ethereum's security. | A foundational Layer-1 blockchain with its own Proof-of-Stake consensus mechanism. |

| Role in Ecosystem | Infrastructure Service Layer: Provides the "picks and shovels" for other chains and services to function. | Settlement & Application Layer: The base "digital jurisdiction" where DApps execute and transactions are finalized. |

| Token Utility | Fees for compute services, bonding/staking to secure the NodeOps network, and governance. | Gas fees for transactions, staking to secure the entire network, and a core store of value. |

| Target Audience | Blockchain developers, new protocols, AI projects, and professional node operators. | DApp developers, end-users of DeFi/NFTs, and investors in the base layer of Web3. |

The key takeaway from the NodeOps vs. Ethereum comparison is that they operate on different, complementary layers of the technology stack. NodeOps is not trying to be a new Ethereum; instead, it is a specialized service that leverages Ethereum's security to provide essential infrastructure for a multi-chain world.

The Technology Behind NodeOps

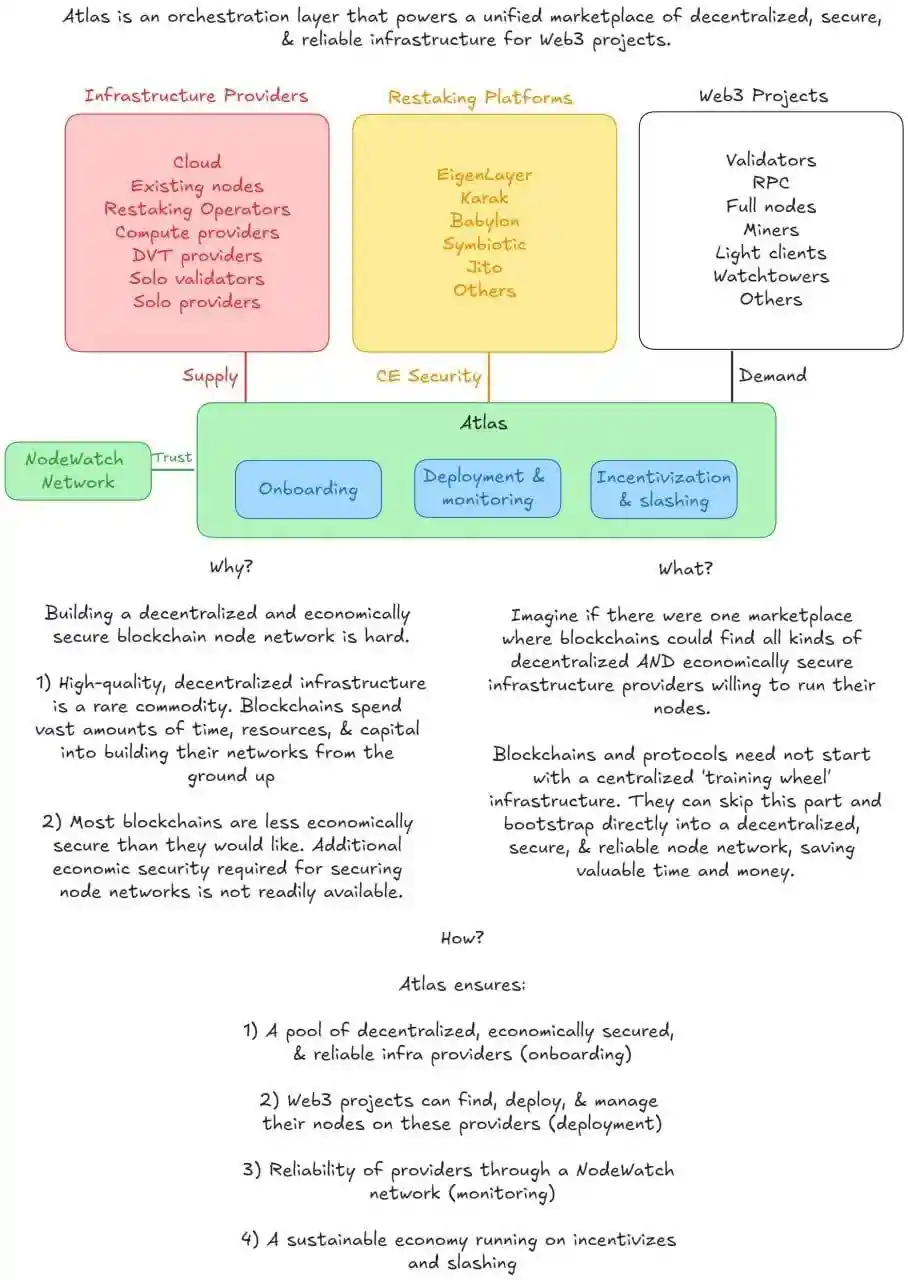

NodeOps is built on a sophisticated technological foundation designed for security and scale. Its core innovation is its position as an Actively Validated Service (AVS) on EigenLayer. EigenLayer is a protocol on Ethereum that introduced "restaking," a mechanism allowing staked ETH to be used to secure other applications.

By operating as an AVS, NodeOps allows new blockchain projects to tap into this shared security pool instead of building their own from scratch. The NodeOps AVS is a decentralized network of operators focused on deploying and managing nodes. This process is secured by both restaked ETH and staked NODE tokens, creating a robust dual-security model. This framework positions NodeOps as a "Layer 0" infrastructure solution, providing foundational services for a wide range of other networks.

Team & Origins

The credibility of a project often rests on its founding team. NodeOps was co-founded by Naman Kabra and Shivam Tuteja, individuals with backgrounds in software engineering and a focus on solving infrastructure-level problems in crypto.

The project gained significant momentum after securing $5 million in a seed funding round. The round was co-led by prominent crypto-native VCs Borderless Capital and Wormhole, among other strategic investors. This financial backing and strategic support provide NodeOps with the resources to pursue its ambitious roadmap.

Is NODE a Potential Good Investment? A Balanced View

This section explores the potential pros and cons of NodeOps but must be viewed through the lens of the high-risk, high-reward nature of early-stage crypto projects.

Disclaimer: This content is for informational and educational purposes only and does not constitute financial advice or an endorsement of any project. All investments, especially in volatile assets like cryptocurrencies, carry a significant risk of loss. You should always conduct your own thorough research and consult with a qualified financial advisor before making any investment decisions.

Potential Strengths:

-

DePIN and Infrastructure Play: NodeOps operates in the DePIN sector, providing essential "picks and shovels" infrastructure. Its success is tied to the overall growth of the Web3 industry rather than the success of a single application.

-

Integration with EigenLayer: Being an AVS on EigenLayer places NodeOps at the center of the powerful restaking narrative, potentially benefiting from its growth and capital flows.

-

Clear Revenue Model: The burn/mint mechanism and fees for services create a direct link between platform usage and the token's economy, providing a clear path to sustainable revenue.

-

Diverse Product Suite: The range of services, from AI development to node deployment, addresses multiple needs within the Web3 space, creating several avenues for adoption.

Risks and Challenges to Consider:

-

Execution Risk: The project's vision is ambitious, and its success is not guaranteed. It depends heavily on the team's ability to execute its complex roadmap, maintain security, and attract a critical mass of both compute providers and consumers.

-

Intense Competition: The node-as-a-service and DePIN markets are highly competitive. NodeOps faces challenges from both established centralized players and other emerging decentralized solutions. There is no guarantee it will maintain a competitive edge.

-

Technological Dependencies: The project's success is deeply intertwined with the security and continued adoption of EigenLayer. Any unforeseen vulnerabilities or failures in the underlying restaking protocol could have a severe, cascading negative effect on all AVSs, including NodeOps.

-

Extreme Market Volatility: Like all altcoins, especially new ones, the NODE price is subject to extreme volatility. Its value can be heavily influenced by broader cryptocurrency market trends and can experience significant price swings in short periods. Investors must be prepared for the possibility of substantial losses.

Conclusion

NodeOps (NODE) represents a technically focused project aimed at solving a fundamental problem in the Web3 space: the complexity of decentralized infrastructure management. By creating a DePIN coordination layer with a sophisticated tokenomic model and a clear suite of products, it is building a foundational service for developers and protocols.

While the project is still in its early stages and faces the inherent risks of a pioneering technology, its strategic positioning within the DePIN and restaking narratives makes it a significant project to watch. For anyone interested in the underlying infrastructure that will power the future of decentralized applications, understanding projects like NodeOps is essential. However, any potential interest must be balanced with a clear understanding of the significant risks involved. As the ecosystem matures, information regarding how to buy NODE on platforms like Phemex will become more available, reflecting its growth and market presence. You can follow news about NODE to stay updated on its development.