Introduction

Fuel Network is an Ethereum layer-2 rollup using FuelVM for scalable, secure transactions. It emerges as a key player in Ethereum’s layer-2 scalability solutions, leveraging the FuelVM to deliver high-performance, cost-efficient transactions. Essentially, this means faster and cheaper transactions on Ethereum, making it easier to build and use decentralized applications (dApps) without the usual hurdles of high fees and slow speeds.

Launched in 2024, FUEL powers a rollup that enhances Ethereum’s throughput with innovative features like parallelized transaction execution and native account abstraction. With a market cap of approximately $55 million in June 2025, FUEL has gained attention for its developer-friendly tools and interoperability. This guide explores what Fuel Network is, how to trade FUEL, its use cases, and key market events, including its rapid growth. Dive in to understand FUEL’s role in Web3, but always conduct your own research before trading.

Fuel Network (FUEL) Quick Facts

-

Ticker Symbol: FUEL

-

Chain: Ethereum (layer-2 rollup)

-

Total Supply: ~10.1 billion FUEL

-

Circulating Supply: ~5 billion FUEL (June 2025)

-

Primary Use Case: Layer-2 scalability solution for Ethereum, enabling fast and low-cost transactions

-

Current Market Cap: ~$55 million (June 2025, check live data for updates)

-

Availability on Phemex: Yes, spot

What Is Fuel Network (FUEL)?

Overview

Fuel Network is an Ethereum layer-2 rollup designed to enhance blockchain scalability and efficiency. It uses the FuelVM, a custom virtual machine, to support parallelized transaction execution, enabling high throughput (>600 transactions per second) and low costs (<$0.0002 per transaction).

Technology

The FuelVM supports parallel processing, reducing bottlenecks, and native account abstraction, simplifying wallet interactions. Developers can use Sway, a Rust-based programming language, and Forc, an integrated toolchain, to build advanced dApps, per Fuel Network.

Market Position

As of June 2025, FUEL has a market cap of approximately $55 million, with Fuel Ignition surpassing $400 million in total value locked (TVL). It faces competition from other layer-2 solutions like Arbitrum and Optimism.

Community and Development

Fuel Network’s active community on X and GitHub collaborates on dApp development and ecosystem growth, supported by points farming and airdrop campaigns, per Fuel Network.

Fuel Ignition (Fuel Network)

Key News & Events

-

2020: Fuel V1 launched as the first optimistic rollup on Ethereum mainnet, setting a precedent for layer-2 solutions (Fuel Network).

-

2024: Fuel Ignition mainnet launched, achieving stage-2 security status and surpassing $400 million in TVL (CoinMarketCap).

-

September 2024: Introduced points farming and airdrop campaigns, boosting community engagement (ICODrops).

-

December 2024: FUEL reached an all-time high price of $0.0845, followed by an 87% decline to ~$0.011, reflecting volatility (Coinbase).

-

Ongoing: Active developer community on X and GitHub, supporting dApp innovation and ecosystem growth (Fuel Network).

-

Regulatory Compliance: No reported SEC or legal issues, indicating a focus on compliant development.

How Many Fuel Network (FUEL) Tokens Are There?

Fuel Network has a total supply of approximately 10.1 billion FUEL tokens, with ~5 billion in circulation as of June 2025, per CoinMarketCap. The tokenomics support ecosystem growth, with allocations likely for:

-

Community and Airdrops: Incentivizing user participation through points farming.

-

Development and Ecosystem: Funding dApp creation and network expansion.

-

Team and Investors: Supporting Fuel Labs and early backers, though specific details are unconfirmed.

The exact distribution and vesting schedule should be verified via Fuel Network’s official documentation or CryptoRank. FUEL’s supply is fixed, with no minting or burning mechanisms noted, ensuring transparency.

What Are Fuel Network’s Use Cases?

FUEL tokens are central to Fuel Network’s ecosystem, enabling key functionalities that enhance Ethereum’s scalability and developer experience, per Fuel Network:

-

Transaction Fees: FUEL pays gas fees on Fuel Ignition, supporting low-cost dApp operations.

-

Developer Platform: Enables access to Sway and Forc for building scalable dApps.

-

Interoperability: Supports cross-network wallet compatibility, enhancing Web3 connectivity.

-

Governance: Likely used for ecosystem governance, though specifics require confirmation.

-

Points Farming Rewards: Incentivizes user engagement through airdrop campaigns.

These use cases position FUEL as a versatile utility token.

How Does Fuel Network Compare to Arbitrum (ARB)?

Fuel Network and Arbitrum are leading Ethereum layer-2 rollups, but they differ in technology and focus. Below is a comparison:

|

Feature |

Fuel Network (FUEL) |

Arbitrum (ARB) |

|---|---|---|

|

Technology |

Optimistic rollup with FuelVM, parallel execution |

Optimistic rollup with EVM compatibility |

|

Blockchain |

Ethereum |

Ethereum |

|

Use Case |

Scalability, developer platform, interoperability |

Scalability, DeFi, gaming |

|

Market Cap |

~$55 million (June 2025) |

~$3 billion (June 2025, estimated) |

Fuel Network’s FuelVM offers unique parallel processing, while Arbitrum’s EVM compatibility supports broader dApp adoption, per CoinGecko. Compare layer-2 tokens on Phemex’s blog.

What Technology Powers Fuel Network?

Fuel Network leverages the FuelVM, a custom virtual machine optimized for high-performance blockchain scalability. It uses optimistic rollup technology, batching transactions off-chain and posting them to Ethereum for cost efficiency and speed (>600 TPS, <$0.0002 per transaction).

The FuelVM supports parallel transaction execution, reducing bottlenecks, and native account abstraction, simplifying user interactions. Sway, a Rust-based language, and Forc, an integrated toolchain, enable developers to build advanced dApps, per Fuel Network.

Who Created Fuel Network?

Fuel Network was launched in 2024 by Fuel Labs, a team of developers focused on advancing blockchain scalability. While specific founder details are limited, Fuel Labs is recognized for its pioneering work, with Fuel V1 being the first optimistic rollup on Ethereum in 2020. The project has raised ~$90.9 million through funding rounds, per ICODrops, supporting its growth.

What Factors Should You Consider Before Trading FUEL?

Trading FUEL involves understanding its market dynamics and risks. Key factors include:

-

Market Volatility: FUEL’s price dropped 87% from its December 2024 high of $0.0845, per Coinbase.

-

Technology Adoption: FUEL’s success depends on developer uptake and dApp growth.

-

Competition: Faces challenges from established layer-2 solutions like Arbitrum and Optimism.

-

Regulatory Environment: No reported issues, but crypto regulations may impact FUEL.

As of June 2025, FUEL’s market cap is ~$55 million, per CoinMarketCap. Cryptocurrencies are volatile, and market conditions can change rapidly. Research thoroughly and monitor live prices on Phemex’s trading dashboard. This information is for educational purposes only and not financial advice.

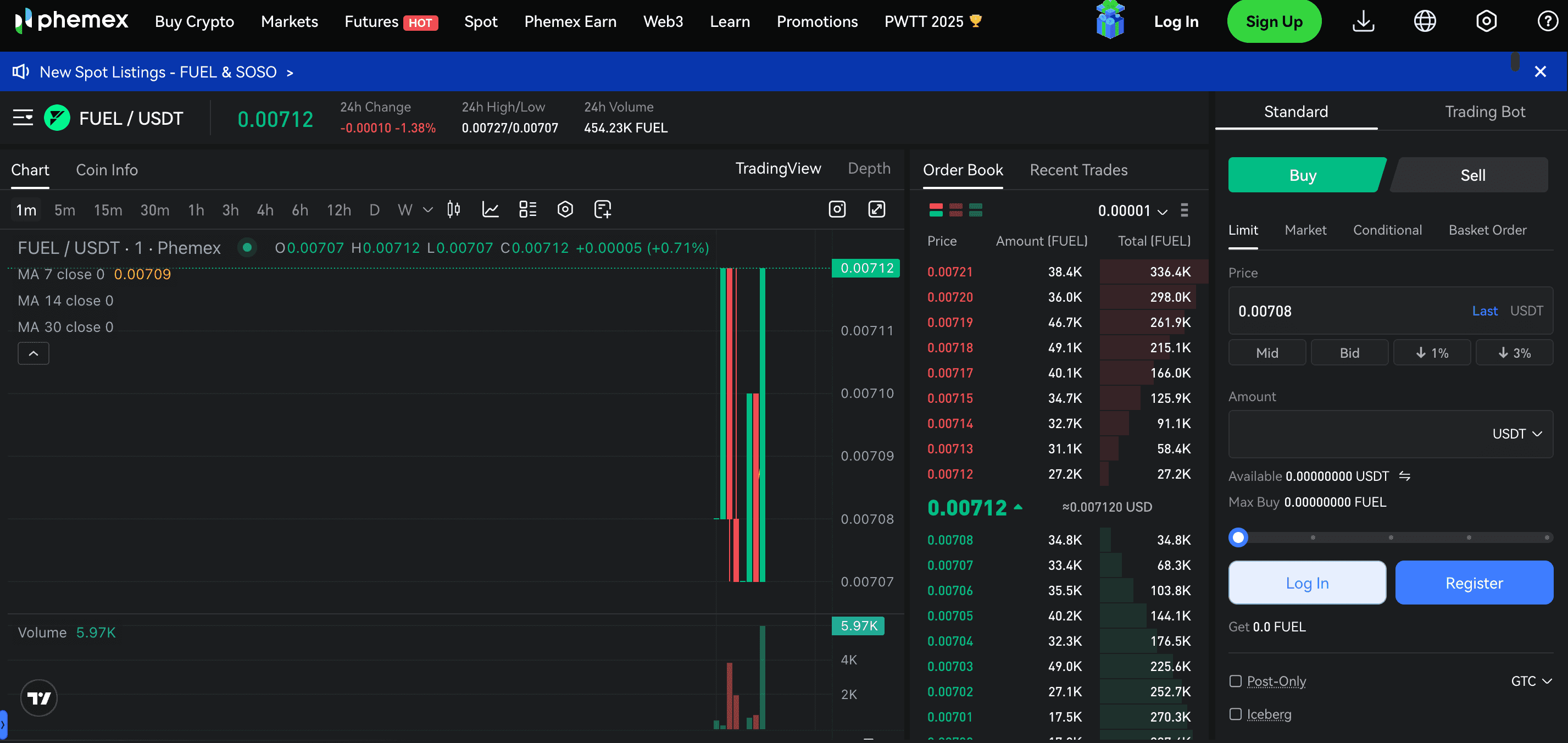

How to Trade Fuel Network (FUEL) on Phemex

To trade FUEL on Phemex (verify availability on Phemex):

-

Sign up for a Phemex account and complete KYC if required.

-

Deposit USDT or supported assets into your Phemex wallet.

-

Navigate to the FUEL/USDT trading pair on the Phemex Spot.

-

Execute a market order for instant trading or a limit order for your target price.

-

Store FUEL in your Phemex account or transfer to an Ethereum-compatible wallet.

Why Fuel Network Matters

Fuel Network drives Ethereum’s scalability with its high-performance rollup, enabling fast, low-cost transactions and developer innovation. Its role in Web3 interoperability and dApp development makes it a significant project. Stay informed with Phemex Academy.

Disclaimer: The information presented in this article is for educational and informational purposes only. It does not constitute investment advice, financial advice, trading advice, or any other form of advice, and you should not treat any of the article's content as such. Phemex does not recommend that any specific cryptocurrency should be bought, sold, or held by you. The cryptocurrency market is subject to high market risk and volatility. Past performance is not indicative of future results. All investment strategies and investments involve risk of loss. You should conduct your own due diligence and consult a qualified financial advisor before making any investment decisions. Phemex is not responsible for any investment decisions you make based on the information provided in this article.