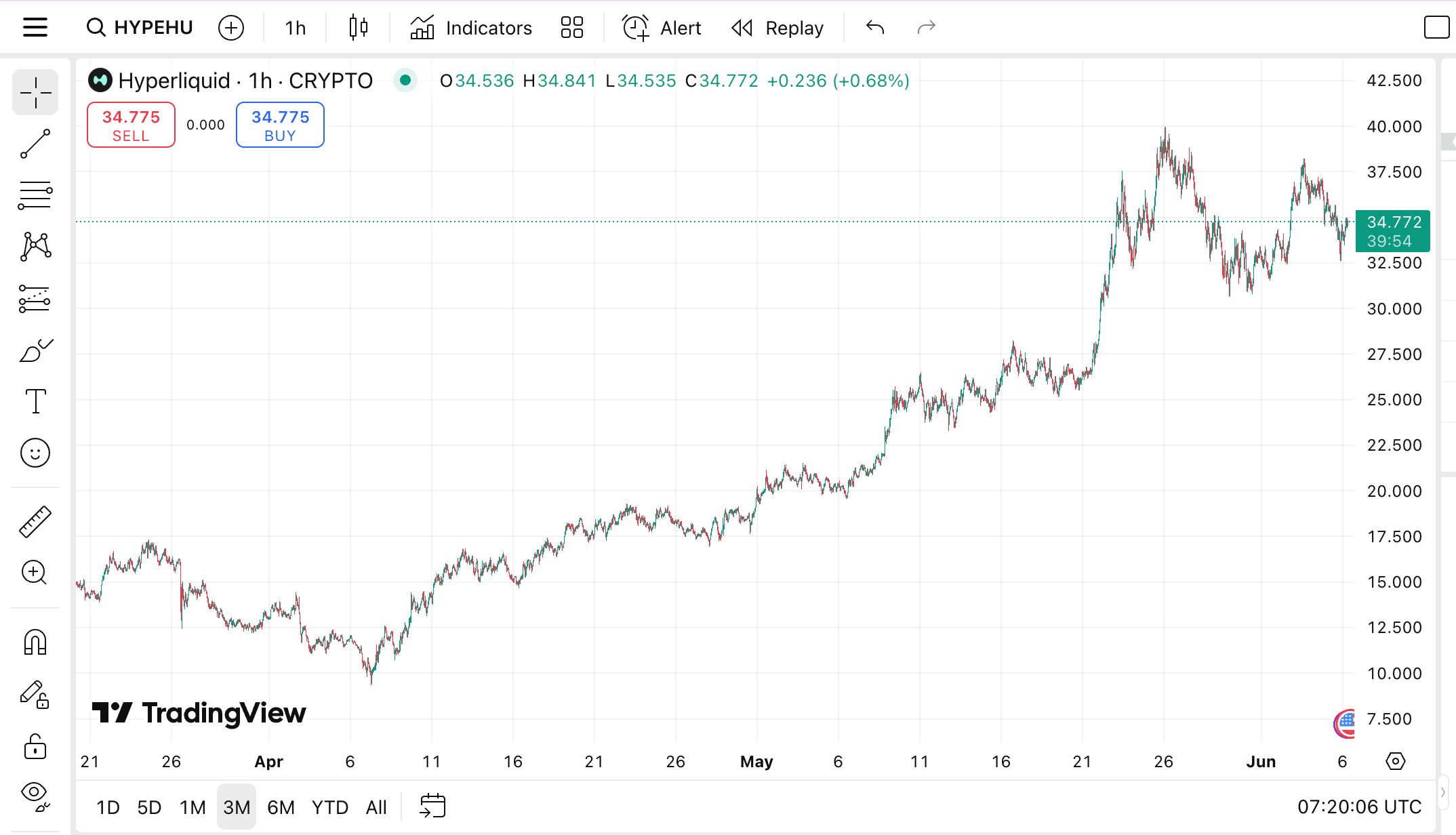

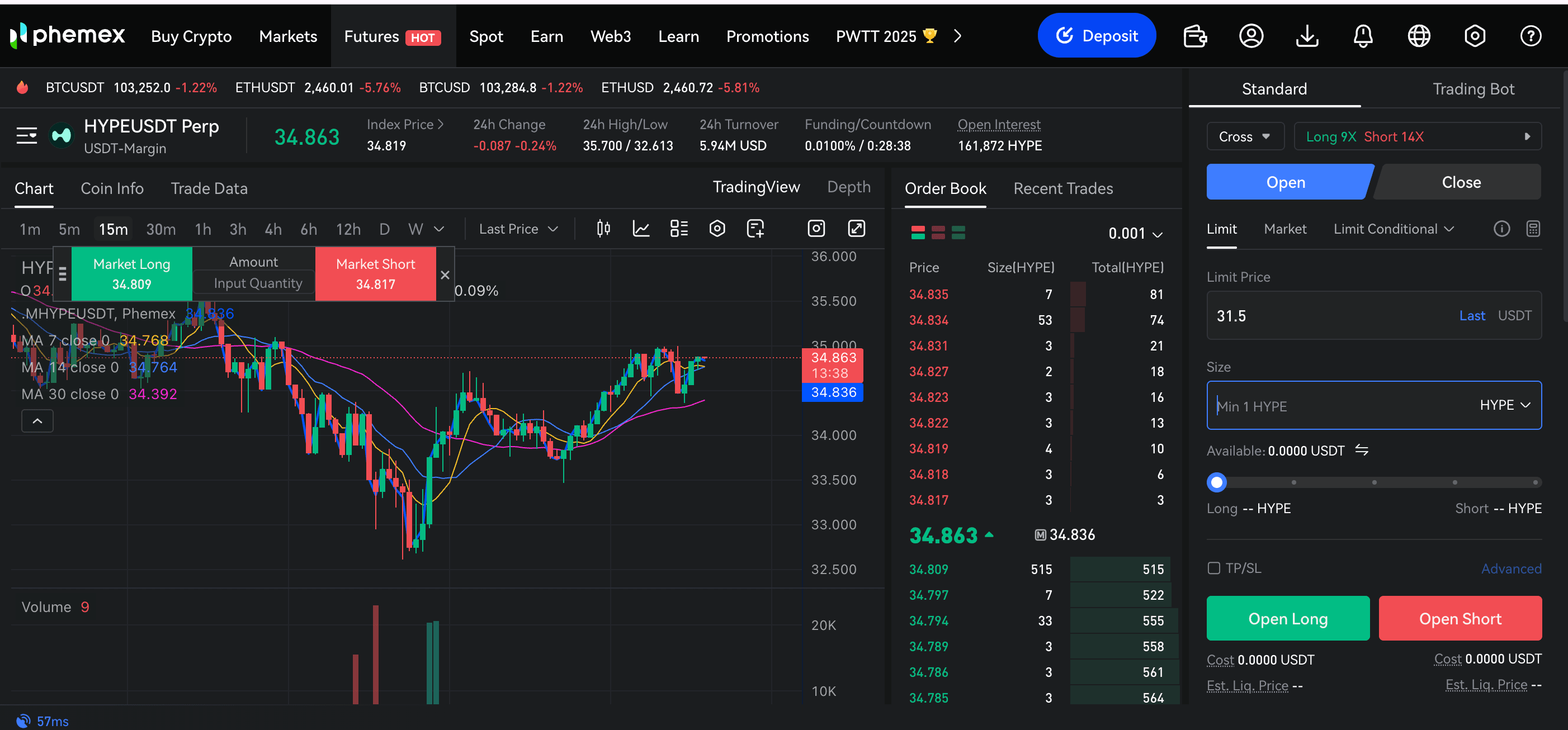

Hyperliquid (HYPE) has surged into the crypto spotlight, soaring 329% from $9.313 on April 7 to a peak of $40.019 on May 26, 2025, defying market volatility. However, a Head-and-Shoulders pattern, with its third peak around June 3, signals a potential bearish reversal. The chart below illustrates this pattern, highlighting key support ($31.5, $30) and resistance ($37.2, $39.7) levels.

This Phemex Academy guide combines expert trading strategies, whale activity insights (including a $3.98M purchase and James Wynn’s trades), project updates, competitive analysis, and community sentiment to help traders navigate HYPE’s dynamic market using Phemex’s advanced trading platform.

Key Takeaways:

-

HYPE’s 329% rally underscores its volatility and trading potential.

-

A Head-and-Shoulders pattern suggests weakening bullish momentum.

-

Whale activity, project developments, and community sentiment provide critical trading context.

HYPE in the 2025 DeFi Landscape

The DeFi sector in 2025 is experiencing robust growth, driven by cross-chain protocols and institutional adoption. HYPE’s focus on low-fee, cross-chain DeFi solutions positions it as a key player, competing with established tokens like UNI and AAVE. With DeFi’s total value locked (TVL) projected to surpass $500B by Q4 2025, HYPE’s upcoming protocol upgrades and $50M ecosystem fund could capture significant market share, making it a high-potential asset for traders.

Trading Implications:

-

Growth Potential: HYPE’s alignment with DeFi trends supports long-term bullish scenarios.

-

Market Monitoring: Use Phemex’s market analytics to track DeFi sector trends and HYPE’s performance.

Technical Indicators for HYPE Trading

Beyond the Head-and-Shoulders pattern, additional technical indicators can refine your HYPE trading strategy:

-

Relative Strength Index (RSI): As of June 6, 2025, HYPE’s RSI is around 55, indicating neutral momentum. An RSI drop below 30 near $30 support could signal oversold conditions, ideal for buying dips.

-

Moving Average Convergence Divergence (MACD): The MACD line is approaching a bearish crossover below the signal line, supporting the Head-and-Shoulders reversal thesis. A bullish crossover above $37.2 would validate breakout scenarios.

-

Bollinger Bands: HYPE’s price is near the upper band, suggesting overbought conditions. A move toward the middle band ($32–$34) could indicate consolidation.

Pro Trading Tips:

-

Combine indicators for confirmation. For example, a bearish MACD crossover with high volume at $31.5 strengthens short signals.

-

Use Phemex’s real-time charts to monitor RSI, MACD, and Bollinger Bands for HYPE.

Trading Scenarios for Hyperliquid (HYPE)

The following chart visualizes HYPE’s price movement from April 7 to June 6, 2025, with key support and resistance levels marked to guide trading decisions.

1. Bearish Reversal: Capitalizing on Downtrends

The Head-and-Shoulders pattern indicates fading bullish momentum, with critical support levels at $31.5 and $30. A confirmed breakdown below these levels, especially with high trading volume, could trigger a sharp decline.

Pro Trading Tips:

-

Short Positions: Initiate short trades if HYPE breaks below $31.5 or $30 using Phemex’s margin trading. Set tight stop-losses above these levels to manage risk.

-

Long-Term Accumulation: Bullish investors can monitor support zones at $25.5 and $24.3 for dip-buying opportunities via Phemex’s spot trading platform.

2. Retesting $30 Support: Consolidation Opportunities

HYPE may retrace to $30 with declining volume, suggesting reduced selling pressure and potential consolidation between $30 and $38.

Pro Trading Tips:

-

Grid Trading Strategy: Use Phemex’s grid trading bot to automate trades within the $30–$38 range.

-

Risk Management: Set stop-losses above $38 or below $30 to protect against breakouts. Explore Phemex’s risk management tools.

3. Bullish Breakout: Seizing Upward Momentum

Despite the bearish setup, a breakout above resistance at $37.2 and $39.7, backed by strong volume or positive news, could drive HYPE to new highs.

Pro Trading Tips:

-

Monitor Resistance: Track breakouts above $37.2 and $39.7 using Phemex’s real-time charts.

-

Confirm Entries: Enter long positions only after sustained volume and fundamental catalysts. Stay updated with Phemex’s news updates.

Practical Trading Example: Shorting HYPE on Phemex

Consider a hypothetical trade shorting HYPE at $31.5:

-

Setup: HYPE breaks below $31.5 with a bearish MACD crossover and high volume, confirming the Head-and-Shoulders breakdown.

-

Entry: Open a short position on Phemex’s margin trading platform with 5x leverage, targeting $25.5.

-

Risk Management: Set a stop-loss at $32.5 (3.2% above entry) to limit losses. Allocate 2% of your portfolio to manage risk.

-

Exit: Take profits at $25.5 (19% gain) or trail stops if the price continues to $24.3.

-

Execution: Use Phemex’s real-time charts to monitor volume and RSI for exit signals.

Outcome: A $10,000 position could yield $1,900 profit (excluding fees) if HYPE reaches $25.5, with risk capped at $320.

Risk Management Strategies for HYPE

HYPE’s volatility (329% growth in two months) requires robust risk management:

-

Position Sizing: Limit HYPE trades to 1–3% of your portfolio to mitigate volatility risks.

-

Stop-Losses: Use tight stops (e.g., 2–3% above/below key levels) to protect against sudden swings, especially after whale moves like James Wynn’s.

-

Diversification: Pair HYPE trades with stable assets like BTC or ETH on Phemex’s multi-asset platform.

-

Volatility Tools: Use Phemex’s trailing stop feature to lock in profits during rapid price movements.

-

Regular Monitoring: Check Phemex’s [market analytics](https://phemex.com/market

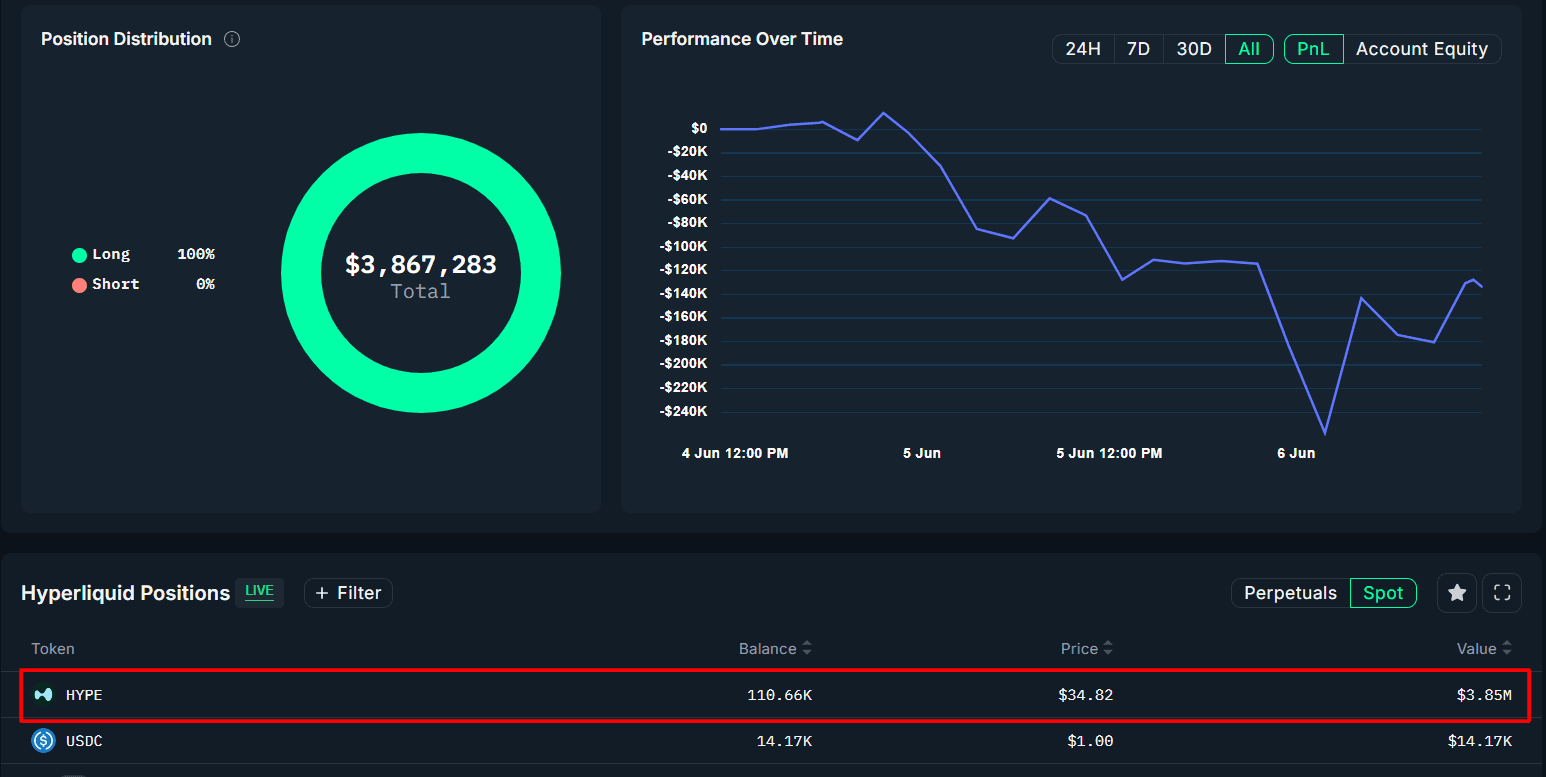

Whale Activity: Tracking Big Players

Recent on-chain data from OnchainLens reveals a whale, dormant for two years, deposited $4M USDC into Hyperliquid in the past 48 hours (as of June 6, 2025), buying 110,663 HYPE tokens at an average price of $36, totaling $3.98M. High-profile trader James Wynn also made headlines, selling 126,116 HYPE tokens for $4.12M at $32.7 on June 2, earning a 31.9% profit from his $3.13M purchase in May. However, Wynn’s $1.25B Bitcoin long position in late May led to a $100M liquidation loss, highlighting the risks of high-leverage trading.

Trading Implications:

-

Accumulation Signals: The $3.98M whale purchase and Wynn’s earlier buys suggest confidence at $25–$36, supporting price stabilization.

-

Sell-Off Risk: Wynn’s exit and 500,000 HYPE transferred to an exchange on June 4 could increase selling pressure. Monitor with Phemex’s market analytics.

-

Volatility Warning: Wynn’s high-leverage trades amplify market swings. Use Phemex’s tools to navigate volatility.

Hyperliquid Project Updates

The HYPE team announced a Q3 2025 protocol upgrade, introducing enhanced DeFi integrations and cross-chain compatibility. A $50M ecosystem fund was launched to support HYPE-based projects, boosting developer interest and adoption potential.

Trading Implications:

-

Bullish Catalysts: Project milestones could fuel breakouts above $39.7.

-

Stay Informed: Follow Phemex Academy and HYPE’s official channels for updates.

Competitive Analysis: HYPE vs. DeFi Leaders

HYPE competes with Uniswap (UNI) and AAVE:

|

Metric |

HYPE |

UNI |

AAVE |

|---|---|---|---|

|

Market Cap |

~$1.2B (June 2025) |

~$5.8B |

~$2.3B |

|

24h Trading Volume |

$150M |

$300M |

$200M |

|

Key Features |

Cross-chain DeFi, low fees |

AMM, governance |

Lending, flash loans |

|

Recent Performance |

329% (2 months) |

45% (2 months) |

60% (2 months) |

Insights:

-

HYPE’s 329% growth outperforms UNI and AAVE, but its smaller market cap signals higher volatility.

-

Cross-chain capabilities make HYPE a unique DeFi player.

-

Trade HYPE, UNI, and AAVE on Phemex’s multi-asset trading platform.

Community Sentiment: Gauging Market Mood

As of June 6, 2025, X and crypto forum sentiment is mixed:

-

Bullish Sentiment (35%): Fueled by HYPE’s rally, the $3.98M whale buy, and upcoming upgrades, with #HYPEto100 trending on X.

-

Bearish Sentiment (45%): Driven by the Head-and-Shoulders pattern and Wynn’s liquidation losses, with predictions of a drop to $25.

-

Neutral Sentiment (20%): Traders expect consolidation at $30–$38, questioning Wynn’s trades as potential Hyperliquid promotions.

Trading Implications:

-

Sentiment-Driven Volatility: Bullish posts could spark breakouts; bearish sentiment may deepen pullbacks. Monitor with Phemex’s market news.

-

Engage with Community: Join Phemex’s X profile for real-time sentiment updates.

Why Trade HYPE on Phemex?

Phemex offers unmatched tools for trading HYPE:

-

Low Fees: Maximize profitability.

-

High Liquidity: Seamless execution for volatile assets.

-

Advanced Tools: Grid trading bots, margin trading, and real-time analytics.

-

Secure Platform: Trade confidently.

Conclusion: Master HYPE Trading with Phemex

Hyperliquid (HYPE) offers dynamic trading opportunities at a critical juncture. Whale activity (e.g., $3.98M buy, Wynn’s trades), project updates, competitive dynamics, and community sentiment provide actionable insights. Use Phemex’s trading platform and Phemex Academy to stay ahead.

Ready to trade HYPE? Sign up on Phemex today!

Stay Updated: Follow Phemex on X for market insights.

Register to get $180 Welcome Bonus!

Register to get $180 Welcome Bonus!