As blockchain technology and decentralized finance (DeFi) expands, popular blockchains like Ethereum are growing at breakneck speed. That growth has ushered in many new DApps and verifying nodes, but network speed and efficiency remains an issue. The increase in nodes has brought an increase in security, but blockchains are still relatively slow and costly, because every node must validate the same information.

This is where SKALE comes in.

What is SKALE?

SKALE is an elastic blockchain network that works interoperably with the Ethereum ecosystem. Developed in 2020 by SKALE Labs, this layer 2 solution is designed to improve Ethereum’s scalability, speed, efficiency, and user experience by creating flexible sidechains that work as independent blockchains for individual DApps. Each DApp will have its own blockchain with its own validator nodes from the Ethereum pool. This improves Ethereum level security with faster speed and no gas fees. Businesses can rent a sidechain that utilizes validator nodes from the Ethereum network, but instead of the nodes validating all blockchain information, a portion of their resources are dedicated to that DApp or business alone. This can all be achieved while maintaining decentralization and security.

SKALE relies on decentralized governance, with representation from all its core stakeholder groups to vote on its functions, rewards system, and development. If a stakeholder chooses not to vote, they do not have to. They can either participate in governance directly by voting with their stake or delegating their voting power to other stakeholders.

Who Is Behind SKALE?

The team behind SKALE has some impressive credentials. Co-founder Jack O’Holleran has worked in and founded multiple Silicon Valley enterprises in machine learning, AI, security, and blockchain technology. Meanwhile, co-founder Stan Klakdo has nearly 20 years of experience in cryptography and enterprise infrastructure technology. He was a key early member of the Java Virtual Machine (JVM) team and a founder of a US government-certified crypto lab.

How Is SKALE Structured?

The SKALE network exists as flexible sidechains. These small independent blockchains use the Ethereum network’s nodes to work as validators through a proof-of-stake (PoS) consensus algorithm. To not compromise on security, these nodes are randomly selected, and developers can enable virtualized subnode shuffling to continually rotate the nodes working for their DApp.

The SKALE network has two components:

- The SKALE Manager exists on the Ethereum mainnet and controls the SKALE ecosystem. This includes everything from the creation and destruction of sidechains, management ofnodes, to SKALE token (SKL) withdrawals and bounties.

- Permissionless SKALE Nodes are created or rejected by the Manager based on certain prerequisites and a deposit of SKL. If accepted, they are assigned peer nodes to regularly review their activity, which is also submitted to the Manager to determine their rewards. Nodes are added as either a “full node” or “fractional node.” Full nodes have all 4 of their resources utilized for a single Elastic Sidechain while fractional nodes participate in multiple Elastic Sidechains (multitenancy).

Diagram of SKALE’s SKALE Manager (Source: SKALE Whitepaper)

When a business wishes to invest in an elastic sidechain, it applies and submits a payment to the SKALE Manager. The capability of its sidechain varies based on the business’ needs, budget, and service duration. To ensure efficiency, security, and speed, a sidechain always has a minimum of 16 virtualized subnodes. Then it’s decided how much of the nodes’ resources are allocated to this sidechain:

Elastic sidechain creation (Source: SKALE Whitepaper)

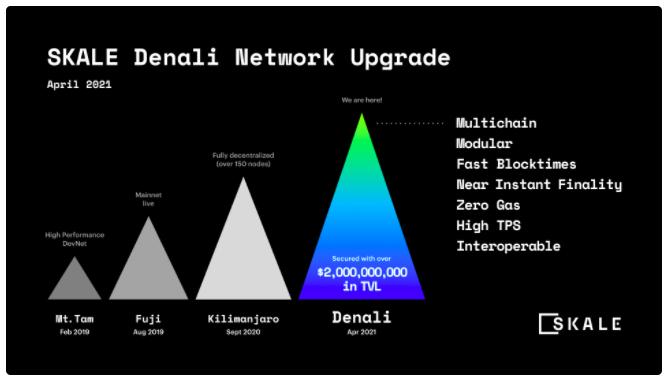

What Is the SKALE Denali Network Upgrade?

Denali is the latest upgrade to the SKALE network and was implemented in April 2021. It comes on the heels of previous upgrades, including Mount Tam, Fuji, and Kilimanjaro.

The Denali upgrade includes the next phase of SKALE’s modular framework, with application-specific architecture for developers to enhance the configurability and modularity of their DApps. To do this, it uses a system that simplifies the DApps’ supporting blockchain functions without any additional coding. This allows developers to create NFTs on their blockchains at no cost with high level security. The Denali upgrade also allows for the flexible and modular inclusion of native and third-party chain services such as file storage, interchain messaging, oracles, rollups, and more.

Through these improvements, DApps on the SKALE network have improved speed. They can run at less than half a second block times at high throughput, with newly audited smart contracts and advanced chain functionality. Most importantly, the Denali upgrade means DApps can be launched with gasless transactions.

SLAKE Upgrades throughout time. (Source: SKALE Labs’ blog)

What Is the SKALE Token?

The SKALE token (SKL) is a work and usage token for the SKALE ecosystem. At the time of its launch in December 2020, its total supply was 4,140,000,000, with a max supply of 7,000,000,000 tokens. As an ERC-777 token, it is efficient with many major functions including:

- Network upkeep and development: SKALE aims to develop and grow by allocating a large percentage of its tokens to creators and builders. Investors must agree to long vesting periods and locks on their tokens to gain higher rewards. A small percentage of the tokens is dedicated to supporting protocol developments in the form of operations and contracts.

- Reward validator nodes: Without incentives, it would be impossible to run a decentralized blockchain. Thus, a large percentage of the SKL tokens are allocated to the validator community to incentivizetheir work validating transactions and keeping the network secure.

- Ecosystem clean-up: There are many sidechains on the SKALE ecosystem. When one expires, it must be removed to declutter the network and efficiently redistribute the nodes. To keep this process running quickly and smoothly, the reporting of sidechain expiration to the SKALE Manager is rewarded with SKL.

Token Distribution Chart (Source: SKALE Whitepaper)

SKL Price Analysis

Like bitcoin (BTC) and most other cryptocurrencies, SKL seems to have followed the crypto bull run of March and April 2021. Since then it has experienced several ups and downs. There has only been a difference of around $0.96 USD between its high of around $1.13 USD in March to its low of around $0.17 USD in July.

These continuous spikes to regain value could easily have been propelled by the new Denali upgrade, implemented in April 2021. This upgrade brought promising solutions to DeFi, including resolving high gas fees and lagging functionality. As the SKL price history shows, its value has gradually continued to increase in the summer. Today, SKL is valued at around $0.35 USD, with a market cap of $423,766,694.

SKL price chart 02 Dec 2020 – 24 Aug 2021. (Source: coinmarketcap.com)

Future of SKALE

With its ability to increase transaction throughput, finalize transactions quicker, and remove gas fees, SKALE’s prospects look bright. The technology offers solutions to many problems faced by new businesses that want to venture into DApps but do]n’t have an immense technical know-how. The community’s belief in the SKALE Network is perhaps best demonstrated by the fact that the new Denali upgrade was secured with $2 billion USD in total value locked (TVL). Major partners include Boot.finance, Covey, CurioDAO, HUMAN Protocol, Ivy, and Minds (all of whom are launching their DApps with SKALE this summer).

Furthermore, SKL is already available on 23 exchanges. With the rise of DeFi and increased traffic to the Ethereum blockchain, demand for a scalability solution that is fast and cost-effective is at an all-time high. If the SKALE Network proves to be that solution, then we can expect its value to keep climbing steadily.

Read More

- What is Scalability and How Are Blockchains Achieving it?

- What is Lisk: Exploring Innovation and The Mass Adoption of Blockchain Technology

- What Are Ethereum Layer 2 Solutions: Decentralized Scalability

- What is Sharding in Blockchain?

- What is Blockchain Trilemma: Solving Crypto’s Big Challenge

- Klaytn: Moving Blockchain to Mass Adoption

- What is a Sidechain: The Most Versatile Layer 2 Solution?

- https://phemex.com/academy/defi